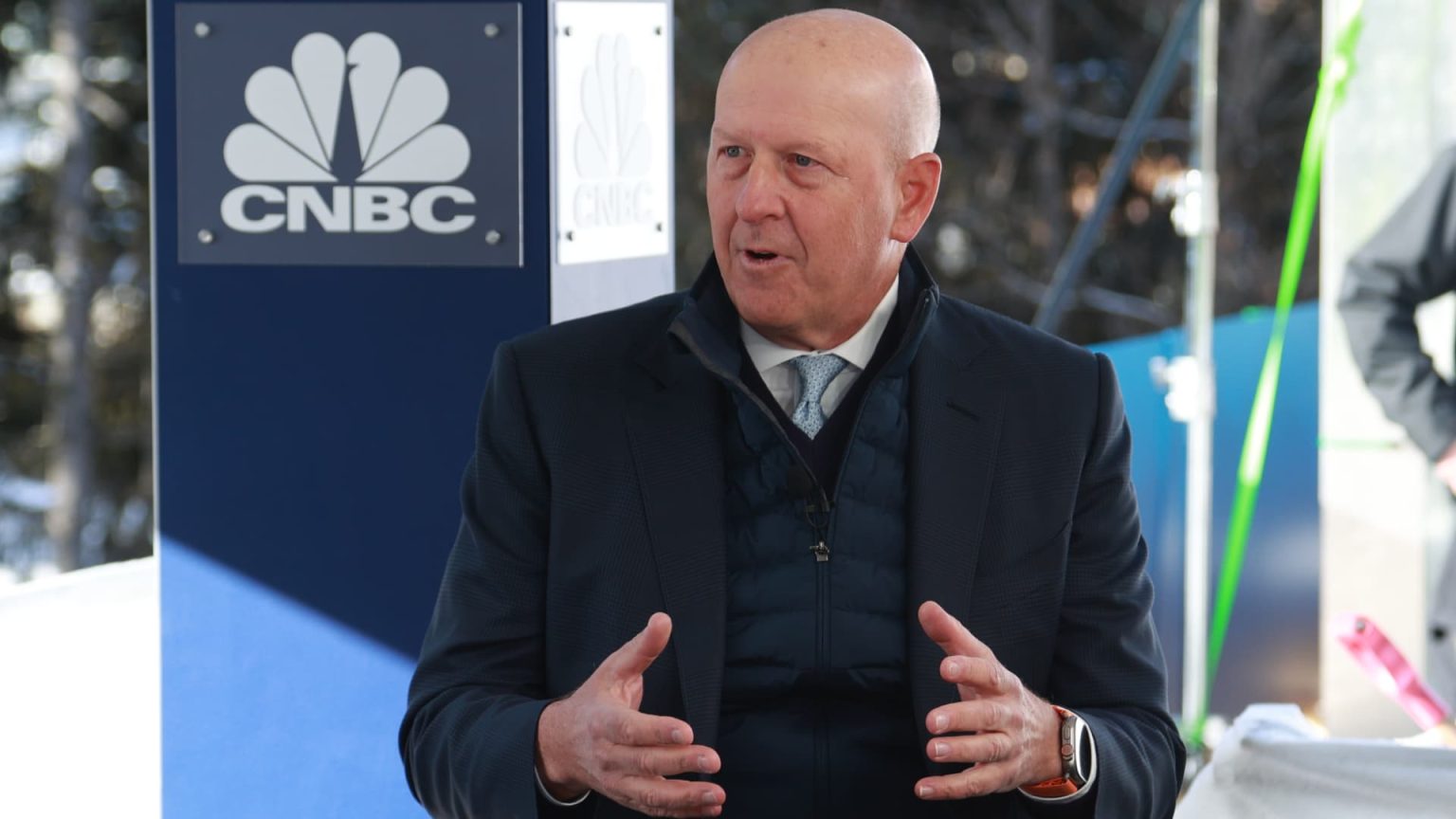

Goldman Sachs is hitting the reset button and giving investors an opportunity to buy into the blue chip bank stock, according to Wells Fargo. Goldman’s embattled CEO David Solomon is rolling back consumer-focused efforts that led to heavy spending and underwhelming stock performance. The latest move came Monday, when Goldman reached a deal to sell its personal financial management division to advisory firm Creative Planning. Wells Fargo analyst Mike Mayo said in a note to clients Monday night that the sale is a solid step toward a leaner, more focused Goldman that will benefit shareholders. “GS is demonstrating its desire to get back to its core strengths,” Mayo said. “To us, the expansion in consumer did not make strategic or financial sense, costing the firm at least $3B over the past 3 years. Yet, the moves that we did not like are now getting reversed.” Goldman is not completely exiting the world of wealth management but is scaling back in a way that is a better fit with its traditional business, Wells Fargo said. “This involves white glove, Northern Trust-like private banking service to sophisticated investors with more complex needs — this is how Goldman typically provides more value and gets better margins for any business. GS will continue to serve personal asset mgmt, but through at-work and indirect channels,” Mayo said. Wells Fargo has an overweight rating on Goldman Sachs, with a price target of $390 per share. The target is more than 19% above where the stock closed Monday. — CNBC’s Michael Bloom contributed reporting.

Read the full article here