The average student loan debt in 2017 is $37,172. This kind of debt is not something that many people can pay off quickly. Instead, they make monthly payments and pay it down over the course of multiple years. Depending on the financial situation, these payments may not be an issue.

In other cases, the burden is too much, or the interest is too high. In these cases, refinancing the loan could be a solution to the issue. This doesn’t take the loan away, but it does offer more ways to control it. Let’s find out how you can decide if this is the right approach for you in your financial journey.

Analyzing The Pros and Cons of Refinancing Student Loans

Given the current costs of tuition, it’s not uncommon for students to take out loans to fund their college education. In many cases, these students don’t need to start paying on their loans until after they’ve graduated.

This is great for convenience, but once they have their degree, the monthly bills start rolling in. Constrained budgets and searching for jobs can take a toll on the new graduates. Student loans add further stress to this equation.

For many people with student loans, refinancing offers a solution that significantly change their situation and give them more control over their student loans. As you set out to explore your options for refinancing with private lenders, you’ll begin to see many of the benefits that refinancing offers:

- A choice between Fixed and Variable Interest rates: If you want to lock in a new interest rate, you have that option. Variable interest rates offer more flexible options, but do have the potential to go up rather than down. If you plan to pay down the loan quickly, variable interest rates do tend to start lower.

- A single monthly payment: If you have multiple loans, refinancing can consolidate them into one loan through a private lender. This will allow you to make one payment each month towards your entire student debt.

- Flexible Terms: During the refinancing process, you can choose to change the terms of the loan. This will allow for a lower interest rate or a different repayment term. If you wish to have lower monthly payments, you can make the loan term longer as needed.

There are some downsides to refinancing. If you have federal loans, you will lose out on benefits offered by them such as loan forgiveness or income-based repayment plans. Your current credit score will also influence the options you have while refinancing. If you’ve struggled with making payments, a lower credit score may affect your options.

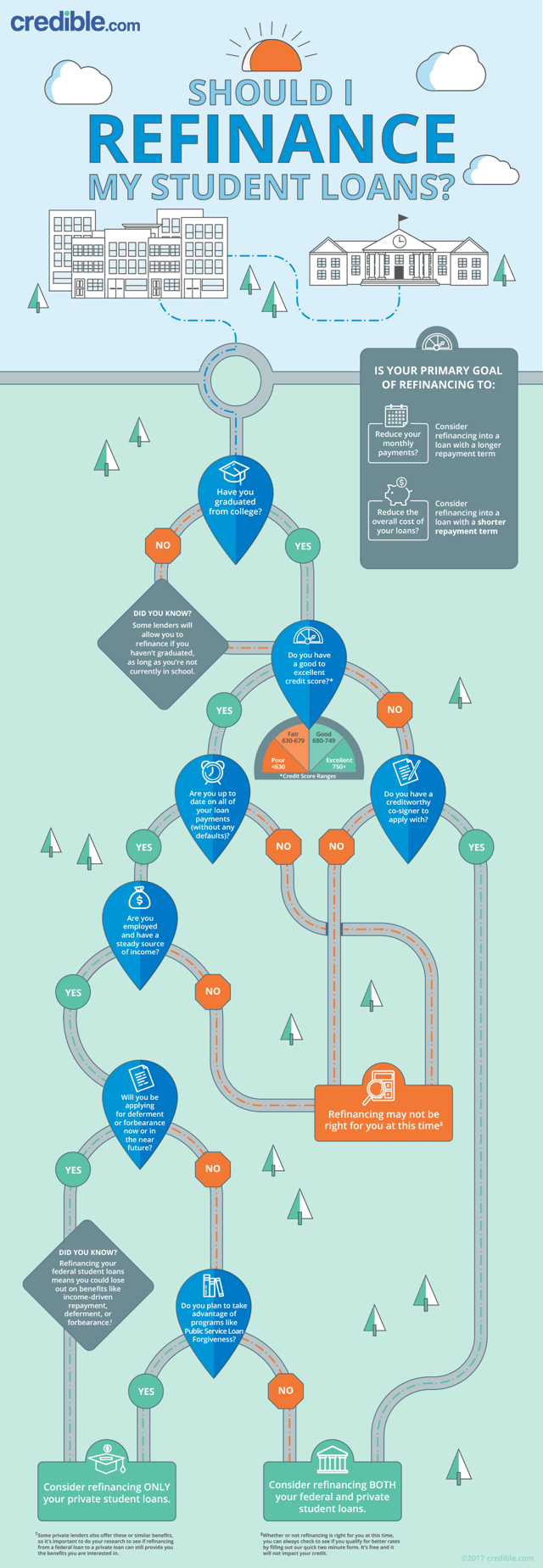

The infographic below from Credible.com illustrates the thought processes and decisions people often make when they are considering a refinancing option.

Read the full article here