“‘Icahn’s favorite Wall Street saying: “If you want a friend, get a dog.” Over his storied career, Icahn has made many enemies. I don’t know that he has any real friends. He could use one here.’”

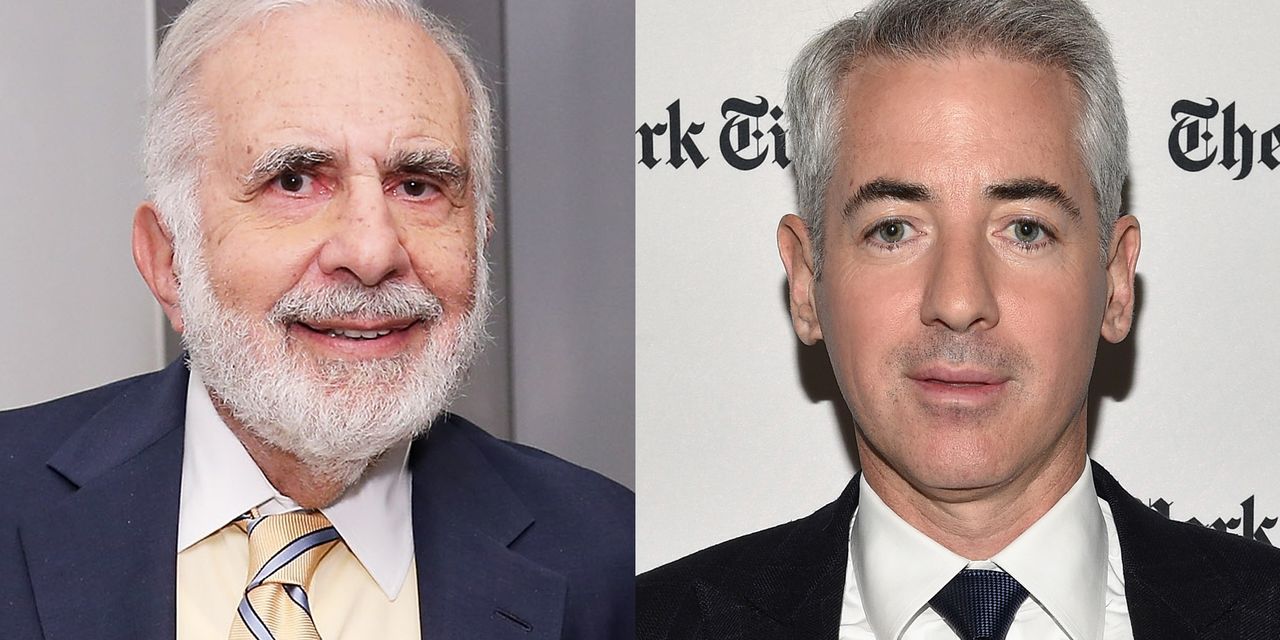

That was billionaire hedge-fund manager Bill Ackman, founder and chief executive of Pershing Square Capital Management, resurrecting his longstanding feud with billionaire activist investor Carl Icahn in a tweet Wednesday.

Ackman was referencing the fallout from the recent report by short-selling firm Hindenburg Research that accused Icahn’s publicly traded investment vehicle, Icahn Enterprise Partners LP

IEP,

of inflating asset values and causing his company to trade at a large premium. The report from May 2 has cost IEP about $10.9 billion in lost market cap, after the stock tumbled another 21% on Thursday.

For more: Carl Icahn rebuts short seller Hindenburg Research’s report. It’s already cost his company $6 billion in market cap.

Ackman said he is neither long or short IEP but merely “watching from a distance.”

But he seemed to agree with Hindenburg’s founder and CEO, Nate Anderson, who questioned margin loans extended to Icahn using his roughly 85% stake in IEP as collateral. Icahn has not disclosed the terms of those loans although he recently told the Financial Times that he used the money to make additional investments outside of his publicly traded vehicle.

“Over the years I have made a great deal of money with money,” he was quoted as having said. “I like to have a war chest, and doing that gave me more of a war chest.”

Ackman said the margin lender or lenders “must be extremely concerned with the situation,” particularly after IEP has disclosed a federal investigation of its business and corporate governance.

For his part, Icahn has called Hindenburg’s analysis “misleading and self-serving” and said it was designed solely to hurt long-term IEP shareholders.

Ackman compared the situation to that of failed investment fund Archegos, “where the swap counterparties were comforted by each having relatively smaller exposures to the situation.”

“The problem is that multiple lenders make for a more chaotic situation. All it takes is for one lender to break ranks and liquidate shares or attempt to hedge, before the house comes falling down. Here, the patsy is the last lender to liquidate.”

Ackman also expressed his surprise that Icahn has not disclosed the margin-loan terms, or even said who provided them. “My understanding of 13D SEC rules is that they require disclosure of sources of financing and even copies of financing agreements, although many investors ignore these requirements.”

Ackman also questioned how IEP’s large dividend yield is feasible, as it’s not supported by operating cash flows.

“The yield is generated by returning capital to outside shareholders, which is in turn funded by the company selling stock to investors,” said Ackman.

Icahn’s problem now is that his system has been outed by the short seller, Ackman wrote.

“Transparency is not the friend of $IEP having caused a more than 50% decline in the shares, which has caused Icahn to post more shares, now more than 65% of his holdings,” he said in the tweet.

The bad blood between Icahn and Ackman goes back to a business dispute the two had over a 2003 deal involving Hallwood Realty. The litigation between them went on for years.

But their animosity for one another hit a crescendo in 2013, when Bill Ackman publicly waged a $1 billion short-selling campaign against Herbalife. Sensing weakness, Icahn took a long position in Herbalife’s stock

HLF,

and helped deal Ackman significant losses on his bet over time.

The two claimed they had made up in 2014, sharing a stage at a conference broadcast by CNBC.

Ackman had previously had taken a soft shot at Icahn over the Hindenburg report, saying there was a “karmic quality” to it. But now their battle of Wall Street titans appears to be back in full force.

Read the full article here