Did you know that April is National Financial Literacy Month? Its purpose is to bring awareness to the importance of financial literacy and educate people on the significance of establishing and maintaining healthy financial habits. As financial advisors, we wholeheartedly support taking these steps and what better time of year than FLM to start working out your finances? Taking the leap towards financial freedom can be daunting, but it doesn’t have to be difficult. Over the next few weeks, we will break down the Financial Literacy Month’s (FLM) “Thirty Steps to Financial Wellness” into a four-part series we’re calling MoneyNav Bootcamp. These posts will outline basic steps to take in order to begin revamping your financial life, managing challenges along the way, and staying motivated. Let’s get started!

Quick Recap

By now, you’re probably feeling the “burn” and are well on your way to becoming more financially fit — great job on making it through Part One!

Just as you would want to maintain your energy and find your rhythm during a tough physical challenge, the same applies to working out your finances. During part one of MoneyNav Bootcamp, we went over the importance of the commitment to a new financial you, assessing and auditing your finances, developing a plan for success, and keeping track of your credit. If you missed week one of MoneyNav’s Bootcamp, check it out here!

Week #2 of MoneyNav Bootcamp: Keeping up the Momentum

All of that hard work has established a strong foundation for you to build on and now you’re ready to spend some time on one of the most important aspects of taking on any new endeavor: Setting Goals. Let’s build on top of the momentum from week one to blast through week two!

Step #8 – Identifying your starting point: When you set a goal, you should have a baseline, or in other words, a starting point. To determine your starting point, first, you need to calculate what your financial picture looks like, or in more technical terms, your Net Worth. This will provide a snapshot of everything you have earned and spent up until now, debts you still owe and how much is in your investment accounts.

Step #9 – Did you pass your debt test? Besides being incredibly stressful and the cause of many financial downfalls, like poor credit and bankruptcy, debt also prevents financial independence. Debt can really inhibit your ability to have sufficient income to cover your daily needs, save for the future and ensure financial freedom. Using FLM’s Debt Test will give you a better perspective of your situation and then you can come up with a strategy that will enable you to cross the finish line of financial freedom.

There are many reasons why facing your debt head-on is better for you in the long run. Besides keeping the number of headaches you have to a minimum, you can also look forward to:

- Less hassle: When you start paying down debt, you have fewer emails, calls, and bills from collectors reminding you of an upcoming payment.

- A better credit score: A better credit score means that lenders, employers, landlords, and banks view you as a financially responsible individual which means whenever you apply for a loan, job, you are more likely to be approved.

- More room to save: You don’t know if everything in your life will turn upside down. A medical issue, job loss, or a major home improvement can all be extremely costly and if you’ve been scrambling trying to pay down debt instead of building emergency savings, it could cause you even more financial woes.

- You don’t owe anyone anything: Much like crossing the finish line at the end of a marathon, making that last payment is always an amazing feeling.

- Extra money for other goals: Besides not having to spend money to pay your debts, you now have extra cash to spend (or save, which is the better choice!). You can focus on a brighter future where you live stress-free (at least financially) and put that money towards goals like an emergency savings fund, a vacation, a new car, or in your retirement fund.

Step #10 – Setting your priorities: This step is incredibly important because it clearly sets apart your needs from your wants. Despite what outside influences may impart to us, what we “want” and “need” are two very different things. Every day, we are bombarded with images and videos from billboards, commercials, and other forms of advertisements with the singular goal to entice us to buy, buy, buy. Even friends and family can contribute to this. Here’s a simple example that can bring this sneaky strategy into perspective. It’s time to get a new car, and you have two options:

Get a used car that is in good working condition and is being sold at a reasonable price.

Get a new car with the latest technology and upgrades, but costs exorbitantly more.

You may think, “I need the newer car, I deserve it, and it will last longer than the used car,” but you really want it because the commercials have been set up to look like a once in a lifetime deal and you think you can handle the extra expenses that come with it.

It’s important to become aware of the different marketing tactics thrown around and subconsciously influencing you. Create a list of financial priorities, ranking them by need vs. want. For example, paying off high-interest debt should be a top priority, while saving for a luxury vacation should definitely be in the “want” category.

Step #11 – Setting SMART financial goals: You know what your financial priorities are, and have a system in place to help you stay on track. Now it’s time to take those priorities and transform them into SMART goals. SMART goals are more specific and focused, so when you are creating your SMART goals you should break them down and think about them like this:

- Specific- Know what the definitive goal is you want to accomplish. If it is to save more money, then what are you saving more money for? Is it for a car, house, or retirement? Then determine how much you want to save for that goal. Do you want to save $1,000, $10,000, or even $100,000?

- Measurable- How do you measure the success of your goals, and how often? Do you measure monthly, quarterly, or annually, and do you determine whether you can add or subtract money from your saving goal?

- Achievable- Your goals have to be realistic. It’s great to have confidence that you can achieve your goal, but not if it is outside of your resources and means.

- Rewarding- You want a goal that leaves you feeling pleased when you accomplish it and worth the effort.

- Trackable- Similar to being measurable, you want to set to be able to schedule milestones for your goals. This allows you to see how close you are to the finish line.

Step #12 – Setting short, mid, and long-term goals: When setting up your SMART goals you also need to understand the timeline of these goals. The priority level of your goals may determine how quickly you will reach them; some will be completed sooner while others will end at a later date. Viewing your goals in this manner may make it easier to parcel out the funds, so the overall amount of money isn’t as overwhelming.

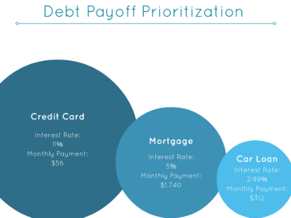

Step #13 – Pay down your debt: There are many ways to pay down debt, but the two most popular ways are the debt snowball and debt avalanche methods.

The debt snowball method works by attacking the debt with the smallest balance first while still paying the minimum for your other debts. You focus on paying whatever you can so the debt can be paid down as quickly as possible. Once that debt has been paid, you take money that was used for the previous debt and shift it towards the new debt. You continue with this pattern until you have paid all that you owe. This method may cause you to pay more interest over time, but you will maintain your motivation and avoid debt fatigue.

The debt avalanche is just like the snowball debt method, except it, focuses on paying off the debt with the high est interest rate first, but like the snowball debt method, you continue to pay the minimum for the rest of your loans. Once that loan has been paid in full, you transfer that money to the next debt with the highest interest rate debt. This method allows you to pay your debts quicker, but you have to have discipline and patience because you may not see immediate results.

est interest rate first, but like the snowball debt method, you continue to pay the minimum for the rest of your loans. Once that loan has been paid in full, you transfer that money to the next debt with the highest interest rate debt. This method allows you to pay your debts quicker, but you have to have discipline and patience because you may not see immediate results.

If you don’t know which method might work best for you, refer to this debt-free calculator. It calculates data like the amount owed, your interest rate, and your monthly payment to tell you what month and year you will be debt-free, in addition to how much total interest you will end up paying.

However, sometimes you just have difficulty paying your debts no matter how strategic you are. If you happen to run into that problem, contact your creditors immediately and inform them of your situation. If you don’t know where to go to get help for debt relief, reach out to Money Management International.

Step #14 – Expect the unexpected: Don’t allow yourself to be caught off-guard by unanticipated events, which can have an unfortunate impact on your finances. This means creating an emergency savings fund. Your emergency savings should have at least three to six months of expenses saved, but before you start saving, plan to do these three things:

- Determine how much you will put into your fund: This means crunching numbers and knowing what are the expenses that need to be accounted for versus the expenses that you can do without.

- Start saving small: Break down the total amount of your saving goal into smaller pieces to avoid becoming overwhelmed. Remember, everyone has to start somewhere, and eventually you will reach your savings goal.

- Make saving a no-brainer: Dedicate and automatically sync a portion of your earnings to a savings account that way you know that your emergency savings is growing.

Having a safety net in place ensures none of your hard work was done in vain, and you can be prepared when a financial calamity occurs. You want to have a buffer in place to protect you and your assets from any crisis of the financial variety.

MoneyNav Bootcamp Week #2 Round-Up

This week it’s time to really get moving, but let’s cool down with a recap of what you can expect this week:

Read the full article here