Take-Two Interactive Software Inc. soared Thursday after the videogame publisher hinted that fresh blockbuster titles like “Grand Theft Auto VI” will arrive in 2024 or early 2025.

Take-Two

TTWO,

shares finished up 11.7% at $139.63, after surging as much as 13% to an intraday high of $141.47, a price not seen in more than a year, Shares had been on track for their best one-day percentage gain since May 19, 2015, when shares jumped 18.3%, but instead, by the end of the session, the stock turned in its best performance since May 17, 2022, when the price rose 11.8%.

Take-Two’s stock also led gainers on the S&P 500 index

SPX,

which closed up 0.9% Thursday. Take-Two shares are up 34.1% year to date, while the S&P 500 is up 9.3%, and the Nasdaq Composite Index

COMP,

is up 21.2% this year.

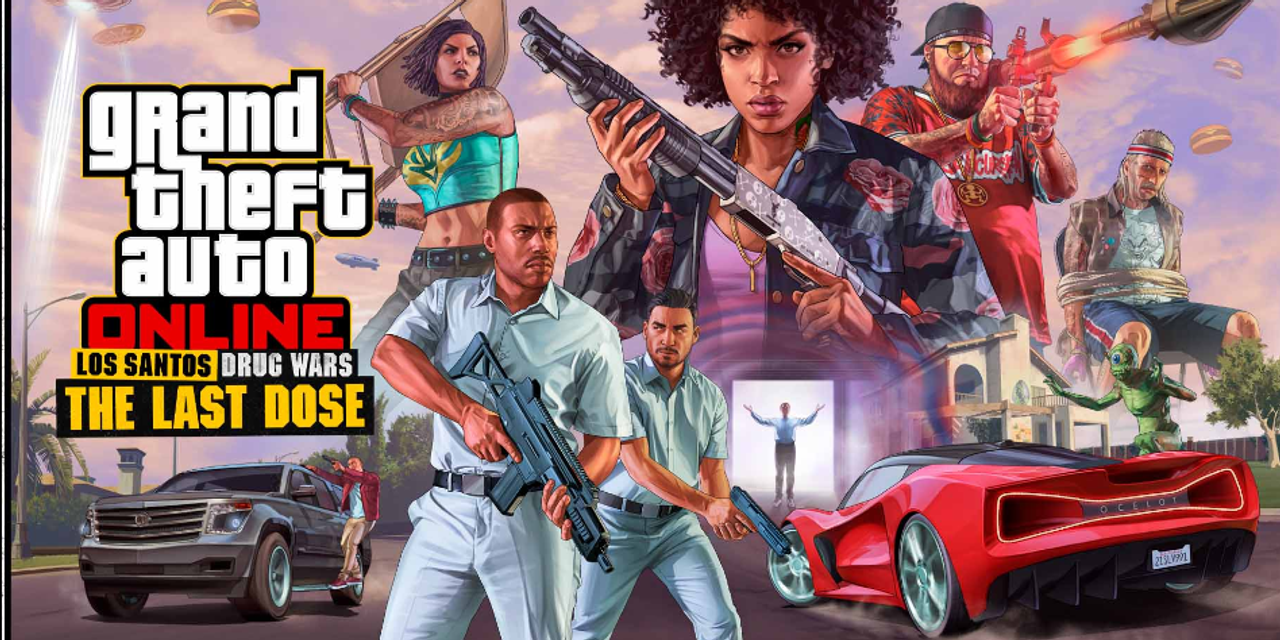

Take-Two — which publishes such videogame franchises as “Grand Theft Auto” and “Red Dead Redemption” under its Rockstar Games label, and “Borderlands” and “NBA2K” under its 2K label — on Wednesday offered a disappointing forecast for the fiscal year that just began, but pointed to the next fiscal year as the launch point for “several groundbreaking titles.” That is expected to include “Grand Theft Auto VI,” the sequel to the most successful videogame of all time that gamers and investors have been anxious to see.

Wedbush analyst Nick McKay pretty much called it earlier this week, noting that if Take-Two lowballed the outlook for the year — as he expected — without mentioning any big titles coming out, then shares would be under pressure. Take-Two, however, all but confirmed late Wednesday a sixth installment of “Grand Theft Auto” coming out next year, along with this year’s poor guidance, allowing “bulls to dream,” as McKay had said.

Jefferies analyst Andrew Uerkwitz, who has a buy rating and $165 price target on Take-Two, called the guidance “groundbreaking” Thursday.

“This is it,” Uerkwitz said. “In a rare move, Take-Two gave 2-year forward guidance with year-3 color. The large immersive core titles we’ve been waiting on since the company started its investment cycle in 2018 are finally expected to be released in [calendar 2024 and 2025],” Uerkwitz said. And with executives quoting $8 billion in net bookings out to fiscal 2026, that means “this growth is more than one specific title,” the Jefferies analyst said.

Full earnings coverage: Take-Two stock soars as outlook suggests ‘Grand Theft Auto VI’ is a little more than a year away

Rockstar Games confirmed last year “that active development for the next entry in the ‘Grand Theft Auto’ series is well under way.”

TD Cowen analyst Doug Creutz emphasized the “several” part of Take-Two chairman and chief executive Strauss Zelnick’s statement that the forecast involved “several high-profile, long-awaited titles in our pipeline,” and called the anticipation “tremendous.”

“The mention of ‘groundbreaking titles’ to us pretty clearly includes GTA6, as we feel confident in saying no other combination of title releases would allow management to confidently project a [year-over-year $2.5 billion plus] increase in bookings,” Creutz said. “We think it almost certainly also includes ‘Borderlands 4,’ as we know that title is in development, and marketing commitment levels disclosed in the last two 10-Ks have suggested a [fiscal 2024 or 2025] release.”

Creutz has an outperform rating and a $147 price target. Of the 29 analysts who cover Take-Two, 22 have buy ratings and seven have hold ratings, along with a price target of $144.88, up from a previous $134.14.

Read: AppLovin stock roars as analyst sees an edge from AI in struggling mobile-ad market

Earlier in the week, Microsoft Corp.

MSFT,

won European Union approval for its $69 billion acquisition of “Call of Duty” publisher Activision Blizzard Inc.

ATVI,

but the deal is still being blocked by U.K. regulators, and Microsoft has said it would appeal. The U.K. block pressured shares of Activision Blizzard recently despite an earnings beat.

Also, Electronic Arts Inc.

EA,

with shares up 3.3% year to date, reported record bookings and forecast a strong outlook last week.

Read: Microsoft wins EU approval for $69 billion Activision deal

Read the full article here