Uber Technologies Inc. continues to defy the doubters, racking up new profitability milestones even as it chases ever-larger ambitions.

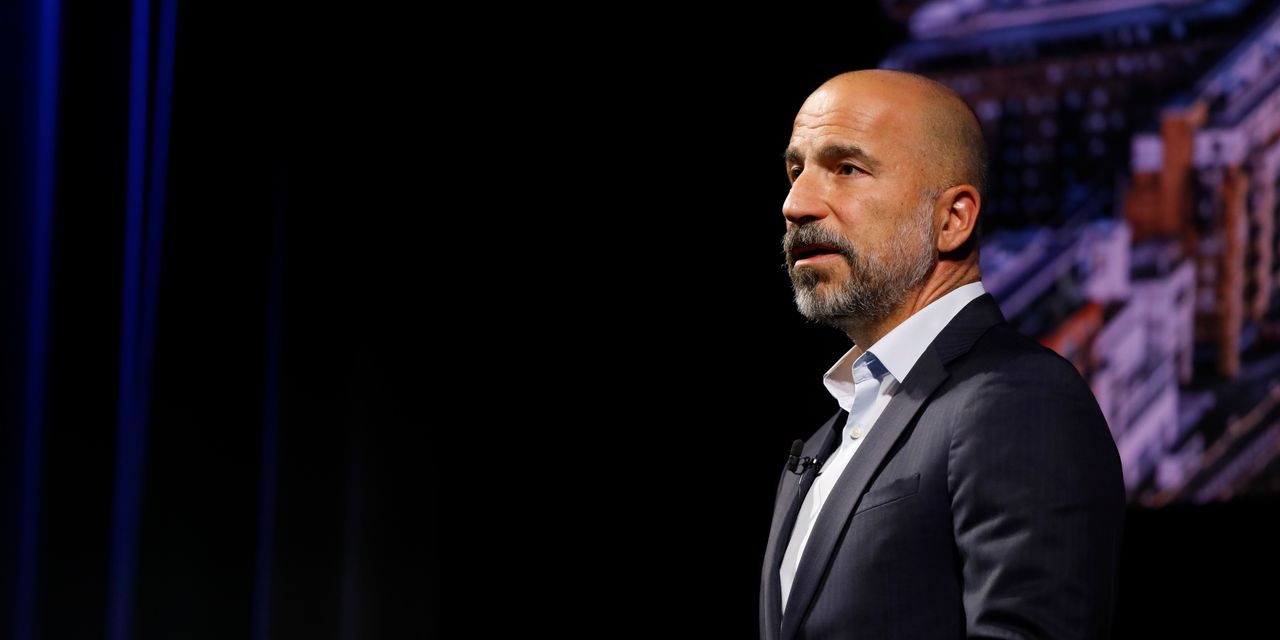

The company’s disclosure of its first-ever quarterly operating profit Tuesday was enough to make Chief Executive Dara Khosrowshahi take a victory lap, as he discussed on the earnings call how “many of the observers over the years boldly claimed” that Uber

UBER,

“would never make any money.” While he understood their concerns about unit economics in tech, he also had confidence Uber would pull off a transformation.

Indeed, MarketWatch had been among those skeptics, while the company spent the past few years sporting heavy losses, fueled in part by volatile equity investments, and duking it out with Lyft Inc.

LYFT,

over riders and drivers in what seemed to be a costly battle. Now, however, Uber’s various business moves seem to all be paying off in a big way. The company is benefiting from strong rider demand and healthier driver supply, cashing in on brand awareness built during the pandemic, seeing new business narratives play out and leveraging cost cuts.

While some investors once speculated Uber (and rival Lyft) would never be profitable until driverless cars came to rule the transportation system, Uber notched a second-quarter GAAP profit, and a GAAP operating profit, in the present-day mobility landscape. It was a far cry from the first quarter of 2022, when Uber posted a $5.9 billion net loss, admittedly driven by paper losses related to equity investments.

Read: Uber’s stock deemed ‘hard to ignore’ with possible S&P 500 inclusion ahead

The company’s Rides business has rebounded from the pandemic and continues to reap the benefits of Uber’s vast umbrella. When ride-hailing demand dried up during the pandemic, the company still offered a food-delivery service in Uber Eats that could keep customers engaged. Now Uber has a strong base of customers who have poured back into the Rides business, helping to drive a 25% rise in mobility gross bookings during the latest period.

Uber also has new initiatives in the works, with management highlighting how advertising is helping to drive growth and making a nod to the artificial-intelligence frenzy on Wall Street, as Uber has been using machine learning for years. Plus, the company started offering the ability to book other travel services, such as train and bus tickets in the United Kingdom, within its app.

“We already know who you are, we know your identity, we know your payments,” Khosrowshahi said on Uber’s earnings call. “We want to be your kind of operating system for everyday life, not just for you to go to work, but to be that travel companion as well, [and] we will extend those services.” The next step is the ability to book flights — not a surprising move from the former CEO of Expedia Group Inc.

EXPE,

See also: Could Uber’s stock cruise to $70? Barclays thinks it can keep riding higher in a big way.

Though Uber shares have nearly doubled so far this year, enthusiasm cooled a bit Tuesday, with the stock off more than 5% in midday action. Investors may have been disappointed by a slight miss in revenue, or the impending departure of Chief Financial Officer Nelson Chai.

But perhaps it’s time to get on board with analysts at Wedbush Securities, who suggested Tuesday that investors don’t want to miss this ride. In their view, Khosrowshahi is “leading the comeback of the ages” at Uber.

Read the full article here