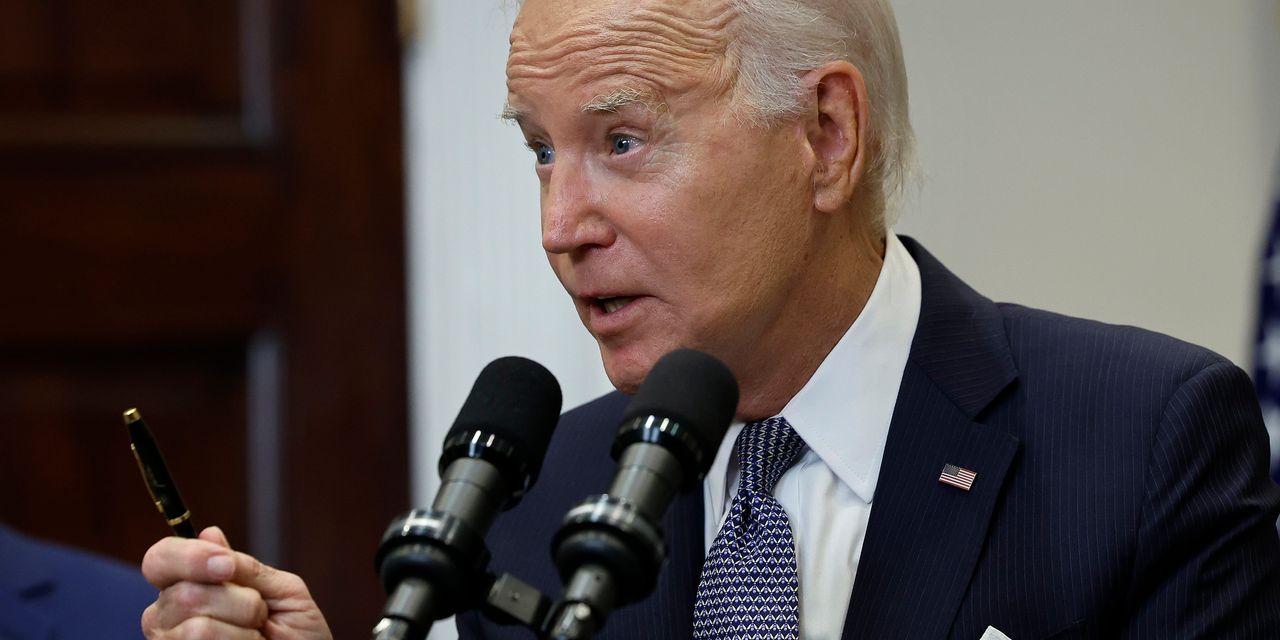

President Joe Biden said he was “discouraged” and “angry” about the Supreme Court’s decision to block his student loan forgiveness plan on Friday — but there could still be some relief in sight for the roughly 40 million borrowers who would have benefited from seeing $10,000 to $20,000 of their debt disappear.

Biden announced “a new path” to provide student debt relief while speaking at the White House on Friday afternoon, which includes what he called “a temporary on-ramp” for when borrowers resume their student loan payments this October.

So what’s the on-ramp? It’s basically a year-long grace period where borrowers who miss student loan payments won’t be reported to any of the credit bureaus, and they won’t go into default.

The president noted that when someone misses a student loan payment, they can fall into delinquency, and ultimately default on their loans if they miss too many payments, which is “not good for them, or the economy.”

Related: What if you can’t pay back your student loans when payments start again? These are your options.

Before the pandemic led to student loan payments being paused, Federal Reserve research put the average monthly payment at $393, while the median payment was $222. So, because many of the most vulnerable borrowers may miss a payment or two on the front end when student loan payments resume on Oct. 1, Biden said that “we’re creating a temporary 12-month, what we’re calling an ‘on-ramp repayment program,’” to give people more time to get their finances in order.

To be clear, Biden noted this on-ramp is not the same thing as a student-loan payment pause; monthly payments will still be due, and loans will still be accruing interest. But if borrowers miss payments when loan payments resume, they will be spared some of the worst consequences — for a year, anyway.

The White House spelled the on-ramp out in a fact sheet released after the president’s remarks. It explains that the Department of Education has created the on-ramp to protect the most vulnerable borrowers “from the harshest consequences of late, missed, or partial payments for up to 12 months,” the statement said. This will run from Oct. 1, 2023 through Sept. 30, 2024.

During this time, the White House noted that student loan payments will still be due, and interest will still accrue on them. But — key for people worried about their credit scores — borrowers will not be reported to credit bureaus, be considered in default, or referred to collection agencies for late, missed, or partial payments during the on-ramp period, the White House said.

And borrowers do not need to take any action to qualify for this on-ramp.

“If you can pay your bills, you should,” Biden said. “But if you cannot, you miss payments, the on-ramp temporarily removes the threat of defaulting or having your credit harmed, which can hurt borrowers for years to come.”

Check out his full remarks here:

And read more on the Supreme Court’s decisions on student-loan forgiveness and affirmative action at MarketWatch.

The Supreme Court just blocked student-loan cancellation. Here’s what happens next for your loans.

Biden turns to Higher Education Act for next move on student loans after Supreme Court rejection of forgiveness plan

Republican presidential candidates praise SCOTUS decision. Democrats blast ruling.

Supreme Court’s ruling against affirmative action leaves defense-related loophole

Read the full article here