Late last year, I detailed how rental car giant Hertz (NASDAQ:HTZ) could be in a tough spot moving forward. I was worried about the rise in interest rates along with drops in vehicle pricing, and the stock has lost almost half of its value since. Thursday morning, we received quarterly results from the company, and the name is getting hit hard by its push into electric vehicles headlined by Tesla (TSLA). With management continuing to pile up debt and use resources on share repurchases at much higher prices, it seems that this stock could continue much lower.

For the Q3 period, Hertz reported revenue of $2.7 billion, a quarterly record. While this number was up 8% over the prior year period, it slightly missed street estimates. The company saw strong growth of 16% in transaction days over Q3 2022, but pricing was down about 7% over this time. There has been some uneasiness over the US economy heading into 2024 and student loan repayments may weigh on consumer spending. As a result, analyst estimates see revenue growth of just 4.6% next year, down almost half from the 8.3% top line increase the street is looking for this year.

Unfortunately, the company’s cost structure is where things are looking much worse. Depreciation per unit per month was up more than 50% over the prior year period, while direct operating expenses rose at a rate that was more than double the growth in revenues. Operating income before interest expenses plunged by almost 28% over the prior year period. However, the company’s growing debt pile and rising interest rates have led to surging interest costs. As a result, total true operating income fell by more than 58%, and non-GAAP EPS of $0.70 missed street estimates by 13 cents.

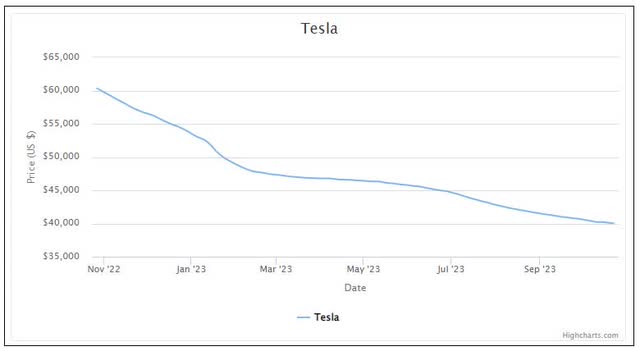

On the conference call, Hertz management specifically called out Tesla for some of the poor results. As everyone knows, the EV giant has been slashing prices on its vehicles for more than a year now. This has significantly impacted used Tesla values, and thus Hertz has to record much higher depreciation expenses that it was originally expecting. The chart below shows the used Tesla index just over the past year, with these overall values being more than 40% off their summer 2022 peak.

Used Tesla Index (CarGurus)

When Hertz goes to resell some of these vehicles, the lower values impact the company’s cash flow. The overall CarGurus index is now starting to see an accelerated decline in Q4, which could further lower residual values as we move into 2024. Management also stated that it is seeing electric vehicle repair costs that are double that of normal ICE repairs. While the rental car name will continue to boost its electric vehicle offerings, it is doing so at a more measured pace currently.

When we look at the balance sheet of Hertz, things look a bit shaky as well. The company is taking on a lot of debt to bulk up its fleet over time. Over the past two years, total net debt has gone from $6 billion to $15.4 billion. Just increasing your debt pile that much adds significant interest expenses, but rising rates further complicate the situation. At the same time, Hertz has spent over $3.1 billion to repurchase shares in the past couple of years. While that has done a nice job of reducing the share count, the average price paid was over $19, more than double where we are now.

On a valuation front, Hertz seems fairly valued at first glance. The stock trades at about 5.89 times expected 2025 earnings per share. That’s close to the 6.05 times that rival Avis Budget Group (CAR) goes for. However, after Thursday’s earnings miss, I think Hertz estimates will come down a bit, which could push that P/E ratio up a bit to a premium over Avis. At that point, the name could be seen as overvalued. I should note that over the past year, the average analyst price target has gone from $28 to $21, implying tremendous upside, but the latest number was going into this poor earnings report.

With the bad earnings results and balance sheet issues, I am continuing to rate Hertz a sell today. Interest costs as a percentage of operating income (before interest) went from 11% in Q3 2022 to 49% in Q3 2023, and Tesla vehicles are still losing a bit of value. I think Hertz management has wasted too much money on share repurchases in recent years, and that will only pressure the balance sheet further in 2024. I will not consider an upgrade to hold until the company shows it can get its debt pile in order, and thus keep interest and other operating expenses reduced to a meaningful level. Earnings per share at Hertz are expected to decline through at least 2025, so that’s not a stock I want to own right now.

Read the full article here