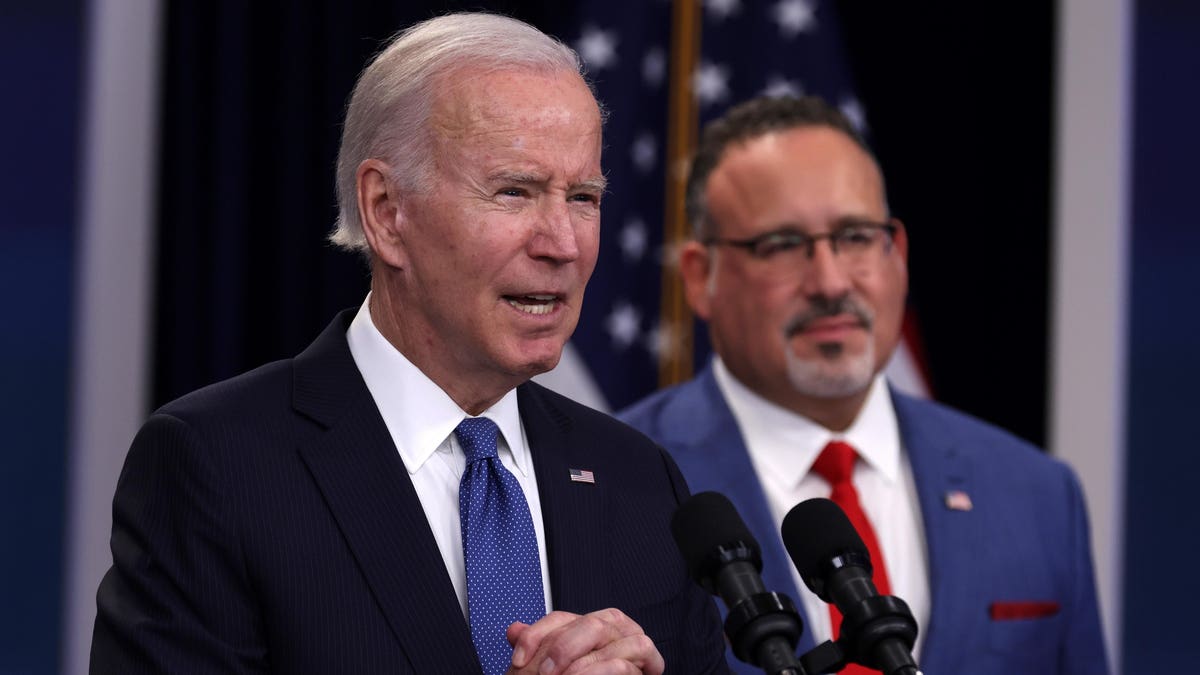

The Supreme Court will soon issue a decision on President Joe Biden’s landmark student loan forgiveness plan. If allowed to proceed, the program would wipe out up to $20,000 in federal student loans for many Americans who fall below the plan’s income threshold. Some borrowers could receive the benefits automatically if the Education Department already has income information on file for a borrower from 2020 or 2021.

The Court may be poised to strike down Biden’s student debt relief plan, based on how oral arguments went earlier this year. But if that happens, there are other student loan forgiveness initiatives in place, including several that are providing automatic relief. None of these programs are nearly as far-reaching as Biden’s signature student debt relief plan. Nevertheless, they will collectively impact hundreds of thousands, if not millions, of borrowers.

Here’s a breakdown.

Automatic Student Loan Forgiveness Under One-Time Account Adjustment

One of the Biden administration’s most significant student debt relief initiatives, other than the one before the Supreme Court, is the IDR Account Adjustment. This program will provide a one-time “adjustment” of credit toward a borrower’s student loan forgiveness term under income-driven repayment plans, which is either 20 or 25 years, depending on the plan and type of federal student loans a borrower has. The Education Department can count most past periods of repayment, as well as certain periods of deferment, forbearance, and even default, toward a borrower’s loan forgiveness term.

Millions of borrowers with government-held federal student loans — including all Direct-program loans — will benefit from the IDR Account Adjustment automatically, even if they are not currently on an income-driven plan. “Any borrowers with loans that have accumulated eligible time in repayment of at least 20 or 25 years will see automatic forgiveness, even if they are not currently on an IDR plan,” says updated Education Department guidance.

Some borrowers will need to take other steps to benefit from the program. Borrowers with commercially-held FFEL loans would need to consolidate their loans via the federal Direct consolidation program before the end of the year. Other borrowers may also want to consider Direct loan consolidation to maximize the adjustment’s benefits. And borrowers who receive substantial retroactive credit under the adjustment, but fall short of the threshold for student loan forgiveness and are not presently in an IDR plan, may want to consider switching to one in order to make continued progress.

The Education Department says that some borrowers will start to receive automatic student loan forgiveness under the IDR Account Adjustment as soon as this August.

Automatic Student Loan Forgiveness Through PSLF

The Education Department is still in the process of implementing the Limited PSLF Waiver, a temporary initiative that relaxed the rules for the Public Service Loan Forgiveness program, a popular student loan forgiveness option for borrowers working for nonprofit and government organizations.

For borrowers who have already certified their employment, the Biden administration is automatically updating PSLF payment counts to include past periods of repayment, deferment, and forbearance that might not have otherwise counted. Over 450,000 borrowers have received student loan forgiveness so far.

The Biden administration is extending many of the benefits of the Limited PSLF Waiver through the IDR Account Adjustment. The retroactive credit borrowers receive under that program can count toward student loan forgiveness under both IDR and PSLF. To receive automatic PSLF credit, borrowers must already have Direct federal student loans and must have submitted the required PSLF employment certifications. The Education Department has recently updated the PSLF certification process to make it easier for borrowers to apply.

Automatic Student Loan Forgiveness For Borrowers Who Attended Shuttered Schools

The Biden administration is currently implementing another automatic student debt relief initiative for former students of certain collapsed for-profit schools.

Last year, the administration announced what it billed at the time as the largest automatic mass student loan forgiveness initiative in history, with $6 billion in discharges for over half a million former students of Corinthian Colleges. Corinthian Colleges was a chain of for-profit campuses (including Everest College, Heald College, and Wyotech) which collapsed in 2015. While the relief is being implemented under the Borrower Defense to Repayment program, which is a student loan discharge program for borrowers who were defrauded by their schools, the Education Department is providing the relief automatically, even for borrowers who did not submit a formal application.

The Biden administration also announced last year a similar initiative for former students of ITT Technical Institutes, another now-defunct national chain of for-profit schools. That initiative will provide $4 billion in student loan forgiveness for over 200,000 former ITT students.

Both programs are automatic and ongoing, and eligible borrowers should continue to receive relief through the rest of this year.

Automatic Student Loan Forgiveness Under Sweet v. Cardona Settlement

Last fall, the Biden administration finalized a settlement to resolve Sweet v. Cardona, a years-long class action lawsuit brought by borrowers over stalled and improperly denied Borrower Defense applications.

Under the settlement, which the Supreme Court ruled can proceed in a brief order in April, hundreds of thousands of borrowers who submitted Borrower Defense to Repayment applications by June 2022 will automatically receive $6 billion in student loan discharges. The Education Department is currently processing student loan forgiveness under the settlement on a rolling basis, with relief expected to continue throughout this year.

In addition, borrowers who submitted a Borrower Defense application between June and November 2022, and attended one of the schools approved under the settlement, will be entitled to a determination within three years. If they don’t receive a timely decision, they can also qualify for automatic loan discharges under the settlement.

Automatic Student Loan Discharges For Disabled Borrowers

The Biden administration is currently in the process of codifying a successful data-sharing agreement between the Social Security Administration and the Education Department to identify disabled student loan borrowers who may qualify for the Total and Permanent Disability (TPD) Discharge program. The TPD program can provide student debt relief to borrowers who have a physical or psychological impairment that prevents them from maintaining substantial, gainful employment.

Under the data-sharing initiative, over 300,000 borrowers have received $6 billion in automatic student loan forgiveness, according to the Education Department. And new regulations set to go into effect this July will simplify and broaden the criteria for Social Security disability benefits recipients to qualify, potentially expanding the pool of borrowers who can receive automatic debt relief through the TPD discharge program.

Further Student Loan Forgiveness Reading

Student Loan Forgiveness Update: What Biden’s Latest Move Means For Borrowers

7 New Flexibilities As Student Loan Pause Ends And Loan Forgiveness Ruling Looms

If The Supreme Court Rejects Biden’s Student Loan Forgiveness Plan, Here Are Other Options

These Democrats Just Joined Republicans To Repeal Student Loan Forgiveness

Read the full article here