Nike (NKE) stock’s big week is already off to a rough start, after J.P. Morgan Securities trimmed its price target to $146 from $152. The bear note comes ahead of the blue-chip apparel maker’s fiscal fourth-quarter earnings report, due out after the market closes on Thursday, July 29. All eyes will be on the Swoosh, with several intriguing trendlines on the charts in play.

Nike stock has a mixed history of post-earnings reactions lately. Half of the company’s last eight earnings reports have resulted in post-earnings moves to the downside, including a 4.9% drawdown in March and a 7% gap lower one year ago in late June of 2022. Overall, NKE averaged a post-earnings move of 8.4% in the last two years, regardless of direction. For Friday’s trading, the options market is pricing in a slightly larger-than-usual post-earnings move of 9.9%.

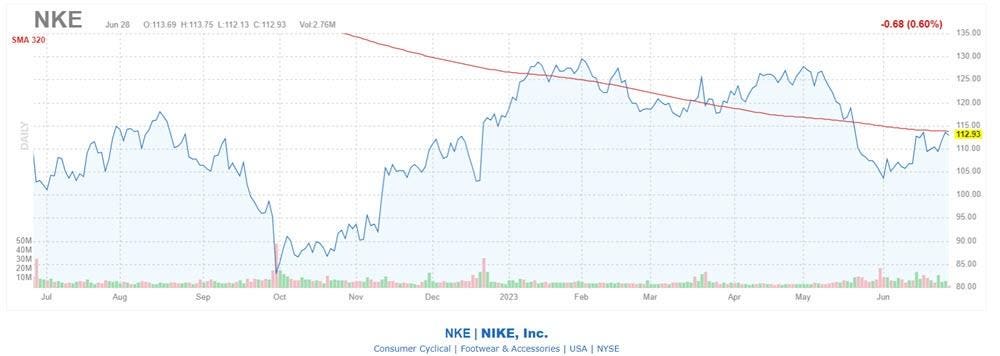

There are three areas on Nike’s chart to watch for Friday. First is the shares’ 320-day moving average, which has turned away two rallies already this month. Second is NKE’s year-to-date breakeven level, with the stock last seen at $112.93, off 3.4% in 2023. Lastly and longer term, there’s the +10% year-over-year level that could act as support or resistance going forward, depending on results of the quarterly report.

Call traders are throwing their weight around. The stock’s 10-day call/put volume ratio of 1.67 over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) sits in the 91st percentile of its annual range, suggesting a very healthy appetite for long calls of late. However, given short interest is up 33% in the two most recent reporting period, its possible some of these short sellers could be using calls as an options hedge.

Now looks like a great opportunity to bet on Nike’s next move with options, per the equity’s Schaeffer’s Volatility Scorecard (SVS) sits at 85 out of 100, meaning it has usually exceeded options traders’ volatility expectations over the past 12 months.

Read the full article here