Investing.com– Gold prices crept lower on Wednesday as markets awaited more cues on the raising of the U.S. debt ceiling, while copper prices slid after data offered more signals of a slowing economic rebound in China.

sank 0.7% to $3.6338 a pound, and were set to lose about 6% in May as data showed China’s shrank for a second consecutive month in May.

The reading, coupled with a drop in overall business activity growth, pointed to a slowing economic rebound in the world’s largest copper importer, and likely signals weak demand for the red metal. Copper prices were on course for their worst monthly drop in 11 months, and traded just above their weakest levels in nearly seven months.

A slew of U.S. economic readings were also on tap this week, with data for May, due on Friday, set to largely factor into the Federal Reserve’s plans for more rate hikes.

The retreated from 10-week highs amid some profit taking and in anticipation of the data. But an increasingly hawkish outlook on the Fed kept the greenback relatively underpinned, while darkening the outlook for non-yielding assets such as gold.

Rising interest rates push up the opportunity cost of investing in non-yielding assets- a trend that battered gold through 2022.

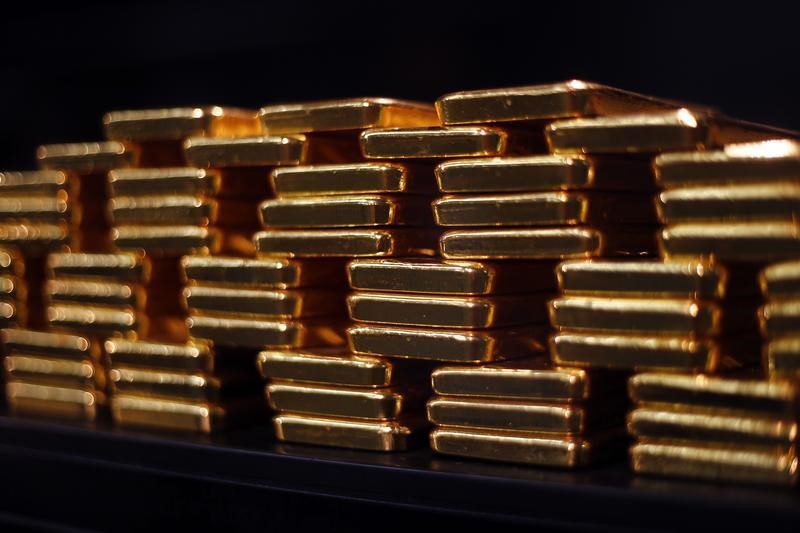

Still, the yellow metal may see increased safe haven demand in the event of a U.S. default, which is likely to trigger a recession. U.S. lawmakers are set to vote this week on passing a bipartisan bill to raise the debt ceiling and avert an economic crisis.

But several Republican and Democrat lawmakers have signaled discontent with the bill, and plan to vote against it in Congress.

fell 0.2% $1,955.14 an ounce, while steadied at $1,973.25 an ounce by 22:42 ET (02:42 GMT). Both instruments rallied nearly 1% on Tuesday, recovering from over two-month lows.

The yellow metal had tumbled from record highs hit earlier in May, and was now set to clock a monthly loss of over 1%. A bulk of this weakness came from that the Federal Reserve will raise interest rates further in June, amid sticky inflation and resilience in the jobs market.

The Fed is also set to keep interest rates higher for longer.

Read the full article here