Stocks have had a banner year, but two Covid-era heroes were left in the dust. Analysts think that could change in 2024.

The

S&P 500

is up more than 24% since the start of the year, while the

Nasdaq Composite

has gained 44%—and both indexes hit a new 52-week high on Tuesday. Yet while many stocks have joined the party in recent weeks, much of 2023’s rally is due to the Magnificent Seven tech companies:

Apple,

Amazon,

Alphabet,

Meta Platforms,

Microsoft,

Nvidia,

and

Tesla.

That means many other individual stocks have lagged behind the overall S&P 500’s double-digit rise.

Few, however, have underperformed as badly as shares of

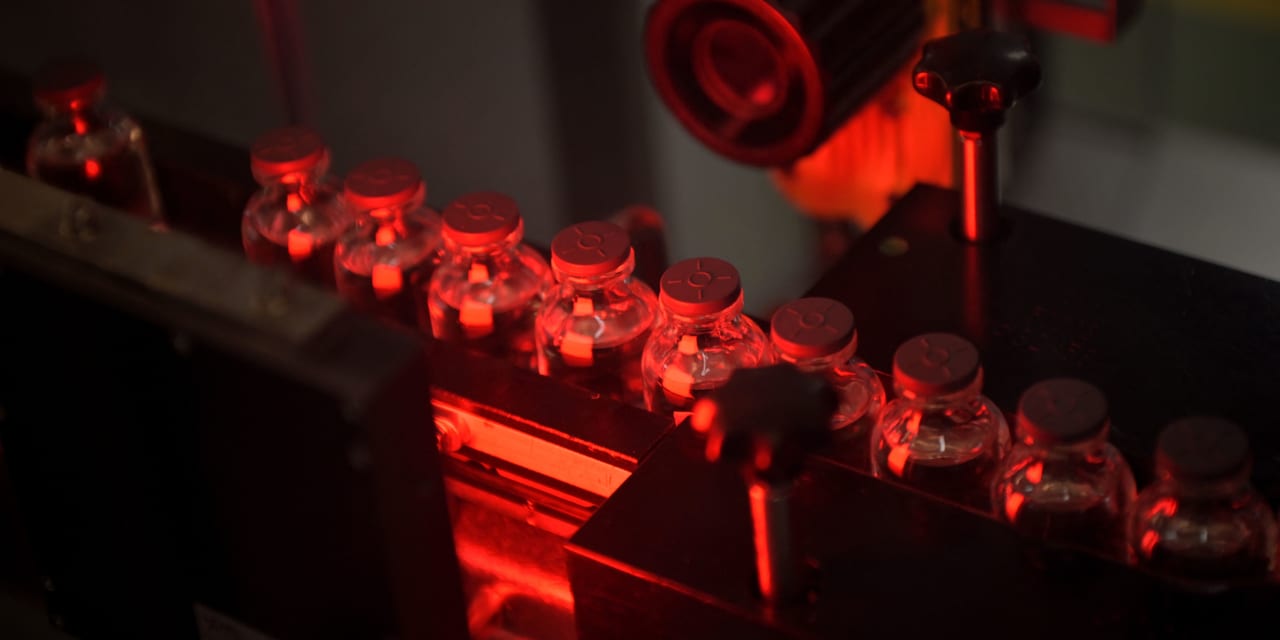

Moderna

and

Pfizer,

which have tumbled 44.8% and 44.2% in 2023, through Tuesday’s close. That makes them the second- and third-worst-performing U.S. stocks with a market capitalizations over $20 billion, following

Dollar General,

which was down 45.4%.

Those declines come after big pandemic-era gains, given Moderna and Pfizer’s hugely popular Covid-19 vaccines. Pfizer shares roughly doubled from March 2020 through the end of 2021, while Moderna was up some 800%.

Nonetheless, Wall Street is notoriously fond of asking the question, “What have you done for me lately?” The answer for both stocks has been “not much” in 2023, as earnings per share shrank from their vaccine-boosted performances in recent years.

Analysts argue that investors shouldn’t write off these stocks: Twenty-four cover both Moderna and Pfizer, and half have a Hold-rating or the equivalent on the former, while 58% are sidelined on the latter. But the average analyst price target for Moderna stock is $125.24, implying upside of nearly 29% from current levels, while Pfizer stock has 10.6% upside to the average analyst price target of $31.42.

That stands in contrast to this year’s other big-cap losers. The majority of analysts are Hold-rated on Dollar General, and their price targets imply less than a 2% gain for the stock.

The fourth- and fifth-worst performers with a market cap over $20 billion—

Estée Lauder

and

Illumina

—will see their shares fall another 9.2% and 1.9%, respectively, if they reach analysts’ average price targets.

Of course, plenty of investors are skeptical of analysts’ price targets: As a whole they can be overly optimistic, and critics argue that they are often too reactionary, rather than ahead of the news.

Still, for those investors who have watched Moderna and Pfizer’s big 2023 declines, it might be some comfort to know that at least one cohort of strategists sees double-digit gains ahead.

Write to Teresa Rivas at [email protected]

Read the full article here