The United Auto Workers returned to the bargaining table with Detroit auto makers Saturday after union leaders took the day Friday to join picket lines at three plants where workers are on strike.

The UAW kicked off the resumed negotiations with

Ford Motor,

the union confirmed to Barron’s. The union called the conversations “reasonably productive,” but didn’t elaborate.

The negotiations resume as two of the Big Three U.S. manufacturers have started to lay off employees as a result of the strike.

The UAW officially went on strike early Friday morning, after contracts between the union and

Ford

(ticker: F),

General Motors

(GM), and

Stellantis N.V.

(STLA) expired late Thursday evening. More than 12,000 UAW members are on strike across different locals targeting all three auto makers at once—a departure from the union’s past strategy of targeting one company.

Workers are on strike at GM’s Wentzville Assembly in Missouri, Stellantis’ Toledo, Ohio, Jeep assembly complex, and select departments in Ford’s assembly plant in Michigan.

The planned layoffs show the unpredictable consequences of targeted strikes in an industry where factories are interconnected. Shortages of parts in one plant can slow or halt production at others. Layoffs are also a way for the companies to put pressure on the union.

Ford and General Motors announced late Friday they were considering laying off about 600 and 2,000 workers, respectively. Both sets of layoffs are in departments that aren’t currently striking, the companies said, but are rather knock-on effects from the strike.

At Ford, the layoffs affect workers in the body construction and stamping departments within its Michigan assembly plant. These departments didn’t go on strike, but they require components completed in striking departments, Ford said.

“Our production system is highly interconnected, which means the UAW’s targeted strike strategy will have knock-on effects for facilities that aren’t directly targeted for a work stoppage,” a Ford spokesman said in a statement to Barron’s.

GM expects that roughly 2,000 workers at its Fairfax Assembly plant in Kansas could be idled as early as next week as a result of the union’s strike at the Wentzville Assembly plant in Missouri.

“This is due to a shortage of critical stampings supplied by Wentzville’s stamping operations to Fairfax,” the company said in a statement. “We are working under an expired agreement at Fairfax. Unfortunately, there are no provisions that allow for company-provided SUB-pay in this circumstance.”

Stellantis said Saturday it was not seeing any knock-on effects from the strike at other plants.

In a Saturday statement posted on X (formerly Twitter), the UAW said it would make sure any workers laid off “will not go without an income.”

“Let’s be clear: if the Big Three decide to lay people off who aren’t on strike, that’s them trying to put the squeeze on our members to settle for less,” said UAW President Shawn Fain. “With their record profits, they don’t have to lay off a single employee.”

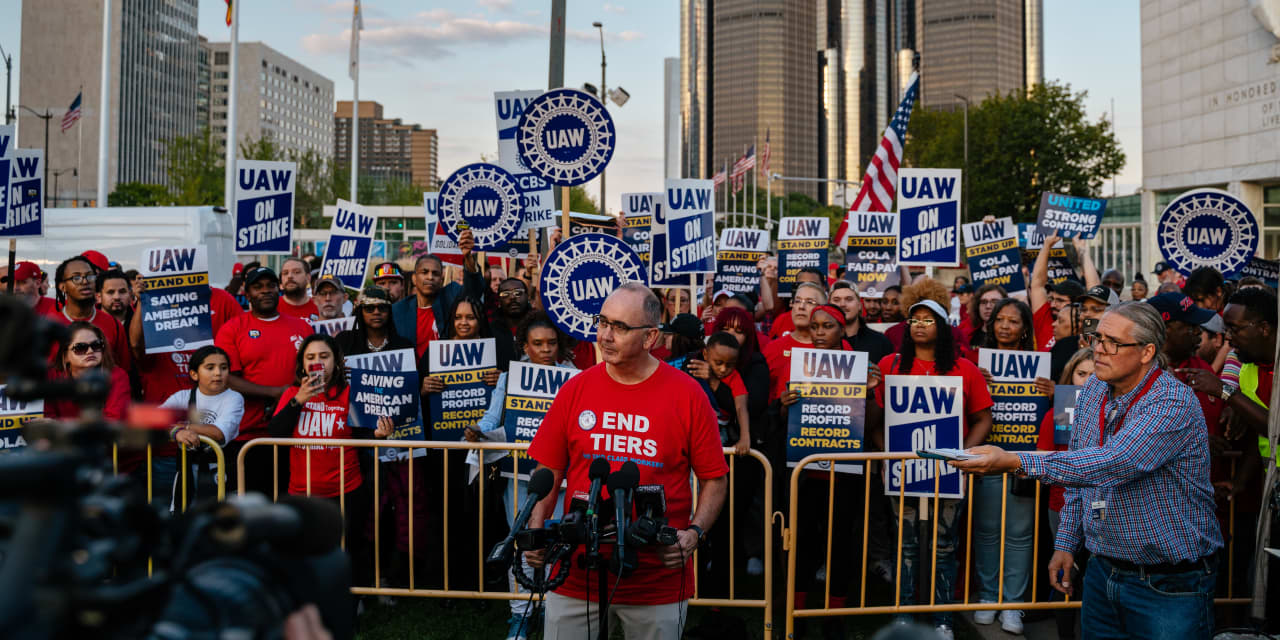

Heading into the bargaining session, there was still a wide gap between the union’s requests and the car makers’ counteroffers, Fain said when speaking to the press after a rally in Detroit Friday.

The union initially sought a 40% increase over four years, along with several other benefits, including cost of living adjustments, a 32-hour workweek, and medical benefits for retirees.

“When we get to where we feel to be, we can take an agreement to our members, we’ll do that,” Fain said when asked if the union was willing to come down to a 30% range for wage increases.

The latest offer from auto makers was a 20% wage increase. Stellantis said Saturday it had raised its offer to a 21% cumulative wage increase, with a 10% bump at the time of ratification. Benefit offers varied depending on the company.

“We’ve got to have a viable industry for the Big Three and at the end of the day, we have to be able to compete against the non-union competitors here in the U.S.,” said Mark Stewart, Stellantis chief operating officer, on a Saturday call with reporters.

Write to Sabrina Escobar at [email protected]

Read the full article here