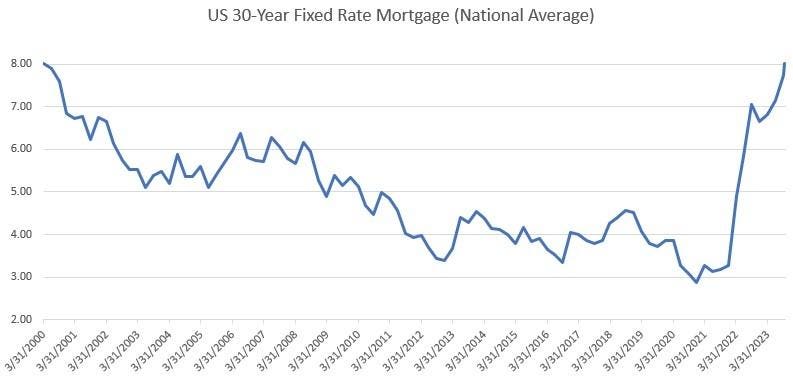

One of the biggest surprises this year has been the seeming resilience of US home prices to rising interest rates with the 30-year fixed-rate mortgage rate reaching 8% last week for the first time since 2000 (see chart). This has occurred as the yield on the long bond surged by a full percentage since the Fed last raised interest rates at the end of July.

Source: Bankrate

Despite this, U.S. home prices have not cracked: The S&P CoreLogic Home Price Index (HPI) turned positive in July for the first time since February 2023, and the firm’s forecast calls for it to appreciate by 3.5% over the 12-months ended July 2024. Goldman Sachs housing analysts have also revised their forecasts for next year, which now call for moderate home price increases.

Yet, the story is quite different when one looks at various measures of housing activity.

Residential investment declined by 9% in real terms last year, and it fell further in the first half of this year. This illustrates the impact that the combination of home price appreciation and higher mortgage rates is having on home price affordability, which is the most expensive for home buyers since 1987 (see chart below). To afford the average home today Redfin calculates that buyers need to earn $115,000, which is $40,000 more than average earnings. According to the Wall Street Journal the cost of buying a home is now 52% more expensive than renting.

Source: Calculations of Fort Washington Investment Advisors based on data from S&P CoreLogic, BLS, and Freddie Mac

While residential investment turned positive in the third quarter, it is likely to be temporary, as other measures including homebuilder sentiment and new home construction point to weakness ahead. Accordingly, many observers are wondering how long housing prices can stay firm.

It is widely recognized that low inventory levels have been the main factor propping up home prices. According to the National Association of Realtors, there were 1.13 million homes for sale or under contract at the end of September. This is the lowest inventory level for any September since 1999 and is equivalent to a 3.4-month supply of homes on the market.

What is less obvious, however, is the role that fixed-rate mortgages have played in limiting the supply of homes. Many homeowners are refraining from trying to sell their home in order to preserve their low fixed-rate mortgage. The reason: They will incur higher costs in buying a home and obtaining a new mortgage. This shows up in existing home sales, which have recently fallen to the lowest level since 2010.

A key feature of the housing market today is that 90% of homeowners have been choosing fixed 30-year rates according to Freddie Mac. By comparison, variable rate mortgages made up about 30% of the US mortgage market before 2008. They also included teaser rates for buyers that would not otherwise have qualified for fixed rate mortgages, which left the housing market vulnerable when the Federal Reserve tightened monetary policy.

The principal reason 30-year fixed rate mortgages are prevalent in the U.S. is they are securitized. This means that U.S. banks do not directly bear the risk of conventional mortgages but instead sell them to government sponsored entities (GSE) such as Fannie Mae

FNMA

The U.S. reliance on long-term fixed rate mortgages also helps to explain why the US housing market has fared much better than most other countries where most mortgages are variable rate.

For example, countries such as Australia, Canada, New Zealand and the UK, which experienced large price appreciations during the Covid-19 pandemic, have seen much greater selling pressure than the US. As of June of this year, home prices in Canada and New Zealand had fallen by 9% and 16%. UK home prices fell by 5.3% in the year to September, and about 800 thousand homeowners will have their mortgages lapse later this year and another 1.6 million next year. According to The Week, a British publication, the UK could be heading for its “biggest ever” house price crash.

Finally, while the reliance on 30-year fixed rate mortgages has helped insulate US housing from Fed tightening, investors should not conclude it is immune from rising mortgage rates. During September, home sales retreated 15.4% from the previous year, and mortgage applications fell to the lowest level since 1995 according to the Mortgage Bankers Association. Consequently, price pressures could surface before long, especially with mortgage rates well above the Fed’s 2% long-term inflation target.

That said, I do not concur with the assessment of a recent Bloomberg commentary titled “The US Housing Market Is Now Completely Broken.” While housing activity is likely to be depressed for a while, Treasury yields could decline next year as the economy softens. There are also many buyers on the sidelines who would like to buy a house with a 5.5%-6% mortgage rate, and there has been a pickup recently in 5-year adjustable-rate mortgages that are fixed for one year.

The principal risk for the housing market is that high interest rates will choke off demand while some homeowners could be forced to sell their houses if the economy weakens and they lose their jobs. In that event, home price declines of 10% or so are possible. Meanwhile, the fate of the housing market is more closely tied to the bond market than to Fed policy.

Read the full article here