Topline

Nvidia shares rallied more than 30% Thursday after an earnings report some on Wall Street heralded as one of the best ever, sending the technology stock to an all-time high – and analysts say Nvidia could rally as much as 38% more.

Key Facts

Nvidia tacked on some $150f billion in market capitalization in early trading after it shattered consensus expectations for quarterly sales and profit in its Wednesday afternoon report, as the chipmaker largely powering the artificial intelligence boom cashes in.

But most impressive from Nvidia were its “cosmological” forecasts for the current quarter, Bernstein analyst Stacy Rasgon wrote Thursday, remarking: “We have never seen a guide like the one Nvidia just put up.”

Analysts’ reactions were unabashedly positive to the report, as FactSet reported 28 bumps to Nvidia stock’s price target over the last 24 hours, none starker than Rosenblatt analyst Hans Mosesmann’s nearly 100% bump from $320 to $600, implying 38% upside from Nvidia’s $375 share price Thursday.

Nvidia’s earnings forecast, which nearly doubled consensus predictions, was “without precedent,” according to Craig-Hallum analyst Richard Shannon, calling the upside for the company’s AI segment “truly amazing” (Shannon nearly tripled his price target for Nvidia from $190 to $500 in his Thursday note to clients, upgrading the stock to a buy).

Nvidia, whose $930 billion market valuation is the sixth-largest in the world, would overtake Amazon as the fourth most valuable company in the world should its stock hit $600, falling just short of Alphabet with a $1.5 trillion valuation.

Nvidia stock’s rally Thursday pushed it far past its prior 2021 peak, becoming the first big tech company to set a fresh all-time high since the group largely lost its luster in late 2021, noted Vital Knowledge founder Aram Crisafulli.

Crucial Quote

“Overall, NVIDIA’s results and guide leave us with our jaws dropped as the technological leadership in AI is being monetized and seems to be blasting through any lingering bear thesis concerns for now,” Cowen analysts led by Matthew Ramsay wrote Thursday.

Surprising Fact

“Generative AI” was mentioned 43 times on Nvidia’s Wednesday earnings call, referring to the phenomenon behind chatbots like OpenAI’s ChatGPT and Google’s Bard.

Key Background

Nvidia shares are up more than 160% year-to-date, making it by far the best-performing stock on the S&P 500, according to FactSet data. That far outpaces the tech-heavy Nasdaq’s 22% gain and the double-digit gains of fellow tech titans Apple and Microsoft.

Big Number

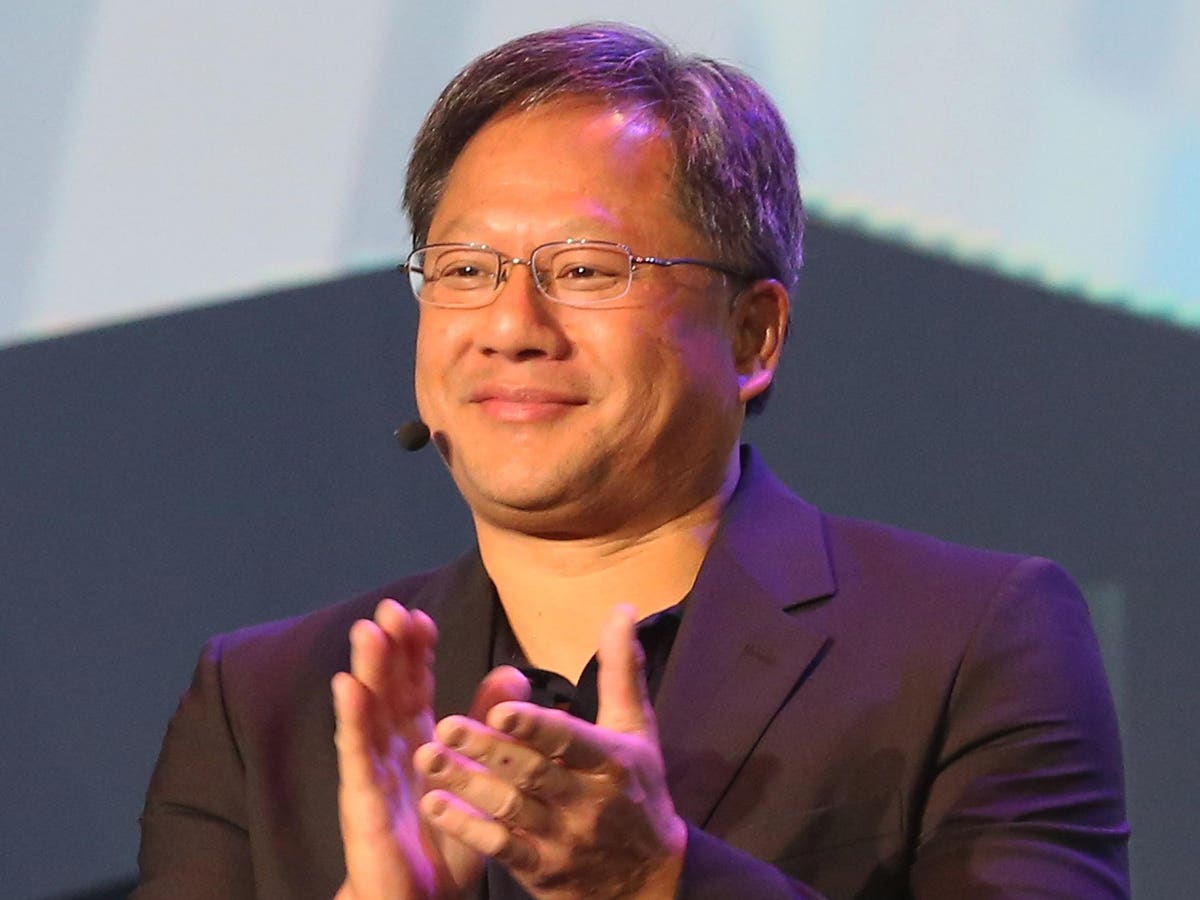

$6.2 billion. That’s how much Nvidia cofounder and CEO Jensen Huang added to his net worth Thursday, growing his fortune to $33.7 billion and becoming the 37th-wealthiest person in the world, per Forbes’ calculations.

Chip Maker Nvidia Shares Soar 14% As Imaginations For AI Future Run Wild (Forbes)

These 7 Tech Stocks Command Almost 90% Of The S&P 500’s Gains—Signaling Market Rally May Not Be So Healthy (Forbes)

Read the full article here