Moderna Inc.’s stock soared 10% Tuesday to lead S&P 500 index gainers, after Oppenheimer upgraded the stock to the equivalent of buy and said it expects the biotech to have five products approved by 2026.

Analysts led by Hartaj Singh upgraded the stock

MRNA,

to outperform from perform and said it expects it to perform better this year than the dismal showing recorded in 2023.

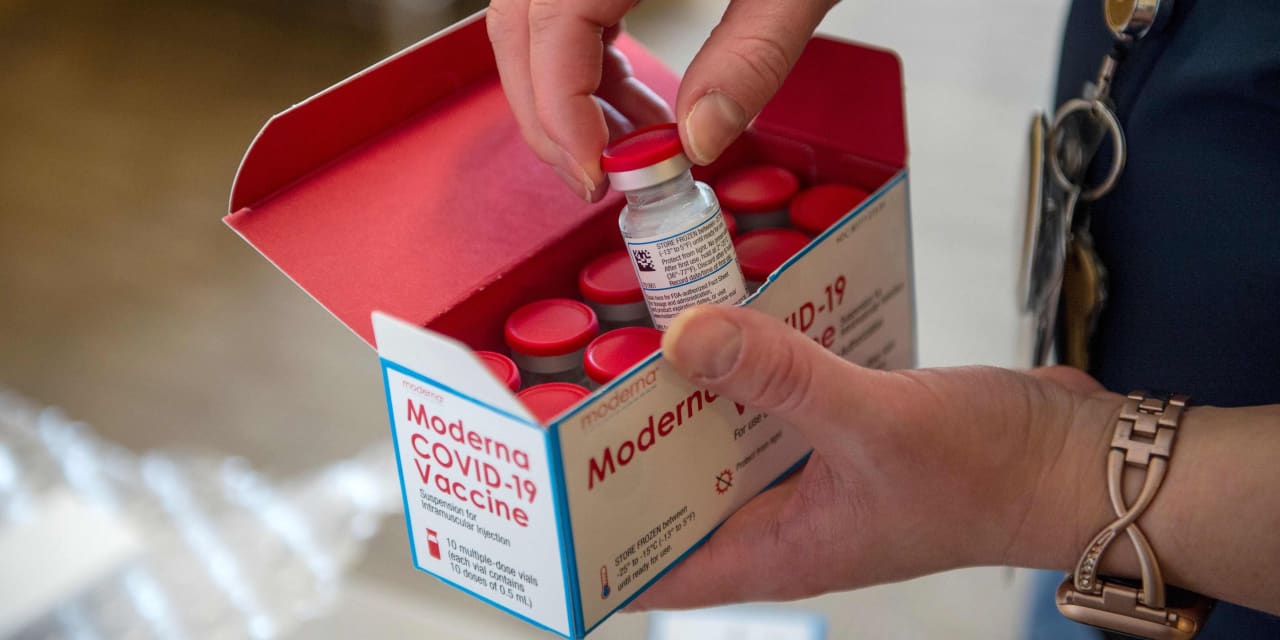

The company currently has just one approved product, its mRNA-based COVID-19 vaccine, which has already passed peak sales. But it has several promising products in its pipeline, including vaccines for flu and RSV, or respiratory syncytial virus, which Oppenheimer is expecting will win regulatory approval in the medium term.

“We see top-line sales starting to grow in 2025E, with multiple product launches next 12-18 months (RSV, Influenza). We also expect material clinical and regulatory catalysts (INT, CMV) in this time frame, making us bullish on the name again,” the analysts wrote in a note to clients.

CMV, or cytomegalovirus, is a member of the herpes family. Moderna is also developing a cancer vaccine that will initially target melanoma patients.

See also: Moderna’s stock boosted by positive data from trial of melanoma treatment combined with Merck’s Keytruda

Oppenheimer downgraded Moderna in August because of concerns about pipeline progress, but said the company has since addressed them, the analysts wrote. And while the stock is down 40% over the last 12 months because of COVID vaccine sales compression, the analyst team is expecting those sales to reach a low in 2024 before ticking up again in 2025, amid increased education and spending on awareness of the need for boosters.

Moderna’s operating expenses are likely to decline significantly in 2024 and 2025, before picking up again after that, the analysts wrote. The company will remain loss-making through 2026, they estimate, while the Bloomberg consensus is for losses to stretch into 2027.

“We should note that MRNA has indicated that if sales progression flattens or stalls, the company will adjust OPEX accordingly,” said the note.

The analysts assigned the stock a $142 12- to 18-month price target, equal to upside of more than 30% over its current price.

See now: Moderna reorganizes to sharpen focus on vaccine sales, chief commercial officer to leave company

Moderna’s gains sent stocks of other vaccine and drug makers higher. Bristol-Myers Squibb Co.

BMY,

was up 4%, Pfizer Inc.

PFE,

was up 3.9% and Merck & Co.

MRK,

was up 2.9%.

Read the full article here