Investment Rundown

If you are looking for a dividend-distributing company that has perhaps some of the most solid margins in the energy sector then a top pick of mine is Enterprise Products Partners L.P. (NYSE:EPD) right now. The business has been incredibly solid and I think the high dividend yield is sustainable thanks to the significant growth in FCF, a result of steady asset expansion measures the company has taken over the last decade. With a market cap of nearly $60 billion the company receives a large amount of attention and I can’t say that the market wouldn’t value it accordingly. By this, I mean that it’s unlikely that we are to see a significant earnings discount appear for example. With the p/e at 10.8 currently, I think you are getting a good price now, and given the reliable FCF, you are also getting a reliable dividend yield.

Company Segments

EPD serves as a vital player in the midstream energy sector, providing essential solutions to producers and consumers in both the natural gas and natural gas liquids segments. Moreover, the company extends its reach into other critical sectors such as crude oil, petrochemicals, and refined products. This diverse operational scope is structured into four distinct segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services, and Petrochemical & Refined Products Services.

Earnings Report

The last quarter for the company showcased strength as the DCF remained high at $1.7 billion. There were fewer favorable commodity prices in the last quarter as compared to Q2 FY2022. But that hasn’t stopped EPD from still being a strong dividend distributor.

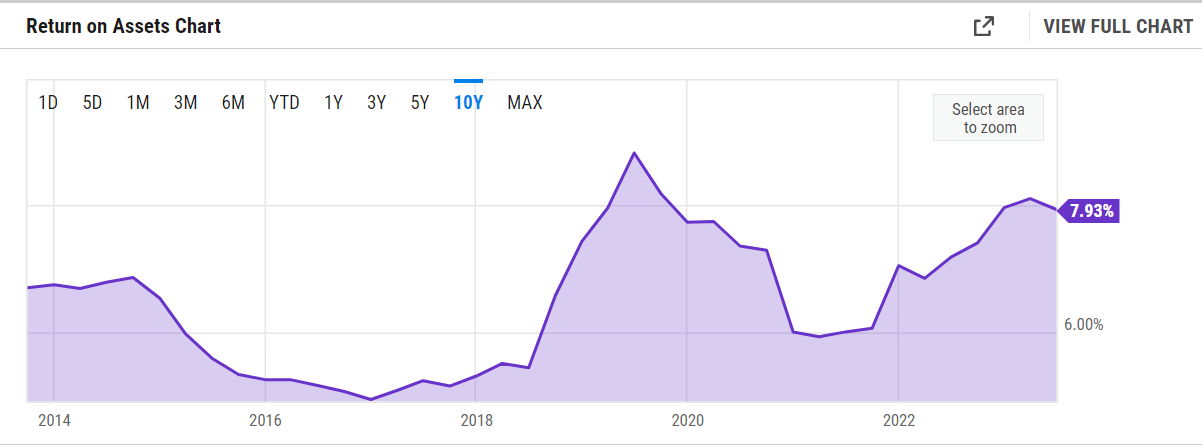

The company has managed to accelerate the total asset growth of the business and over the last decade, it has averaged a 5.98% CAGR. If this can be maintained as a result of acquiring more companies and yield pipeline expansion then I think EPD looks very attractive as an investment. But it won’t be just expansion that will result in higher valued assets. The fact that they already have the assets and the necessity for natural gas and crude oil growth each year is sufficient enough to result in it growing too.

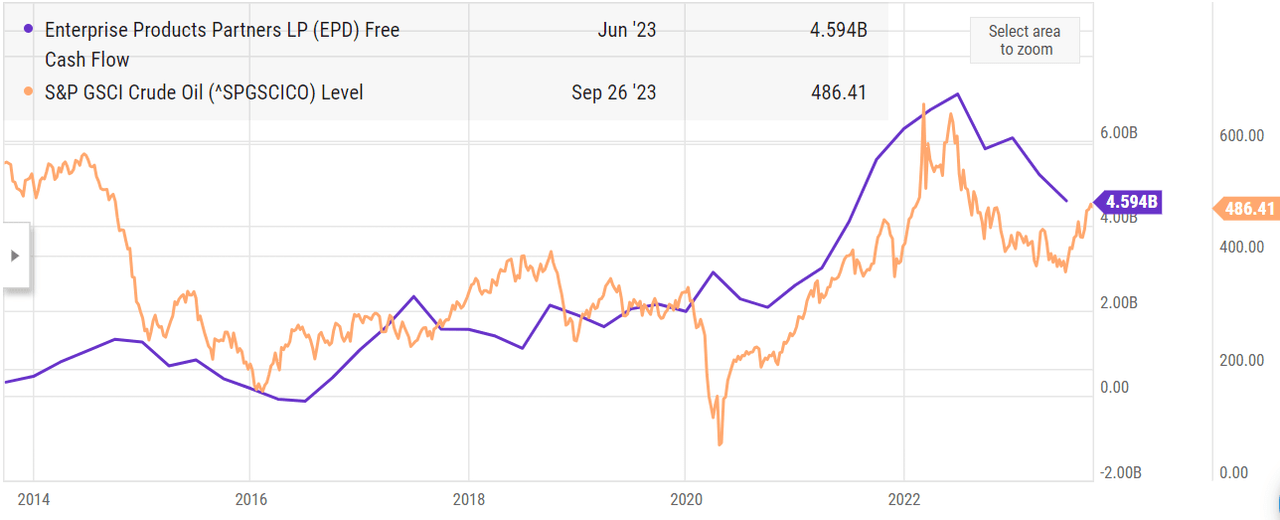

YCharts

As for how EPD has been able to leverage this into stronger earnings I think that they have done a great job as commodity prices of both oil and gas have appreciated in the last couple of years. Both seem to be trending upwards as well and production cuts are resulting in higher prices.

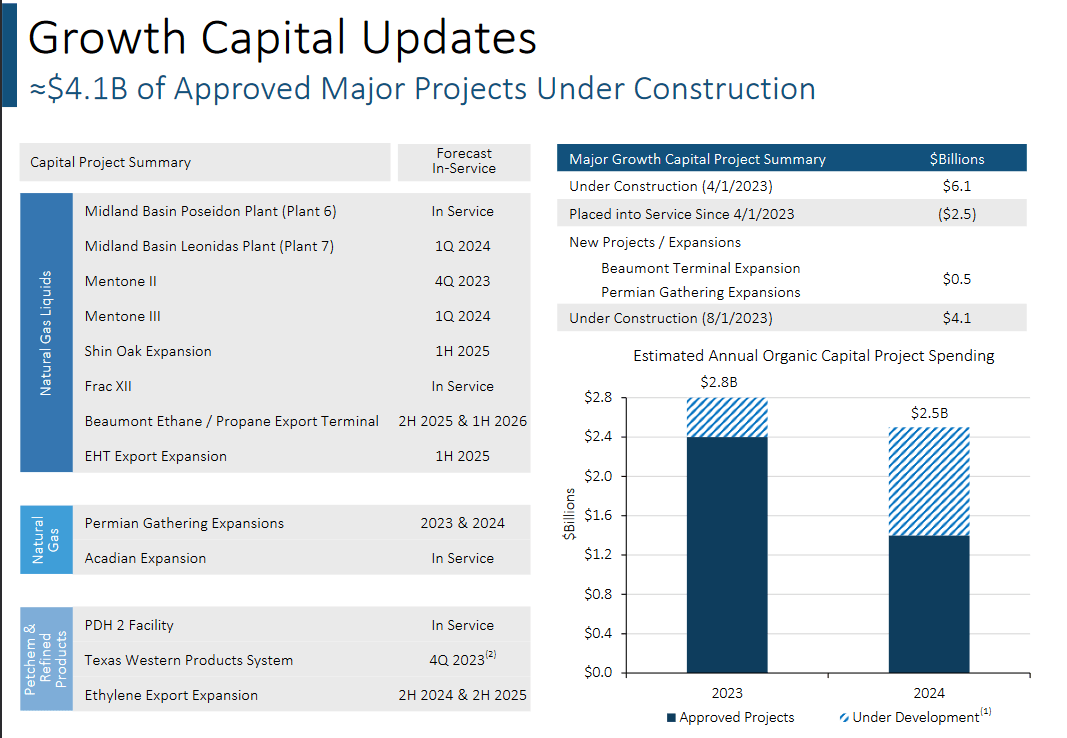

Investor Presentation

Even though there is a general sentiment that renewables are going to make up a larger portion of energy generation, EPD is still investing quite heavily in new projects related to oil and gas pipelines. Approved and under-development projects have a total value of $4.1 billion so far. Looking ahead several projects are expected to be in service as of 2024 and 2025, which supports the prospects of growing distributable cash flows as EPD expands the asset base.

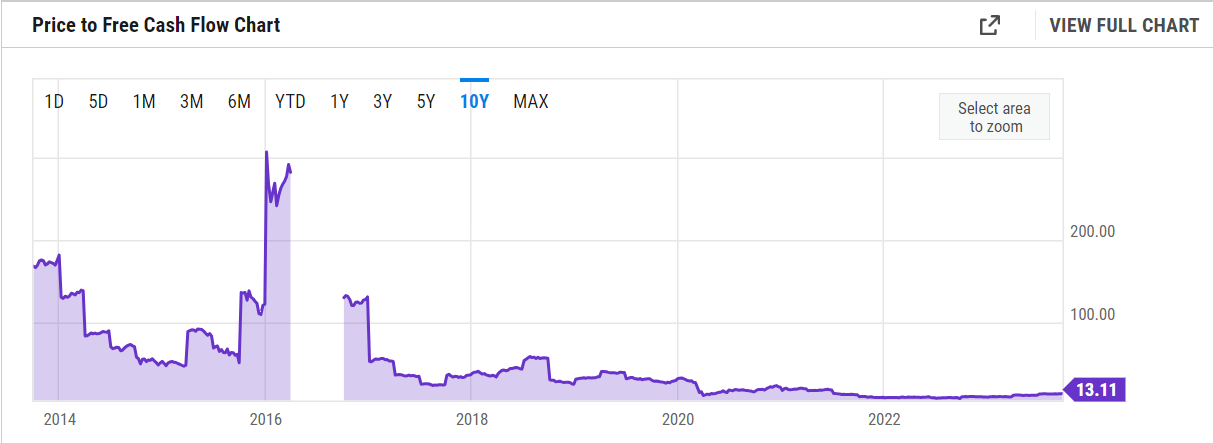

YCharts

Even as the company has been growing its FCF over the years the relation between it and the price has been declining. EPD still posts a premium in p/fcf in comparison to the sector of about 52.13% on a FWD basis. I don’t think that should construed as the buy case here though. EPD is still a very appealing company to be in given the reliable dividend it has maintained through the years, that is what investors and the market are valuing. On a p/e basis, it looks a little more realistic as it trades more or less in line with the broader sector median right now. EPD still equals a buy in my book primarily because of the dividend yield of over 7% and the fact there are still several ongoing projects in the pipeline that further solidify the position of the company in the markets.

Looking At The Dividend

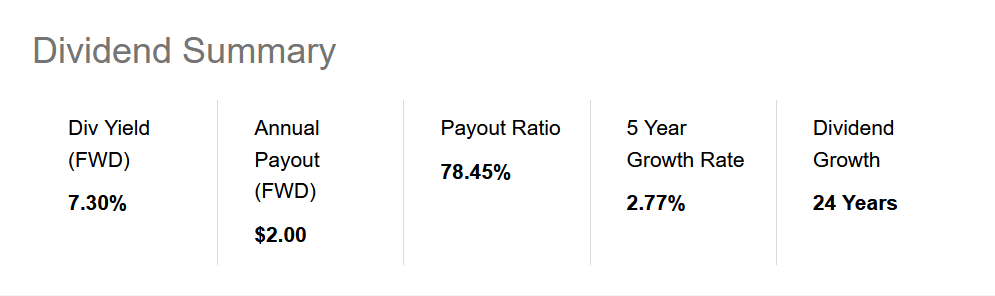

Seeking Alpha

I think that for EPD the dividend remains incredibly stable as we will see below, the FCF of the business has been incredibly stable throughout the commodity cycle of oil for example. With the last quarter having $1.7 billion in distributable cash flows, it more than covers the TTM dividends paid of $4.1 billion on an annualized basis.

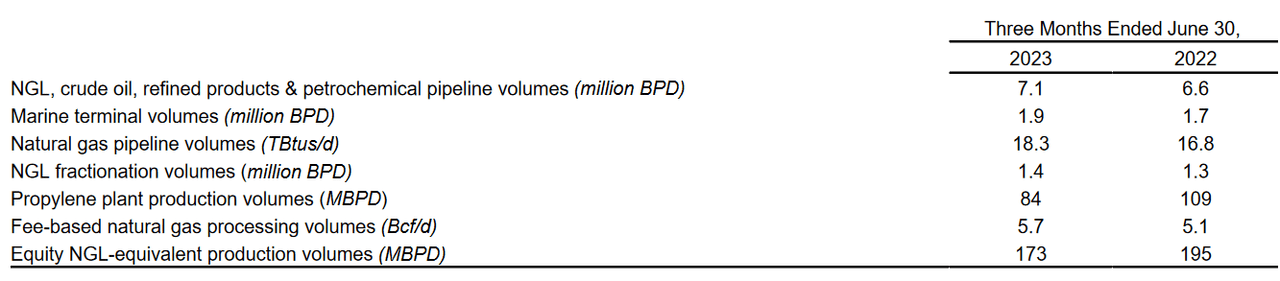

Volumes (Earnings Report)

Volume elves remain stable for the company and I think this underscores the capability the company inhabits to possibly post even stronger earnings in the coming quarters. If commodity prices keep ticking upwards going into the colder months of the year I think EPD is ripe to post higher distributable cash flows then the previous $1.7 billion. Over the last 24 years, the dividend has been raised and this would add more support to that practice and let EPD perhaps continue doing it for another 24 years, as long as they maintain this fortress of assets they have accumulated.

Risk

EPD’s unitholders are exposed to a significant risk factor that arises from the company’s growth trajectory closely aligning with broader macroeconomic trends within the United States. EPD’s expansion efforts are intricately intertwined with the overall economic climate, which can impact the volumes of energy resources it handles. However, it’s worth noting that EPD has taken strategic measures to mitigate this risk effectively.

YCharts

EPD engages in several smaller sub-segments, such as propylene and octane enhancement. These specialized areas can be challenging for investors to predict in terms of sales margins and volumes. The limited availability of data in these niches may introduce additional uncertainties for investors who are trying to evaluate the company’s performance within these specific markets. It seems unlikely though that these would heavily construe the earnings results and capabilities of the business so the risk it presents is rather slim.

Final Words

Investors who seek a solid dividend addition to a portfolio should be considering EPD right now. With a massive presence in the energy sector as a pipeline owner and operator for natural gas and oil, it has managed to grow into a dividend aristocrat over the years. 24 years of consecutive raises speaks volumes about the value shareholders have in the company. With plenty more projects and expansion plans in the pipeline, I remain bullish on EPD and will be rating it a buy as such.

Read the full article here