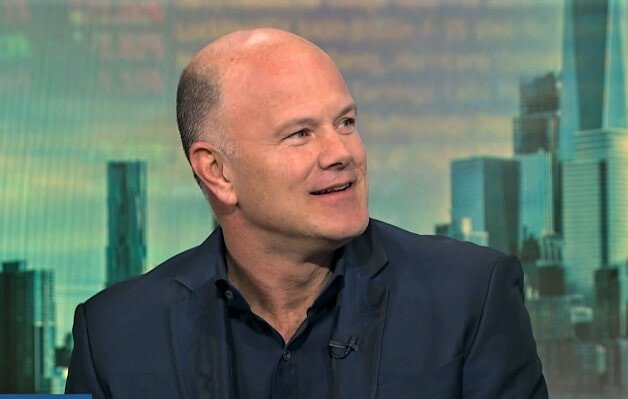

Galaxy Digital CEO Mike Novogratz believes the crypto market lacks momentum to move higher as Bitcoin posts its first monthly loss of the year.

The flagship cryptocurrency lost 6% of its value in May, while Ethereum fell by 1%. Both remain well over 50% year to date, however.

In a recent interview with CNBC, Novogratz said the “dog days of summer” have arrived early for the trillion-dollar cryptocurrency industry, with major tokens trading sideways and very little institutional enthusiasm.

“Crypto’s lackadaisical right now. There’s a constant bid from retail. We’re seeing it through all the platforms.”

Despite this lack of excitement from the corporate investors as he duly noted, Novogratz highlighted a number of positive events that shows promises in the industry.

The crypto veteran argued that retail interest has remained strong, as demonstrated by recent digital yuan integration with Chinese social media giant WeChat.

Meanwhile, Novogratz expressed concern over the lack of new large-scale buyers in the crypto market.

He suggested that many new users tend to be smaller players who buy modest amounts of cryptocurrency on platforms like Robinhood, Revolut, or Square.

While these new buyers are typically long-term holders, providing some stability to the market, they do not yet include significant institutional activity.

The majority of new Bitcoin purchases, according to Novogratz, are old buyers, meaning that the number of new users buying cryptocurrency is relatively small and consolidated on platforms like Cash App and Revolut.

Tighter Monetary Policy Continues to Weigh On Digital Asset Maret

The main reason for the stalling of the cryptocurrency market is thought to be concern over tighter monetary policy.

Central banks have continued to express hawkishness, with the Federal Reserve delivering 10 consecutive interest rate hikes since March 2022 in an attempt to tackle inflation.

The European Central Bank has also tightened monetary policy and recently suggested that more increases could be on the horizon.

Many investors believe that the risk associated with such central bank policies will continue to impact cryptocurrency markets.

Nevertheless, Novogratz has an optimistic outlook for the cryptocurrency market.

He believes that if the Federal Reserve cuts interest rates in response to a potential economic slowdown in the second half of the year, cryptocurrencies, including Bitcoin and Ethereum, could see a significant boost.

Galaxy Digital is a cryptocurrency investment and merchant bank founded by former hedge fund manager Michael Novogratz.

The company specializes in providing investment banking services and asset management for digital assets such as cryptocurrencies, blockchain-based ventures, and other related technologies.

In the first quarter of the year, Galaxy Digital reported a profit of $134 million, marking a significant improvement for the firm since the previous quarter when it reported a loss of $288 million.

Read the full article here