No doubt, the big news on the individual stock front of late has been the euphoria surrounding just about any company having anything to do with artificial intelligence (AI), following the recent release of a much-better-than-expected quarterly earnings report and extraordinarily bullish outlook from graphics chip titan Nvidia.

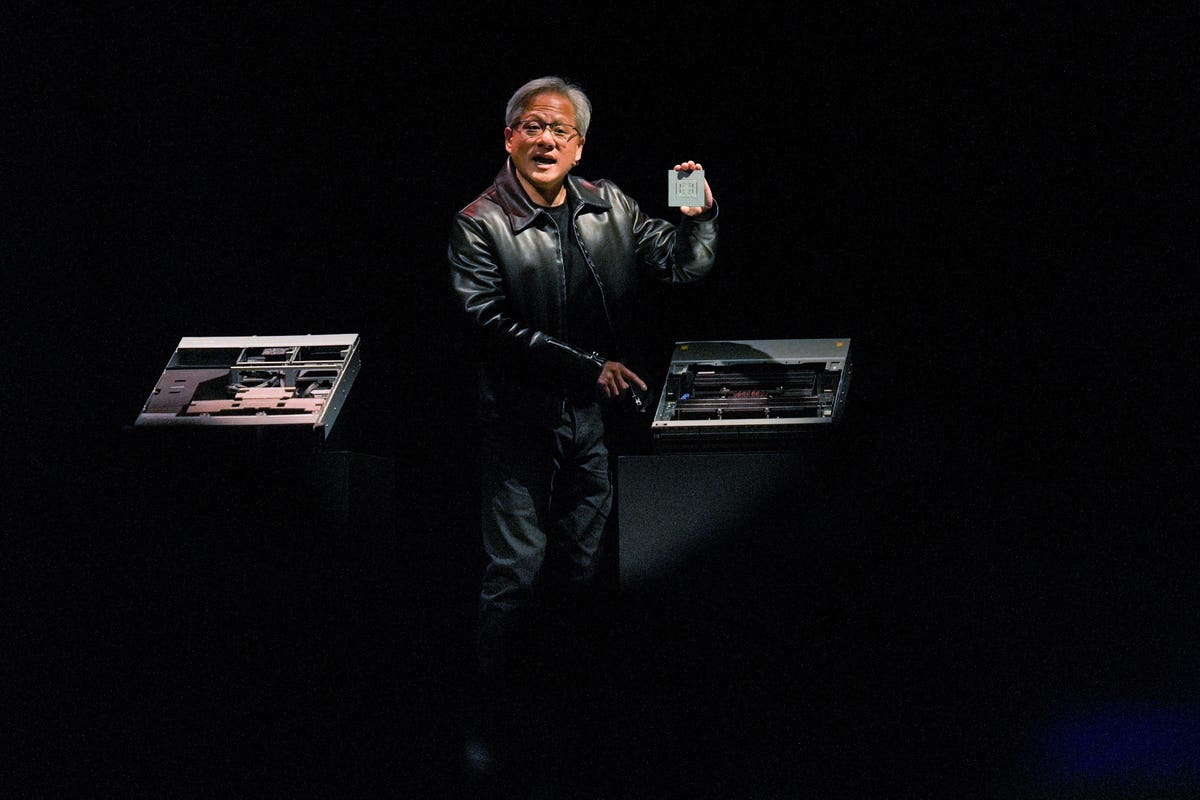

“The computer industry is going through two simultaneous transitions — accelerated computing and generative AI,” said Jensen Huang, founder and CEO of Nvidia.

He continued, “A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process.”

The company raised its Q2 revenue guidance to $11 billion, up from analyst estimates of $7.1 billion, with Mr. Jensen concluding, “Our entire data center family of products — H100, Grace CPU, Grace Hopper Superchip, NVLink, Quantum 400 InfiniBand and BlueField-3 DPU — is in production. We are significantly increasing our supply to meet surging demand for them.”

The very next day brought a similarly enthusiastic outlook on AI from Marvell Technology

MRVL

True, there is plenty of optimism about the future AI-related business that may come Nvidia and Marvell’s way, so traders are understandably excited about the stocks. After all, the AI-app Chat GPT reached a whopping 100 million downloads in just two months, while Goldman Sachs researchers concluded recently, “Breakthroughs in generative artificial intelligence have the potential to bring about sweeping changes to the global economy. As tools using advances in natural language processing work their way into businesses and society, they could drive a 7% (or almost $7 trillion) increase in global GDP and lift productivity growth by 1.5 percentage points over a 10-year period.”

However, there is also plenty of regulatory scrutiny ongoing, while there is no assurance that reality will live up to the hype. Given a trailing P/E ratio of 128, a Price to Sales ratio of 37, and a Price to Book Value ratio of 40, Nvidia is not a Value stock, even as I had owned it in the past when the financial metrics were far more reasonable, while I understand that the company could well grow into its valuation.

Marvell is another name that I have owned previously, but a trailing P/E ratio of 30, a forward P/E ratio of 34 and a Price to Sales ratio of nearly 9 keeps me on the sidelines for this name, especially as it scores in the bottom quartile of my proprietary valuation algorithm.

MORE REASONABLY VALUED AI STOCKS

On the other hand, I have long had exposure to AI via tech titans like Microsoft

MSFT

AAPL

It also has been nice to see stocks like Eaton Corp (ETN) and Digital Realty (DLR) catch a bid as investors raced into anything AI-related.

Eaton is a global power management company, helping customers solve their greatest power challenges through industry leading electrical, aerospace, hydraulic and vehicle products and services. Real Estate Investment Trust Digital Realty is the largest global provider of cloud- and carrier-neutral data center, colocation and interconnection solutions.

Eaton’s power equipment, the thinking goes, will be needed to serve vast energy requirements needed for AI data centers,…

…while Digital Realty CEO Andrew Power and Chief Technology Officer Chris Sharp offered the following comments six weeks ago explaining the impact of AI, which prior to the last few weeks was viewed by investors as more of a headwind for the company.

Of course, the investment theses for the six companies I own are not AI-centric. I like the businesses for the long haul, independent of the AI potential, while I continue to find the valuations to be reasonable. True, if I continue to see a divergence in returns between the “AI-plays” and rest of the market, I may be inclined to trim positions to swap into other less-richly-valued names, but I am very comfortable today holding Eaton, Digital Realty and the four megacap tech names.

Read the full article here