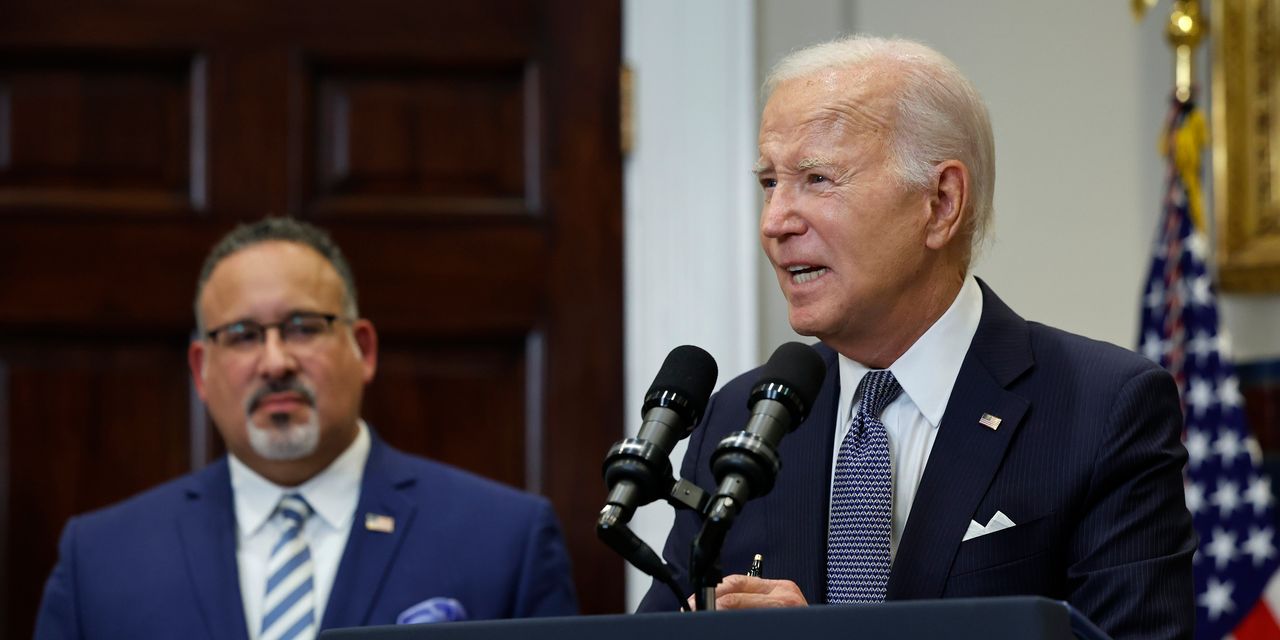

Hours after the Supreme Court struck down his student-debt relief plan, President Joe Biden announced that he would look to cancel debt en masse via other means. But whether borrowers’ wallets feel the impact of the announcement will depend on its implementation, experts say.

The court ruled Friday that the Biden administration doesn’t have the authority to cancel student debt under the HEROES Act, a 2003 law that allows the secretary of education to waive or modify student loans during a national emergency. Now, Biden said, his administration will take another stab at forgiving student loans for a wide swath of borrowers and rest its authority to do so in a different law, the Higher Education Act.

“I’m not going to stop fighting to deliver borrowers what they need, particularly those at the bottom end of the economic scale,” Biden said. “We need to find a new way, and we’re moving as fast as we can.”

Advocates and activists have argued for years that the executive branch has the authority to cancel student debt under the Higher Education Act. They’ve been particularly focused on a provision allowing the Department of Education to “compromise, waive, or release,” any right to collect on student loans. Almost immediately after the court announced its decision on Friday, advocates and lawmakers urged the Biden administration to use that authority to cancel loans.

One of those advocates, Persis Yu, managing counsel and deputy executive director at the Student Borrower Protection Center, an advocacy group, said she was “really excited” to see that “President Biden agrees with us that there is an alternative pathway to deliver the relief.”

“The thing that we’re looking to now is to make sure the president delivers on this relief as fast as possible,” she said. That’s particularly crucial because student-loan payments are scheduled to resume in October after a more than three-year freeze, Yu said. Without some kind of relief, a wave of borrowers could slide into delinquency and default, she said. The challenges borrowers may face in resuming repayment was part of the Biden administration’s legal argument for debt relief.

“It’s great that there is a plan, but what we need is we need action,” she said.

Biden administration started a regulatory process

On Friday, the Department of Education filed notice indicating it would begin a regulatory process that would flesh out an alternative pathway to debt relief. Through the process, known as negotiated rulemaking, the department will take comments from the public on the relevant issues and convene a group of stakeholders to discuss a proposed rule related to the waiver and compromise authority under the HEA.

Ultimately, a final regulation would be developed based on the feedback. That process, which is typical of most Department of Education regulations, takes several months. The Biden administration has vowed to deliver the debt relief “as fast as possible.”

Still, any delay in canceling debt puts the Biden administration at risk of being sued again over the plan.

“If you don’t do it immediately, you tip your hand, you let the other side build its case,” said Luke Herrine, an assistant professor at the University of Alabama Law School, who has written about the authority to cancel student debt under the Higher Education Act for years. “Then it can be challenged and enjoined before it even gets enacted.”

And if a new debt-cancellation plan reaches the Supreme Court, it may face a similar fate.

One of the questions before the justices was whether the parties had standing, or the right to sue, as having been directly harmed by the Biden plan. Legal experts, even those who didn’t think the Biden administration was within its legal authority in authorizing debt relief, were skeptical that the parties bringing the cases had standing.

The court’s six-justice conservative wing ruled that the state of Missouri had the right to sue because of its relationship to the Missouri Higher Education Loan Authority. MOHELA, as it’s also known, is a state-chartered organization that services federal student loans.

Because they found MOHELA had standing, the justices were able to move on to the merits of the case and whether the executive branch had overstepped its authority in issuing debt relief. “Our precedent — old and new — requires that Congress speak clearly before a Department Secretary can unilaterally alter large sections of the American economy,” Chief Justice John Roberts wrote in the majority opinion.

Though the decision was focused on the HEROES Act, “the court made its views clear,” more generally, on mass-scale debt relief, Herrine said.

Leaving time for opponents to sue over the plan revived criticism from last summer, when the specifics of the Biden administration’s debt-relief plan started to surface. At the time, advocates worried that a means test and an application process would make it more difficult for borrowers who could benefit the most from debt relief to receive it. In addition, they worried that by requiring borrowers to apply instead of automatically canceling their debt, the administration had allowed time for opponents to challenge the plan.

“If they had done it automatically, it would have been done last summer,” said Thomas Gokey, an organizer with the Debt Collective, which has been pushing for more than a decade for mass student-debt cancellation. “There is a way where they really could fight and do everything they can and it still doesn’t work. But we will never know.”

Yu said there are faster ways than negotiated rulemaking that the Biden administration could use to take on student debt. She added that there are steps that could be taken to speed up the negotiated rulemaking process. Announcing the slower process doesn’t necessarily take those off the table, she said.

“We still are urging them to move with the urgency that this moment requires,” she said.

The debt-relief plan the court struck down Friday would have wiped away up to $20,000 in debt for a wide swath of borrowers. The Biden administration said its new plan would provide debt relief for “as many borrowers as possible, as fast as possible,” but didn’t provide detail on the scope of the new effort to cancel student debt under the Higher Education Act.

“They haven’t been specific on any sort of confines of what the authority could be in terms of how many people could be affected,” said Aaron Ament, the president of the National Student Legal Defense Network, which represents student-loan borrowers in litigation. “What we’re waiting to see now is whether the administration is going to put forward a plan that is going to still help millions of Americans, particularly those in need, and still move forward with addressing the student-debt crisis and ensuring that future students aren’t taking out piles of debt that they can’t afford to repay.”

Read the full article here