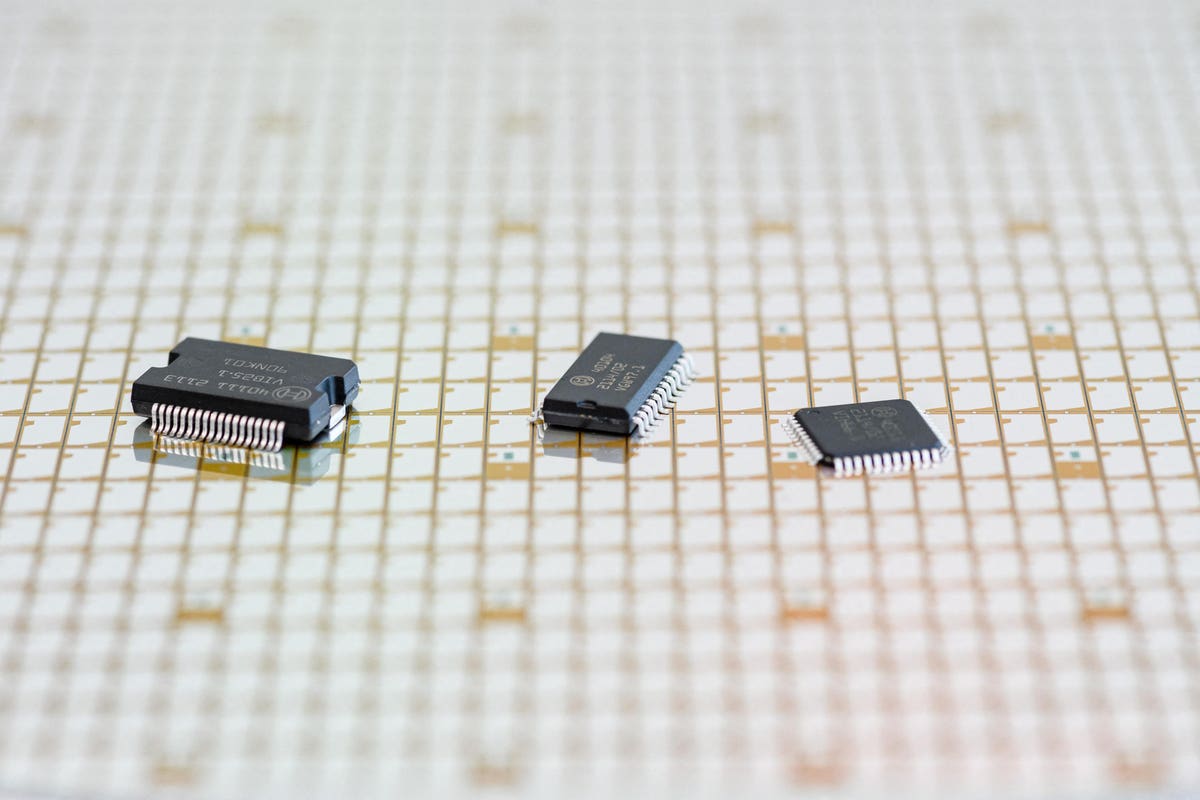

There is a glut of some semiconductors, so investors are selling the stocks of all chip companies.

The Wall Street Journal on Tuesday ran a feature about semiconductors, soaring inventories, and weak demand. Investors then sold chip stocks across the board. Easy narratives drive stock prices, regardless of facts.

It’s a lesson, and an opportunity for investors.

Let’s be clear, some semiconductor markets are in a glut.

We know this because executives from the companies that are the biggest players in those markets have told us. Sanjay Mehrotra, chief executive at Micron Technology

MU

Then there is Intel

INTC

Micron and Intel are big suppliers to the largest personal computer markets. The companies supply Hewlett Packard (HPQ), Dell Technologies

DELL

AAPL

The upgrade cycle coming out of the pandemic was real, yet short-lived.

The lockdown forced companies to upgrade laptops, and enterprise software suites. A lot of those sales were pulled forward, out of the normal capital expenditure cycle. Sales that would have occurred in 2022 became redundant. Add a slowing global economy, due to higher interest rates, layoffs and general worry and you get weaker consumer demand, too. These factors are causing a glut of chips, for PCs, smartphones, and other categories impacted by the pandemic pull forward.

That is a substantial part of the semiconductor business, however, it is not all of the sector. The world is not really awash in chips. There are too many of the chips that have become commoditized over time.

Some parts of the sector, like specialized graphics processing units for cutting edge datacenters, next generation silicon for electric vehicles, power stations and EV charging infrastructure are experiencing high demand. Companies like On Semiconductor (ON) have sold out production years in advance.

And the Journal notes that executives at Lattice Semiconductor

LSCC

Despite this, both On Semiconductor and Lattice were hit hard Tuesday in the fallout from the WSJ semiconductor story. The stocks declined 1.7%, and 3.5% respectively.

And that is the lesson for investors: Big narratives drive stock prices, even when the storyline is fundamentally flawed. Smart investors wait for the fallout, look for support levels, then invest wisely.

There is one other factor for semiconductor investors to keep in mind.

The stock prices typically begin moving higher as executives guide analysts’ expectations about future inventories.

Colette Kress, chief financial offer at Nvidia told analysts in November that inventory levels could normalize by the end of January. Nvidia shares responded by rising from $139 to $187.70 during the next six weeks, a gain of 35%.

Overall, semiconductor sales are projected to reach $1 trillion by 2030, according to a research reports from Gartner

IT

The bottom line is that the current narrative about the semiconductor glut is an opportunity. Investors should look for attractive entry levels for their favorite businesses in the sector. The sector is not a monolith, and it is not in decline.

I’m keeping On Semiconductor on my radar.

Discover the secrets to successful investing with our Strategic Advantage newsletter. Try it now for just $1!

Read the full article here