After becoming a mainstay for millions of Americans during tax season, the standard deduction’s rules and payout size are becoming a part of the brewing Capitol Hill debate over the future of the tax code.

A new bill introduced by Republican lawmakers provides insight into what the tax code may look like in the coming years — specifically after 2025 when current Trump-era tax rules and standard deductions expire.

The House Committee on Ways and Means — the chief tax-writing committee in the Republican-controlled House of Representatives — passed a bill earlier this week that aims to raise the standard reduction. That’s in addition to previous increases.

The 2017 Tax Cuts and Jobs Act almost doubled the standard deduction’s size, and reduced income tax rates for five of seven tax brackets among other things. Since then, the standard deduction has become an increasingly popular path.

These provisions last through 2025. Without Congressional action before then, these parts of the tax code revert to their 2017 status.

“When people file their federal income taxes, they choose between the standard deduction and the itemized deduction as the way to reduce their taxable income.”

When people file their federal income taxes, they choose between the standard deduction and the itemized deduction as the way to reduce their taxable income. Approximately 90% of 2021 individual income tax returns claimed the standard deduction, according to the Internal Revenue Service’s most recent figures.

The legislation would add an extra $2,000 on top of the underlying deduction for individuals, and it would add $4,000 more for married couples filing jointly. The bill renames the deduction as the “guaranteed deduction,” and the extra amounts would apply to Americans’ 2024 and 2025 income tax returns.

For this year, the IRS says single filers have a $13,850 standard deduction and married couples filing jointly have a $27,700 standard deduction. Standard deduction amounts are pegged to rise with inflation. The bonus money would be indexed for inflation as well.

The extra money applies for taxpayers making under $200,000 a year and $400,000 a year for married couples. The sum phases away beyond the threshold.

Around two-thirds of households would get a tax cut in 2024 through the bill, according to researchers at the nonpartisan Penn Wharton Budget Model. But generally, households making up to $19,500 and the top 1% of taxpayers would not benefit, their projections said.

“The new legislation would add an extra $2,000 on top of the underlying deduction for individuals, and it would add $4,000 more for married couples filing jointly. ”

In a divided Congress with Democrat Joe Biden as president, observers say there’s a slim chance that these bills will become law. The next step is a full vote from House members. The Tax Cuts for Working Families Act is grouped together with other GOP tax bills focused on large and small businesses.

The chances for the standard deduction bill are “about as close to zero as you can get,” said Howard Gleckman, senior fellow at the Tax Policy Center.

Still, the bill sends the signal that in 2025 the standard deduction will be in play. “How big a standard deduction are we going to have?” Gleckman said, “and what do we do about those itemized deductions?”

“This does set the table for the broader discussion,” said Kim Wallace, senior managing director at 22V Research, an independent policy and risk research firm geared at institutional investors. It’s part of a discussion on tax policy that happens on the campaign trails this year and next year, he said.

The debate is expected to begin in earnest in 2025 when various tax rules are about to sunset, and the federal government again nears its debt ceiling, Wallace said.

Taxes can get complicated quickly, but the bill’s backers may find it easier to make campaign-trail explanations of a proposed change to standard deduction, Wallace said.

Republicans and Democrats debate tax measures

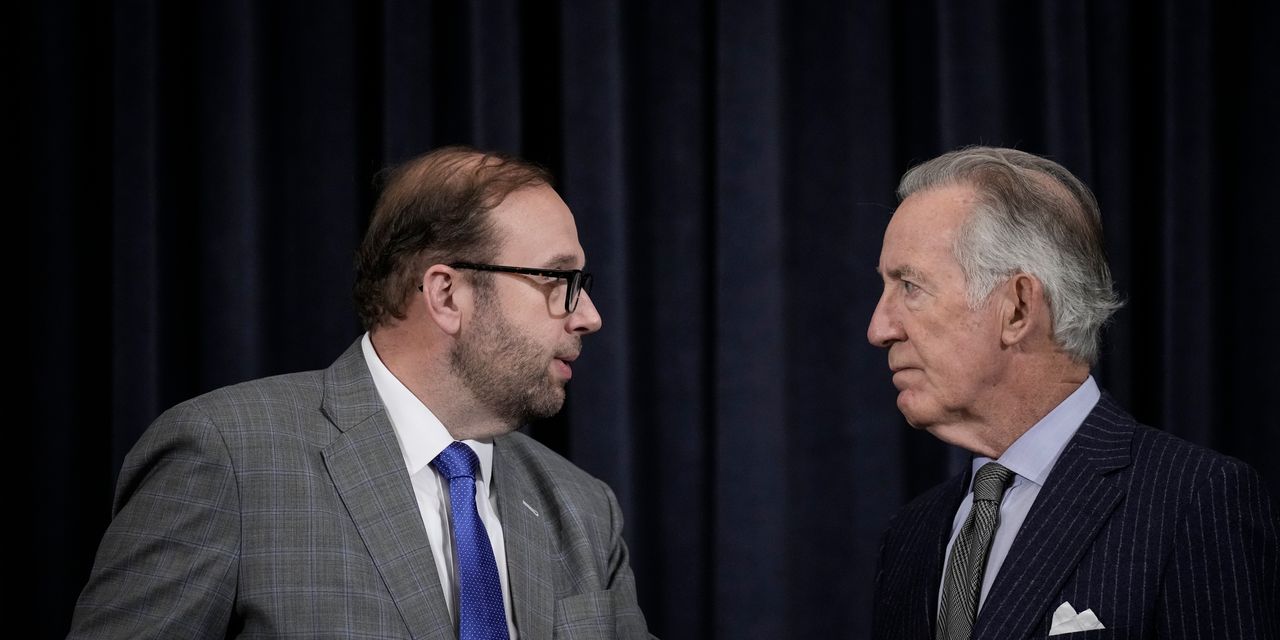

The Tax Cuts for Working Families Act is trying to ease inflation’s grip on people’s wallets, said Rep. Jason Smith, a Republican from Missouri, who chairs the Ways and Means committee.

It’s “a necessary response to the economic nightmare that President Biden and Washington Democrats reckless tax and spend agenda has created,” he said this week.

Inflation rates rose 0.1% from April to May and the yearly rate slowed to 4% in May from 4.9% a year earlier, its lowest level since March 2021, according to numbers this week from the Bureau of Labor Statistics.

Rep. Richard Neal, the ranking Democrat in the Ways and Means Committee, said he’s all for helping families but the bill increasing the standard deduction falls short.

The increased deduction does too little for the lowest earners, the Massachusetts lawmaker said during a committee hearing. “With the proven success of the Child Tax Credit, I cannot accept this as an alternative for working families,” he said.

The 2017 Tax Cuts and Jobs Act doubled the child tax credit to $2,000. For 2021, a Democratic Congress set the child tax credit to $3,600 for children under age six and $3,000 for ages 6 to 17. Child poverty levels fell to record lows that year, according to one of the Census Bureau’s poverty measures.

“Democrats want to permanently increase the child tax credit — cited by some economists as helping to lower child poverty — with their own tax bill reintroduced this month.”

Democrats want to permanently increase the child tax credit — cited by some economists as helping to lower child poverty — with their own tax bill reintroduced this month.

During the committee proceedings, Neal called the Republican tax bills “corporate giveaways to the wealthy and well-connected,” and described the change for the standard deduction as “an afterthought.”

The batch of bills awaiting a full vote from the House of Representatives cover a range of business-related tax rules. The provisions include changes on the write-off rules for corporations’ research and development costs.

Another Republican-led provision raises the money threshold mandating when payment platforms such as Venmo and PayPal

PYPL,

should start reporting the income of sellers and gig workers to the IRS.

For now, it will take just one transaction over $600 for the tax reporting requirement to apply. The rules were supposed to kick in for the taxes filed this year, but the IRS paused their implementation.

The Republican-led bill would ensure that payment thresholds go back to the original requirements of more than 200 transactions and $20,000 before the IRS reporting kicked in.

The bill would ensure “Americans aren’t saddled with a mountain of paperwork, confusion or taxes that they don’t owe,” Smith said at the committee hearing.

Read the full article here