Casino stock MGM Resorts (MGM) scored a 12-month high of $46.24 on March 6. Since then, though, the shares have taken a 7% haircut and are heading for their first monthly loss of 2023. If past is precedent though, MGM could be rolling again, thanks to a pullback to a trendline with historically bullish implications.

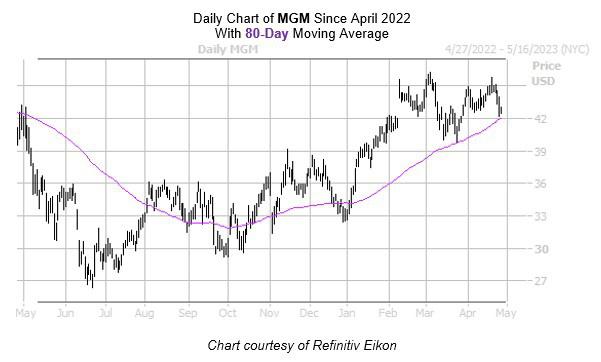

According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, MGM has pulled to within one standard deviation of its 80-day moving average. Per White’s data, seven similar signals have occurred in the past three years. The stock enjoyed a positive one-month return in 71% of those cases, averaging a 12.2% gain. From its current perch at $42.85, a similar move would send MGM to nearly $48 – levels not seen since February 2022. Further, the equity’s 14-Day Relative Strength Index (RSI) of 35.4 is nearing “oversold” territory, which indicates a short-term pop could be on the horizon.

An unwinding of options traders pessimism could create additional tailwinds. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), MGM Resorts stock’s 50-day put/call volume ratio of 2.11 ranks higher than 81% of readings from the past year. What’s more, MGM’s Schaeffer’s put/call open interest ratio (SOIR) of 1.14 stands in the 93rd percentile of its annual readings.

It’s also worth that the casino company reports earnings after the close on Monday, May 1. While the stock has a negative post-earnings history based on the last eight quarters, it did finish the next day 6.4% higher after its February report. This time around, options traders are pricing in a 7.1% post-earnings swing for MGM, which is higher than the 4.9% move MGM averaged over the past two years, regardless of direction.

Read the full article here