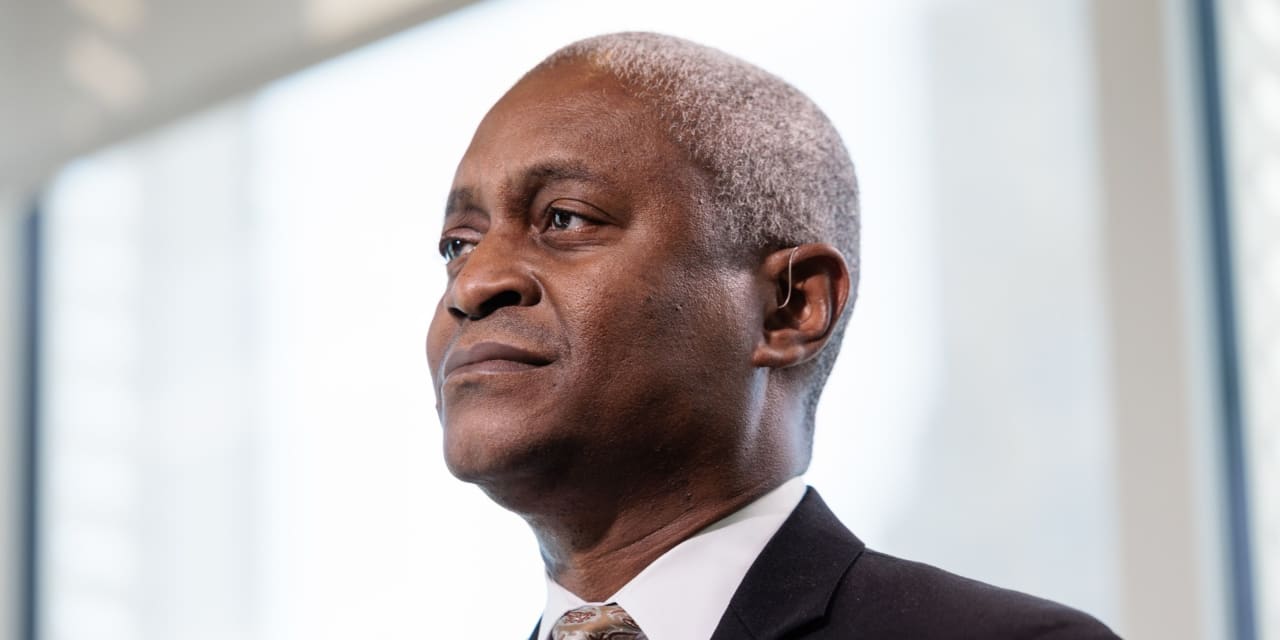

Atlanta Federal Reserve President Raphael Bostic said he expects the central bank to start implementing rate cuts in the third quarter of this year, as long as the current economic conditions hold steady.

In remarks delivered to the at the Atlanta Business Chronicle’s 2024 Economic Outlook event on Thursday, Bostic said unexpectedly strong progress on bringing inflation back to the Fed’s 2% target and cooling economic activity have moved up his projected timeline to begin “normalizing the federal-funds rate” to the third quarter of this year. He previously had forecast that rate cuts would likely start in the fourth quarter of 2024.

“Should conditions evolve differently from my expectation, I am willing to adjust my view of policy based on what happens,” Bostic added, saying his views will continue to depend on the economic data. His views are particularly important because starting with the Fed meeting at the end of the month, he will be a voting member of the Federal Open Market Committee.

Given the unpredictable current macroeconomic environment, it would be “unwise to lock in an emphatic approach to monetary policy,” he said. In comments similar to remarks from Fed Governor Christopher Waller earlier this week, Bostic advocated for careful analysis and allowing “events to continue to unfold before beginning the process of normalizing policy.”

Bostic said he is also mindful of the risk that underlying economic momentum could prove stronger than expected and spark inflationary pressure. If that occurs, he said, Fed policymakers may need to keep monetary policy restrictive longer than he now expects. There is also a risk that cutting rates too soon could unleash a surge in demand that might push prices higher.

“This argues for caution to ensure that we don’t undermine the great progress we have made to date in bringing inflation back to target,” Bostic said.

In assessing economic conditions, Bostic said, he is looking at shorter-term measures for “clues” on where 12-month inflation is likely headed. And he noted that the six-month and three-month changes in the core personal consumption expenditures price Index—the Fed’s favored inflation measure, which excludes the more volatile food and energy costs—were close to the 2% target as of November.

“I will look for continued good news there,” he said.

Yet even given recent progress, Bostic said, his baseline forecast for full-year core PCE inflation is still 2.4% in 2024. “If we continue to see a further accumulation of downside surprises in the data, it’s possible for me to get comfortable enough to advocate normalization sooner than the third quarter,” he said. “But the evidence would need to be convincing.”

Data on the labor market also can offer important signals, Bostic added.

While annual wage growth picked up in December, he said, “a bit more acceleration” wouldn’t necessarily spark a resurgence in inflation. “In short, a normalization of real wage growth back to prepandemic levels would be conducive to reaching the inflation objective without tanking the economy, and by and large that’s what we’re seeing,” Bostic said.

Bostic is also tracking job growth and losses, noting that payroll growth in the healthcare and social assistance sectors have been largely responsible for the overall gains in recent months. That is a shift from the broad-based increases seen as the economy has recovered from the pandemic.

“For now, the labor market remains broadly healthy—remarkably so during a forceful monetary policy tightening cycle,” Bostic said.

If employment growth slows more rapidly than the current pace, that would likely “complicate” the task of continuing to tamp down inflation while maintaining a healthy economy, Bostic said. A rapidly slowing labor market would also cause Bostic to adjust his view of the appropriate path for monetary policy, he said.

If the Fed waits too long to begin rate cuts, he said, it could lead to an economic downturn because a weaker labor market would hurt consumer spending—a setback for growth in gross domestic product.

Global factors could also complicate the path of monetary policy, he said. “Uncertainty lurks in numerous corners,” Bostic said, citing risks that conflicts abroad pose to supply chains and energy prices.

“Striking the delicate balance of price stability without undue harm to labor markets will be exceedingly difficult. It’s rarely been done following a serious bout of inflation,” Bostic acknowledged. “But that’s the job, and we are going to continue to do everything we can to achieve it.”

Write to Megan Leonhardt at [email protected]

Read the full article here