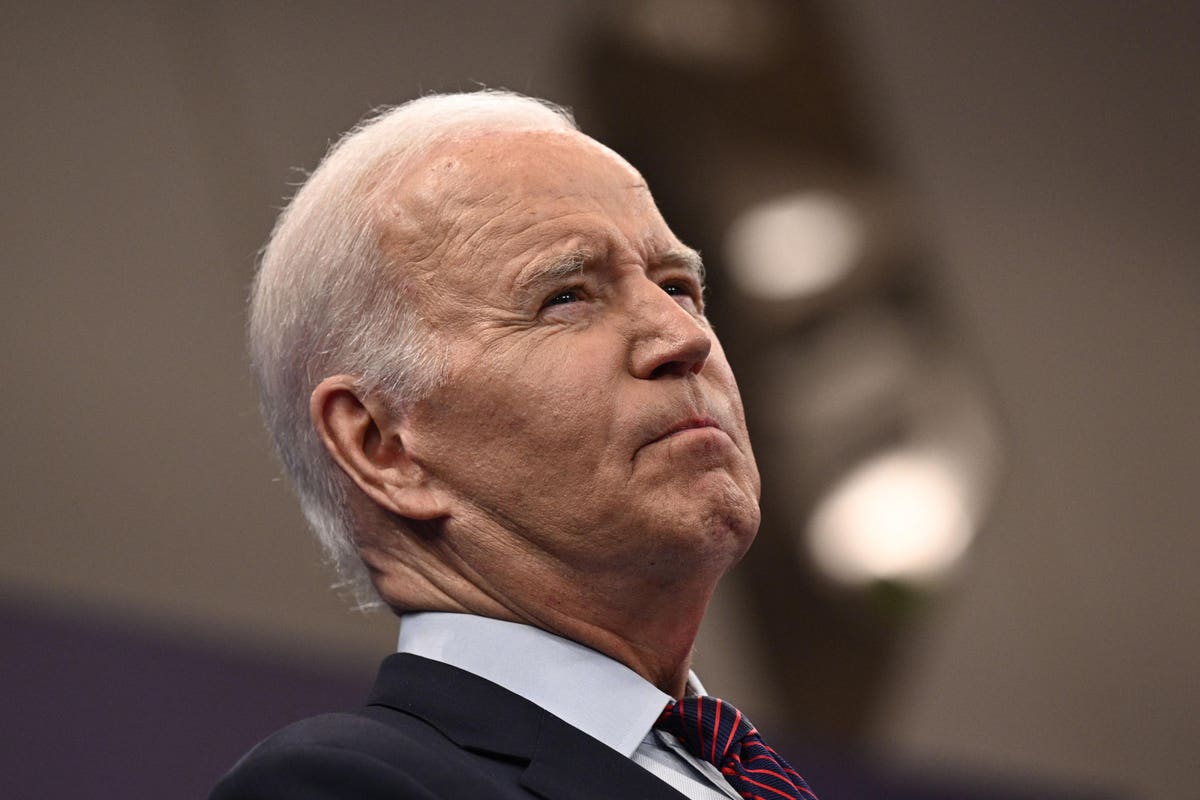

The fate of President Joe Biden’s unprecedented student loan forgiveness plan will be determined in a matter of weeks. The Supreme Court is expected to soon rule on a pair of challenges contesting the legality of the initiative, which could wipe out up to $20,000 in federal student loan debt for over 30 million borrowers if it is allowed to proceed.

The Biden administration has maintained that there is no backup plan if the Supreme Court winds up striking down the President’s signature student debt relief program. If there is an adverse ruling, Biden will have a handful of options to consider, none of which would necessarily be ideal. Here’s an overview.

Establish Similar Student Loan Forgiveness Plan Under A Distinct Statutory Authority

The Education Department established Biden’s student loan forgiveness plan using emergency regulatory authority under the HEROES Act of 2003. This statute, passed in the wake of the September 11th terrorist attacks, gives express authority to a presidential administration to “waive” or “modify” the rules governing federal student loan programs (including programs related to loan repayment and discharge) in response to a national emergency.

In oral arguments before the Supreme Court in February, the Solicitor General argued on behalf of the Biden administration that the clear, unambiguous text of the HEROES Act provides express authority for the Education Department to change nearly “any” provision of the federal student system if justified by a national emergency. But several conservative justices on the Court seemed to agree with the challengers that mass student loan forgiveness may exceed what Congress originally had in mind.

Advocacy groups for borrowers and some progressives in Congress have urged Biden to consider re-issuing the student loan forgiveness plan under the legal authority of a different statute if the Supreme Court makes an adverse ruling. The Higher Education Act is a separate federal statute that has its own provision providing authority for the Education Department to “compromise,” “waive,” or “release” federal student loan obligations. Although this provision remains legally untested for such a broad student loan forgiveness plan, the Biden administration did cite to this provision to justify wide-scale student debt relief as part of an unrelated initiative.

In comments to Politico last week, Rep. Alexandria Ocasio-Cortez (D-NY) urged the Biden administration to have a backup option ready if the Supreme Court strikes down the Biden student loan forgiveness plan. It’s “very important the administration has a plan that is an actual response in the event of SCOTUS overturning student-debt relief,” she said. “Is the president prepared to re-administer the loan forgiveness program? And I think this is the most crucial question.”

Similarly, in comments to NPR last week, Rep. Ayanna Pressley (D-MA) pressed the administration to have a “contingency plan” in case the Supreme Court rules against Biden’s plan.

Of course, starting a new student loan forgiveness from scratch under the Higher Education Act could invite fresh legal challenges. Those challenges could also end up before the Supreme Court yet again, leaving borrowers in limbo during another protracted legal battle.

Make Bigger Improvements To IDR To Speed Up Student Loan Forgiveness

The Education Department released a proposed overhaul of income-driven repayment, or IDR, last year. IDR plans use a formula that calculate a borrower’s monthly student loan payments based on their income and family size, and can result in eventual loan forgiveness if the balance has not been repaid by the end of the term (which is usually 20 or 25 years). A separate initiative called the IDR Account Adjustment is also currently being implemented; the adjustment could further accelerate many borrowers’ student loan forgiveness timelines.

Notably, the proposed regulations governing the IDR overhaul have not yet been finalized. It is possible that if the Supreme Court rejects Biden’s student loan forgiveness plan, the Education Department could further modify the overhaul to make it more generous, such as by further reducing monthly payments or shortening the repayment term. Such changes may be less susceptible to legal challenges, as the department’s authority to establish new IDR rules is fairly clear-cut.

However, the changes would not be immediate, and the benefits would likely be drawn out over a period of years for many borrowers. This would leave Biden without the nearly instant relief that his student debt relief plan was intended to provide.

Extend Or Modify The Student Loan Pause

The ongoing student loans pause, which has suspended monthly payments for most federal student loan borrowers and set interest rates to zero, is scheduled to end in just a couple of months. Biden had initially extended the student loan pause as a result of the legal challenges before the Supreme Court.

Should the Court strike down the Biden student loan forgiveness plan, the administration could consider another extension of the student loan pause, particularly in conjunction with implementing a backup loan forgiveness plan such as through the Higher Education Act or via a new IDR plan.

But there are no signs yet that the administration is considering another extension. And another extension of the student loan pause could invite further risks and uncertainties. Biden’s most recent extension is already subject to separate pending legal challenges. And with the recent end of the Covid pandemic emergency, the administration has lost its central justification for extending the relief again.

The administration argued before the Supreme Court that HEREOS Act relief (which was the basis for the student loan pause extensions as well as Biden’s student loan forgiveness plan) is allowable even after a national emergency has ended, as long as it is “in response to” that emergency and the resulting economic harms. The administration could make that argument here to justify another extension of the student loan pause. To get around the possible legal and political battles that would likely ensue, the Education Department could narrow the pool of eligible borrowers who would qualify for a new extension (i.e., income restrictions akin to those that were part of the eligibility criteria for the student loan debt relief plan), or extend only certain elements of the pause, such as the interest freeze.

Do Nothing Else On Student Loan Forgiveness

Biden could decide to do nothing if the Supreme Court rejects his student loan forgiveness plan. The administration could focus instead on touting the relief it has provided under separate programs, such as the Limited PSLF Waiver and Borrower Defense to Repayment. The Education Department recently announced that it had approved over $55 billion in student loan forgiveness for hundreds of thousands of borrowers under these programs. And more may be coming, as the department ramps up implementation of the IDR Account Adjustment and rolls out new borrower-friendly regulations this summer.

But while relief under these other programs is both unprecedented and significant, it pales in comparison to the student debt relief plan that is currently before the Supreme Court. And $55 billion is a tiny fraction of the nearly $2 trillion in total outstanding student debt in America.

“We should not have a Dobbs-style situation where we literally had the ruling months in advance and it seemed as though the response was not fully prepared for when we literally had the answers,” said Rep. Ocasio-Cortez, referring to the Supreme Court’s decision overturning Roe v. Wade, which seemingly caught the Biden administration flat-footed. Biden should not “just take whatever it is laying down and say, well, it’s canceled. We’re not going to do anything else.”

Further Student Loan Forgiveness Reading

New Plan Would Update Student Loan Forgiveness Rules For Borrowers Who Leave Qualifying Jobs

Lowering Student Loan Payments Just Got Easier Amid Uncertainty Over Loan Forgiveness

Student Loan Forgiveness Eligibility Expanded In 3 Ways Under New Account Adjustment Guidance

$55 Billion In Student Loan Forgiveness Approved, Says Biden Administration — And More May Be Coming

Read the full article here