New data keeps showing a strong and remarkably resilient U.S. economy:

- Capacity utilization increased by 0.3 percentage points in April to 79.7 percent, very close to the long-term norm

- Consumer spending grew at a very strong 3.7 pace during the first quarter even after adjusting for inflation

- Sales of new homes during March were stronger than expected

- Durable goods orders grew much more strongly in March than expected at a 3.2 percent annualized pace

- GDP grew at a 1.1 percent annualized pace in the first quarter, and is on track for a 2.6 percent pace in the second quarter according to the Atlanta Fed’s GDPNow

The first-quarter growth of the overall economy is not especially strong, but it is entirely consistent with the goal of achieving a “soft landing,” which would mean conquering high inflation without sending the economy into a recession.

The Federal Open Market Committee (FOMC) has hiked interest rates at ten consecutive meetings over the past 14 months to pull inflation back to a healthy range. That battle has essentially been won, but there remains the danger that inflation could flare up again. Because of that, there is still a solid chance that the FOMC could continue to raise rates at its next meeting, in early June: the likelihood of another rate hike is more than 22 percent according to the CME FedWatch Tool.

After that, three broad outcomes are in play:

- The economy’s strength and resilience—and the attendant high inflation—persist, forcing the FOMC to hike interest rates even further.

- The interest rate hikes turn out to have been too much for the economy to bear, triggering a recession.

- The FOMC’s moves turn out to have been enough to temper inflation but not so much to start a recession: the never-before-achieved victory of a soft landing.

My own recession forecasting model is built on five key macroeconomic indicators:

- The Near-Term Forward Spread, which has proven far superior to yield spreads (that is, the slope of the yield curve) for recession forecasting purposes;

- The strength of the labor market as measured by nonfarm payroll employment, labor force participation, and average working hours for manufacturing employees;

- The strength of housing construction as measured by single-family housing starts and new permits for single- or multifamily construction;

- The pace of overall inflation; and

- Total capacity utilization: that is, the measure that just increased by 0.3 percentage points in April.

Recession or Not?

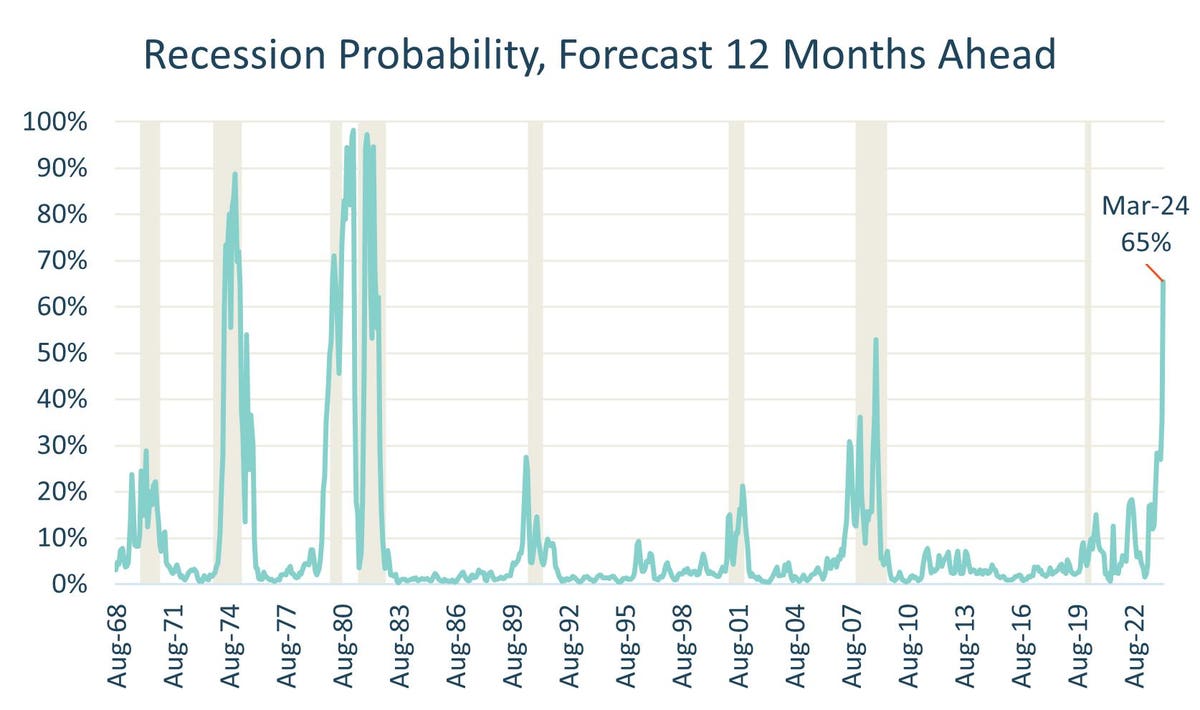

The latest reading from my recession forecasting model gives a 65 percent chance of a recession starting in March 2024. My own subjective judgment, however, is that the U.S. economy is likely to avoid a recession altogether, notwithstanding the output of the forecasting model.

There are three reasons for that subjective judgment. The first is that the model-generated probability of a recession actually declined by five percentage points as a result of the increased capacity utilization number. The second is that the model forecasts a recession only at its farthest horizon—attaching no more than a 35 percent chance to a recession starting any earlier, where one can have (slightly) greater confidence in forecasting accuracy.

The most important reason, though, has to do with the single most important variable in the forecasting model, the Near-Term Forward Spread (NTFS). The NTFS is computed as “the difference between the expected 3-month interest rate 18-months from now minus the current 3-month yield,” according to the two economists who publish figures for it. It takes a positive value when 3-month yields are expected to increase over the next 18 months, and a negative value when they are expected to decline. As with a yield spread (but more accurately), a negative value is associated with a coming recession because it suggests that the FOMC will need to reduce interest rates to fight the recession.

The key observation is this: a negative NTFS also predicts a soft landing.

Soft Landing or Not?

In the FOMC’s perfect scenario, interest rates are high enough (perhaps after one more hike) to cool down inflation; the Fed then starts reducing interest rates to make sure it doesn’t overshoot the goal; and the final result is the soft landing. The recession forecasting model doesn’t estimate the probability of a soft landing for a simple reason: it has never been observed before. That doesn’t mean the soft landing can’t happen, but it does mean it can’t easily be estimated. That is why my forecast is based on subjective judgment rather than on the outcome of my forecasting model: the model simply does not contemplate a soft landing as a viable outcome.

Tom Barkin, the President of the Federal Reserve Bank of Richmond, noted in a television interview on May 16 that, before the FOMC holds its next meeting on June 13-14, several additional pieces of information will be available that will be relevant to its decision. That will continue to be true far beyond the June meeting: in order for the Fed to achieve a soft landing, it will have to pay attention to further developments in labor markets, income growth, consumption, and business investment and calibrate its responses carefully. Still, the possibility for a soft landing has perhaps never seemed as favorable as it does now.

Read the full article here