Nvidia stock was rising on Thursday, with technology stocks looking to regain their footing after a Federal Reserve-inspired selloff the previous day. Big technology company earnings are set to provide further insight into demand for the company’s artificial-intelligence chips.

Nvidia

stock wa up 0.7% in early trading after falling 2% at $615.27 on Wednesday as the tech sector was hit by Fed Chairman Jerome Powell pushing back against expectations that interest rates could be cut as soon as March.

Earnings reports from

Amazon.com

and

Meta Platforms

on Thursday could offer new signs about the outlook for sales of Nvidia’s AI semiconductors. Both

Microsoft

and

Alphabet,

Google’s parent, flagged increased capital expenditure this year in their own reports this week.

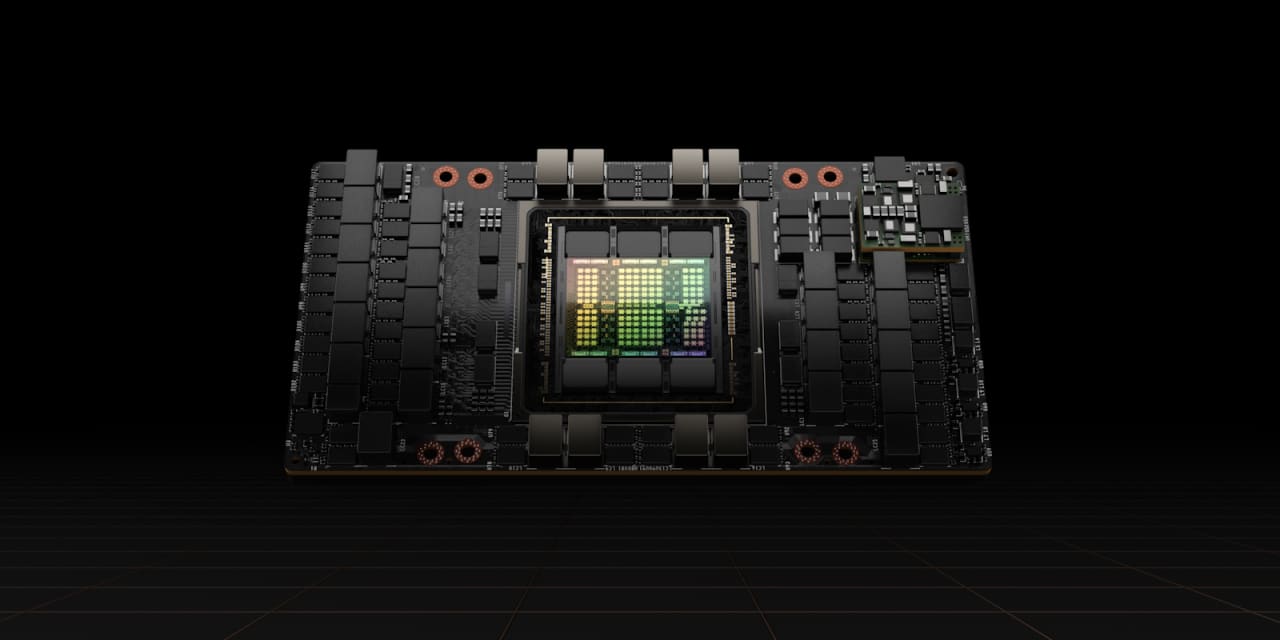

Elsewhere, Nvidia has started taking preorders for its H20 chip for the Chinese market. Distributors are pricing it at a similar level to rival products from Huawei, Reuters reported, citing people familiar with the matter.

Nvidia has priced the chip at $12,000-$15,000 per card but distributors are applying a markup that brings the price close to that of Huawei’s Ascend 910B AI chip, according to the report. Nvidia declined to comment.

Nvidia stock was outperforming other chip manufacturers on Thursday.

Advanced Micro Devices

was down 0.5% in early trading while

Intel

fell 0.2%. The

S&P 500

was up 0.5%.

Nvidia stock remains close to the record high of $627.74 it reached on Tuesday. Trading volume of 45.4 million shares on Wednesday was ahead of its 65-day average of 42.5 million shares.

Write to Adam Clark at [email protected]

Read the full article here