Artificial intelligence may destroy humanity, but not before creating enormous wealth. Such is the paradox that now confronts investors after

Nvidia’s

recent earnings report inadvertently created a large-scale ethics experiment on Wall Street.

On Tuesday, days after Nvidia (ticker: NVDA) stunned investors with a financial forecast that some have said augurs a new Industrial Revolution, AI experts released an ominous warning.

“Mitigating the risk of extinction from AI should be a global priority alongside other societal-scale risks such as pandemics and nuclear war,” according to a statement released by the Center for AI Safety that was signed by many in the field.

The warning has so far had little impact on investors.

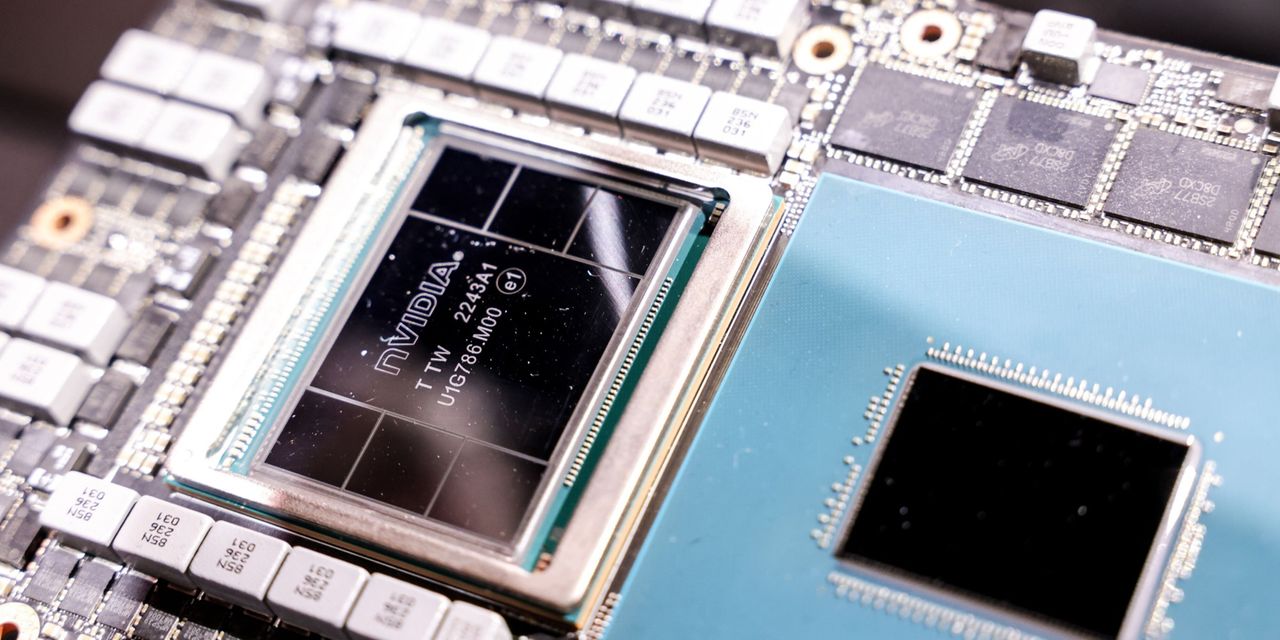

Shares of Nvidia, which makes semiconductor chips that are used to power AI, have continued to surge ever higher. The excitement over AI is so intense that Nvidia’s stock’s extreme valuation is apparently of little concern. Some pundits and investors are even crediting the sudden emergence of AI for rescuing the broad market from getting dragged down by concerns of a potential recession, the debt-ceiling crisis, and any other bearish hobgoblins.

How hot is Nvidia? Many investors speak of the stock, and AI, with language rarely heard in generally staid financial circles. Christopher Rolland, Susquehanna Financial Group’s semiconductor analyst, told clients in a recent note that Nvidia’s earnings report was “an unfathomable beat as generative AI and accelerated computing inflect. It looks like the new gold rush is upon us and Nvidia is selling all of the picks and shovels.”

This year, Nvidia’s stock is up some 174%. The stock chart reveals extraordinary trading volumes and so much upward momentum that it is as if the laws of gravity—and markets—don’t apply.

While such setups generally inspire bearish trading strategies that would benefit from a stock decline, Nvidia might be an exception to the rule. At least temporarily.

The primary debate in the markets now is over the best way to harness Nvidia stock besides owning it outright. Many investors are opting to rent it in the options market. Call options, which increase in value when a stock price rises, cost a fraction of the stock price and offer investors a way to risk less money chasing a hot stock.

Aggressive investors who want to harness Nvidia’s surge could consider a “call spread,” which entails buying one call and selling another to profit from an advance in the stock price. The strategy is a favorite of many professional traders because the potential returns can be significant while the amount of money that is tied up in the strategy is less than simply buying a call.

With Nvidia stock at $401.11, the July $415 call could be bought for about $24 and the July $475 call could be sold for about $8. The spread cost $16. If Nvidia is at $475 at expiration, the spread is worth a maximum profit of $60.

The potential return is attractive, but there is nothing certain about the strategy except for extreme risk. Any stock that has advanced as quickly and as aggressively as Nvidia has in the past week almost always succumbs to its own momentum. After a while, most everyone who wants to buy the stock has done so, and there is little money left to push the price higher.

Should Nvidia decline and trade below $415, the trade fails. To break even, the stock needs to advance to at least $431. During the past 52 weeks, Nvidia stock has ranged from $108.13 to $419.38.

Steven M. Sears is the president and chief operating officer of Options Solutions, a specialized asset-management firm. Neither he nor the firm has a position in the options or underlying securities mentioned in this column.

Email: [email protected]

Read the full article here