Domino’s Pizza Inc. delivered sharp gains for its shares Monday, after the pizza chain logged a profit beat for its latest quarter, amid strength in both delivery and carryout sales.

What helped drive results that its rewards program increased by 3 million active members, or 10%, to end 2023 with 33 million active members.

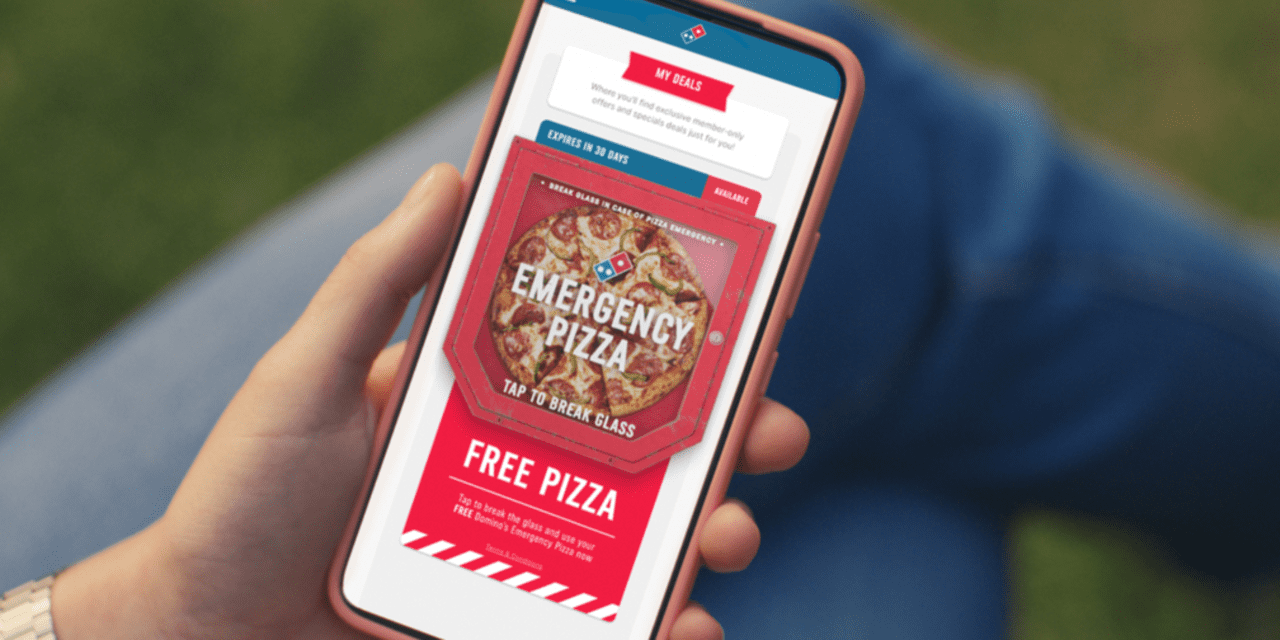

“A big driver of the increase in active members, as well as the early success of the program, was our ‘emergency pizza’ promotion, which was an innovative marketing initiative that drove increased order counts and acquisition of customers into Domino’s Rewards,” said Chief Executive Russell Weiner, according to an AlphaSense transcript of the post-earnings call with analysts.

The stock

DPZ,

shot up 5.9% in morning trading, putting it on track for the highest close since Jan. 19, 2022.

The company logged fiscal fourth-quarter net income of $157.3 million, or $4.48 a share, compared with net income of $158.3 million, or $4.43 a share, in the year-earlier period. Analysts tracked by FactSet had been modeling $4.38 in earnings per share.

Net income slipped while EPS increased because the number of shares used to calculate EPS declined to 35.14 million from 35.72 million. The company spent $269 million on share repurchases in 2023.

Revenue edged up 0.8% to $1.40 billion, whereas analysts were looking for $1.42 billion.

The company saw 2.8% U.S. same-store-sales growth in the fourth quarter, along with 0.1% same-store-sales growth internationally, when excluding currency impacts. The FactSet consensus was for U.S. same-store sales to rise 2.2%.

Franchised U.S. stores grew sequentially by a net of 92 locations in the fourth quarter, while international store count grew by a net of 302.

“Our positive U.S. transactions and same-store sales growth in both our delivery and carryout channels in the fourth quarter underscore the strength and momentum in our business,” said CEO Weiner.

He said on the post-earnings call with analysts that adverting its “homemade pan pizza” offering on air for the first time since 2014 helped get the word out.

“We call Pan Pizza our best kept secret,” Weiner said. “It’s time to change that.”

Domino’s noted that its board of directors on Feb. 21 approved a 25% increase to its quarterly dividend, which was declared to be $1.51 a share. Shareholders of record on March 15 will be paid the new dividend on March 29.

At current prices, the new dividend rate implies a dividend yield of 1.32%, which compares with the implied yield for the S&P 500 index

SPX

of 1.41%.

The company also announced a new $1 billion stock repurchase program, to increase the total authorization for repurchases to $1.14 billion. That represents about 7.1% of Domino’s market capitalization of about $16.02 billion.

Domino’s stock has run up 24.0% over the past three months, while the S&P 500 has advanced 11.6%.

Read the full article here