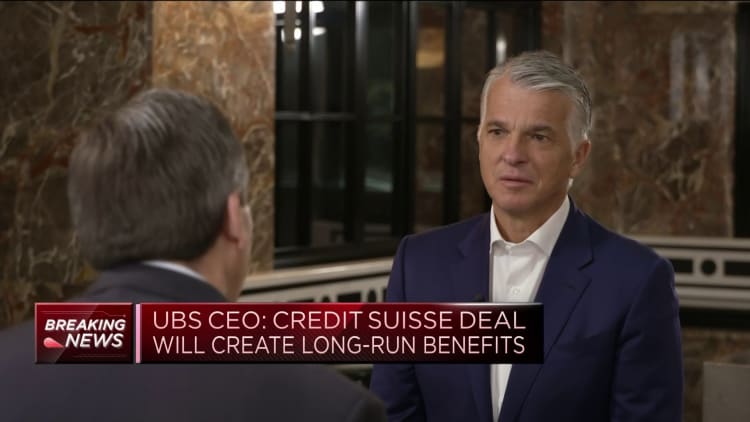

Ulrich Koerner, chief executive officer of Credit Suisse Group AG, during a Bloomberg Television interview in London, UK, on Tuesday, March 14, 2023.

Hollie Adams | Bloomberg | Getty Images

UBS on Tuesday announced that Credit Suisse CEO Ulrich Koerner will join the executive board of the new joint entity once its emergency purchase of the stricken bank completes.

The Swiss giant said the legal close of the acquisition is expected within the next few weeks, and the combined entity will operate as a “consolidated banking group.”

related investing news

The Credit Suisse brand will operate independently for the “foreseeable future” as UBS integrates the business in a “phased approach,” the bank said in a statement.

Swiss authorities brokered the controversial emergency rescue of Credit Suisse by UBS for 3 billion Swiss francs ($3.37 billion) over the course of a weekend in March, as a crisis of confidence among depositors and shareholders threatened to topple the 167-year-old institution.

UBS confirmed that it will initially manage the two separate companies upon the closure of the deal, with each institution continuing to operate its own subsidiaries and branches while the UBS board of directors and executive board will hold overall responsibility for the consolidated group.

Koerner, who took over the ailing Credit Suisse in July 2022 and immediately launched a massive strategic overhaul aimed at reversing the bank’s chronic loss-making and risk management failures, will join the board, UBS confirmed.

“With his knowledge of both organizations, he will be responsible for ensuring Credit Suisse’s operational continuity and client focus, while supporting the integration process,” UBS said.

UBS veteran Todd Tuckner will become chief financial officer for the group, taking over from Sarah Youngwood, who has decided to step down after the transaction closes.

The combined firm will operate with five business divisions, seven functions and four regions in addition to Credit Suisse, with each represented by a board member reporting to UBS CEO Sergio Ermotti.

Ermotti said this was a “pivotal moment for UBS, Credit Suisse and the entire banking industry.”

“Together we will solidify and represent the Swiss model for finance around the world, one that is capital-light, less reliant on taking risk and anchored by stability and high-touch service,” Ermotti said in a statement.

“Adding Credit Suisse to UBS’s highly capital-accretive business model, diversified revenue streams, disciplined risk management and balance sheet for all seasons will benefit our clients, employees, investors, the economies we serve and the wider financial system.”

Read the full article here