Apple Inc. will hit a major milestone by the end of next year, boosted by the tech giant’s performance in China, according to Wedbush analyst Dan Ives.

“We believe Apple will be the first $4 trillion market cap by the end of 2024 given the pace of growth and monetization we estimate for Cupertino over the next year,” Ives wrote in a note released Monday. “While there are lingering worries around iPhone shadow government bans in China, for now this issue is very containable and has not dented demand for Cupertino in this key region based on our recent checks.” Apple is headquartered in Cupertino, Calif.

Wedbush maintained its outperform rating and $250 price target for Apple

AAPL,

The iPhone maker has the largest market capitalization of the Dow components, at $3.07 trillion, followed by Microsoft Corp.

MSFT,

at $2.76 trillion and Visa Inc.

V,

at $518.7 billion.

See Now: Apple’s stock falls after WSJ report that Apple Watch sales will be halted

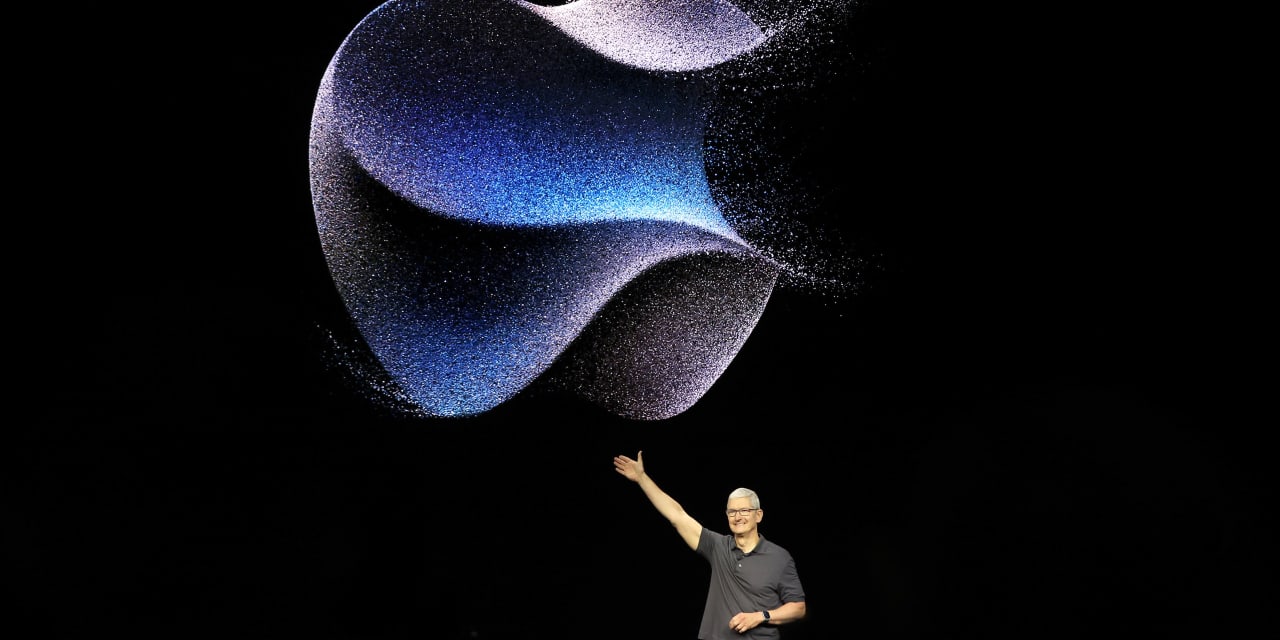

Despite lingering bear worries, China remains “Rock of Gibraltar strong” for the company, according to Ives, who is a noted Apple bull. “We believe Apple is heading into a strong holiday season over the coming weeks that should translate into iPhone 15 growth that exceeds [Wall] Street estimates for the December quarter on the heels of strong upgrade activity within the U.S. and China markets that is resilient despite the bear noise,” he wrote. “We have not seen any negative revisions around iPhone units coming out of our recent Asian supply chain checks into holiday season/early 2024, which speaks to what we believe is a very consistent consumer demand environment around iPhone 15 so far and is good news for [Apple CEO Tim] Cook & Co.”

Apple’s stock fell 0.7% Monday following a Wall Street Journal report that Apple Watch sales will be halted as the company prepares to comply with a U.S. import ban.

The company’s shares have gained 50.9% in 2023, outpacing the S&P 500 index’s

SPX

gain of 23.6%.

Related: A new tech bull market is gaining momentum as rest of the group now joins the party, says Dan Ives

Of 44 analysts surveyed by FactSet, 27 have an overweight or buy rating, 14 have a hold rating and three have an underweight or sell rating for Apple.

Read the full article here