“ The auto industry’s success owes a great deal to the UAW.”

One of the greatest Super Bowl ads ever came out in 2011. It was a Chrysler ad, but it sold a broader domestic brand — “imported from Detroit” — by drawing on the story of the American worker, stirring up hard-won feelings of place, patriotism, and dignity.

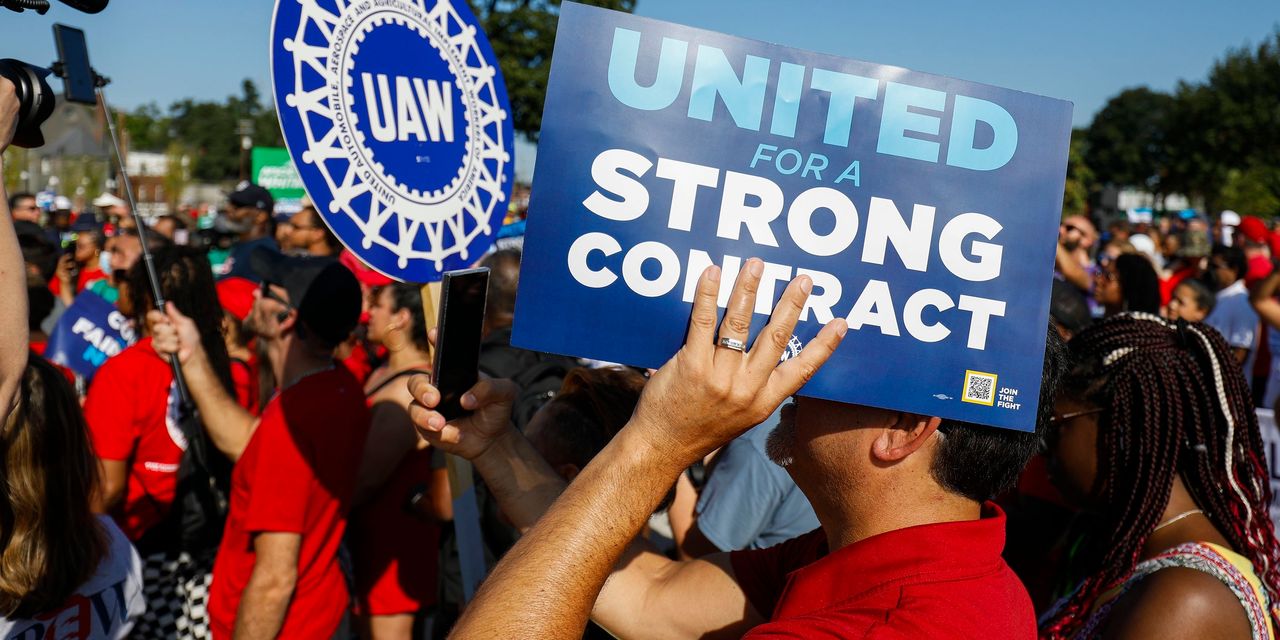

Twelve years later, it seems Detroit’s Big Three need a reminder of who built them. As the auto companies face a September 14 deadline to agree to a new contract with 150,000 United Auto Workers (UAW) members, the auto industry needs to honor their sacrifices, ensure that the supply chain for electric vehicles (EVs) are union jobs, and make sure people can still be proud of the cars Americans build.

The auto industry’s success owes a great deal to the UAW, who have fought to ensure that auto jobs offered opportunities for people from all walks of life. When the Great Recession hit in 2008, the industry needed a massive infusion of federal cash to stay solvent. To save hundreds of thousands of jobs and communities across the American Midwest, the Obama administration stepped in and worked with the UAW and the Big Three — Ford Motor

F,

General Motors

GM,

and Chrysler (now Stellantis

STLA,

) — on a rescue package that incorporated major union concessions alongside the requested funding from the federal government.

The union agreed to create a lower tier category of assembly-line worker who received a third- to half-less pay than those under the master contract. The auto industry made it through the recession and has booked hundreds of billions in profits over the past decade — profits subsidized by their own workers, who continue to suffer under concessionary business practices agreed to under threat of bankruptcy.

“ The auto industry should be embracing its workers.”

Moreover, the Big Three are again benefiting from generous and vital federal support. This time it is manufacturing investments and consumer incentives to manage the transition to EVs. This transition has the potential to reshape the U.S. economy for the better, but the auto industry risks using it as an opportunity to shift to new non-union suppliers. The auto industry should be embracing its workers as partners in building this new future.

Beyond bargaining for a fair and just transition to EV production, the UAW is also demanding the Big Three abandon Great Recession relics, like the two-tier wage scale and the elimination of cost of living adjustments. They’re also seeking pay increases aligned with the increases of company executives. A Stellantis executive recently claimed that UAW’s demands “could endanger their ability to make decisions in the future that provide job security to our employees.” While scary sounding, consider that Stellantis’s CEO made almost $25 million in 2022 and the company reported $12 billion in profit in the first half of 2023.

Related: Why United Auto Workers are fighting to end a two-tier system for wages and benefits

Finally, the Big Three has a responsibility to support U.S. efforts to fight climate change. Automobile emissions represent roughly 17% of U.S. emissions, hence the crucial transition to EVs to decarbonize the economy. As part of the 2009 auto industry rescue negotiation, the Big Three and the UAW agreed to the biggest advancement of Corporate Average Fuel Economy Standards (CAFE) in history. The efficiency improvements were critical for pollution reduction, and pushed the domestic industry to build more fuel efficient cars. This proved to be prescient in helping consumers deal with high- and volatile gas prices over this past decade.

The U.S. auto industry is in danger of not learning their lesson. The Alliance for Automotive Innovations — a trade association that includes the Big Three –recently called proposed emissions standards “neither reasonable nor achievable,” even though the latest projections show EV adoption will outpace even what the standards assume. Electrification of the global auto industry is happening, and we cannot afford for the industry to slow-walk itself into global uncompetitiveness, costing American auto jobs. We need the Big Three to meet the moment on the transition to a decarbonized economy.

An American-made car means something more than the miles a person puts on it. It means good, middle class jobs and stable communities for the people who make the parts and assemble the vehicle. Generations of American families have enjoyed the benefits of a middle-class life thanks to those family-sustaining jobs secured by the UAW. The EV transition is one of the biggest transitions the auto industry has ever seen, and it should mean a continuation of the American dream. As President Joe Biden argued recently, now is the time for the Big Three to work with the UAW, step up for hardworking Americans, support our country’s competitive standing in the world and help fight the climate crisis.

Mike Williams is a senior fellow at the Center for American Progress, where his work focuses on the nexus between creating and retaining high-quality, union jobs and fighting the climate crisis.

More: United Auto Workers reject GM counteroffer — and say ‘the clock is ticking’ for potential strike

Plus: Hollywood strikes have cost California $5 billion, analyst says

Read the full article here