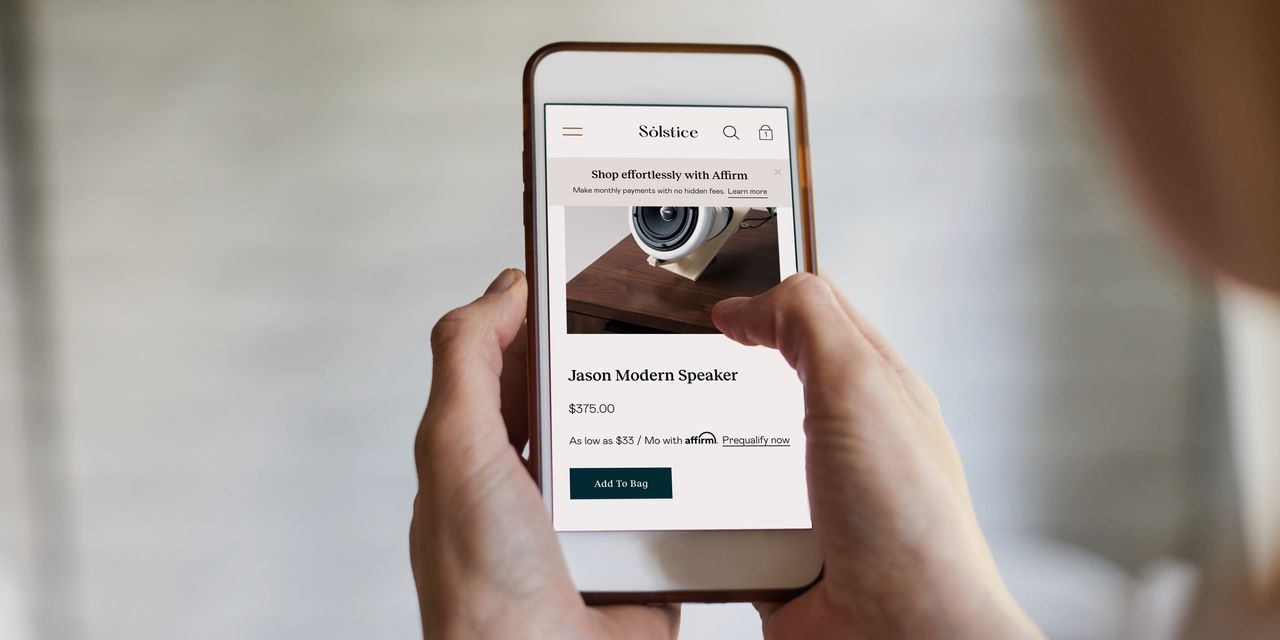

Affirm

Holdings stock was surging Friday but Wall Street analysts were divided on whether it’s the right time to back the stock after the pay later company shrugged off concerns about strains on consumers in its latest update.

Affirm

(ticker: AFRM) shares were up 23% at $17.04 but both bulls and bears found things to pick out of its latest earnings report.

Affirm’s ability to grow revenue while keeping delinquency rates falling is the key factor for Mizuho Securities analyst Dan Dolev. He kept a Buy rating and $20 target price on the stock.

“We note healthy acceleration in transactions per active customer, suggesting engagement is ever stronger. The success of the Affirm Card (adding 75,000 cardholders monthly) should take center stage,” Dolev wrote in a research note.

Affirm has been battling expectations that the restart of federal student loan payments this fall will hit its borrowers. Company executives said Thursday they expect the restart only to be a modest headwind and that it was included in its guidance.

That call surprised BTIG analyst Lance Jessurun, who argued the company would be better off being conservative.

“There appears to be potential downside to numbers in the form of losses and higher provision should the impact of payment resumptions on consumer credit be slightly more than ‘modest’,” Jessurun wrote.

He kept a Sell rating and $10 target price on the stock.

Affirm has also dealt with intensified competition this year after

Apple

(AAPL) introduced its own buy now, pay later service earlier this year. Affirm CEO Max Levchin told analysts that the company remains the best underwriter in the sector and he didn’t expect increased competition to hit its future results.

However, Wedbush analyst David Chiaverini cited competition as a reason to remain cautious, alongside potential margin pressure from rising funding costs, and slowing growth in e-commerce spending. He raised his target price on the stock to $10 from $9 but kept an Underperform rating.

Write to Adam Clark at [email protected]

Read the full article here