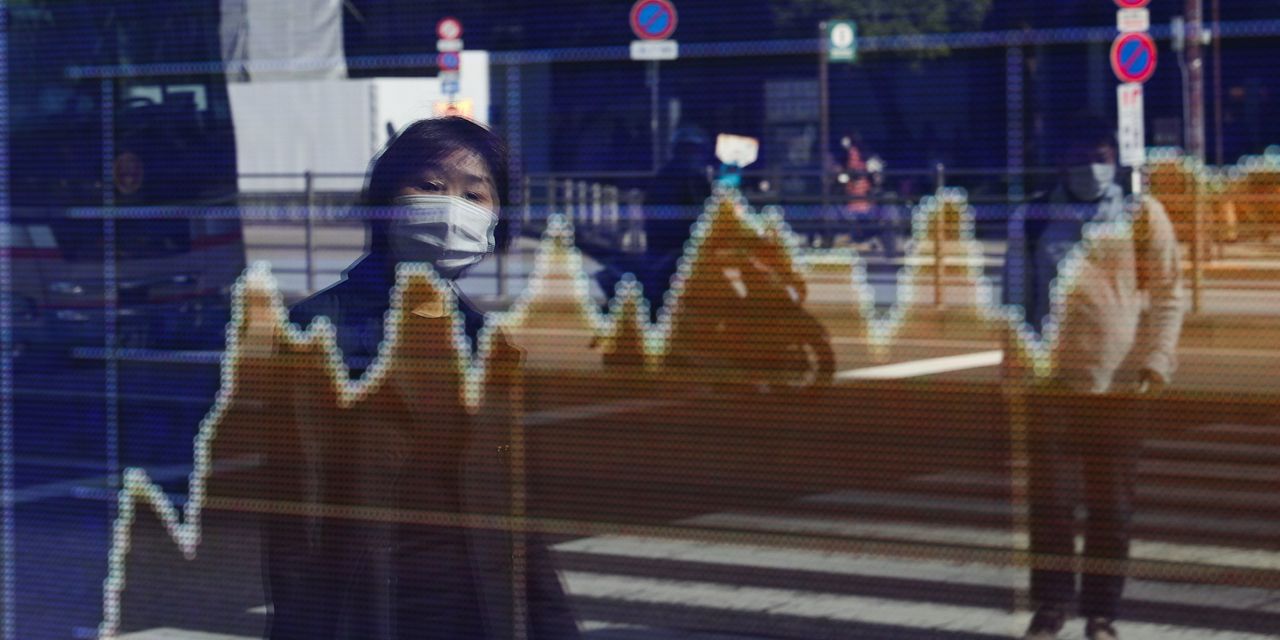

Japanese stocks are largely trouncing the U.S. market in 2023, and there may be plenty of fuel for further outperformance, analysts said.

The broad Tokyo Price Index, or TOPIX

180460,

ended Wednesday at ¥2,133.61, up 0.3% for its highest close since Aug. 3, 1990, according to Dow Jones Market Data. The benchmark Nikkei 225

NIK,

was up more than 15% year-to-date through Wednesday, outpacing the S&P 500’s

SPX,

8.3% rise.

The biggest Japan-tracking exchanged-traded fund, the iShares MSCI Japan ETF

EWJ,

which follows the MSCI Japan Index, was up 11.8% through Wednesday versus 8.6% for the S&P 500-tracking SPDR S&P 500 Trust

SPY,

Yet in some ways Japan’s outperformance may feel a bit under the radar.

Blame the tech-concentrated Nasdaq-100

NDX,

It has surged more than 24% so far this year, possibly making the Japan story seem irrelevant to some U.S. investors, said Jeff Kleintop, chief global investment strategist at Charles Schwab, in a phone interview.

But Japanese stocks have delivered their returns with far less volatility than U.S. tech stocks, he noted. That means Japanese stocks should still look attractive to U.S. investors.

What’s driving the rally? While borrowing costs for U.S. companies jumped last year as the Federal Reserve aggressively hiked interest rates, the Bank of Japan has maintained its ultraloose policy. The yield on the 10-year Japanese government bond

TMBMKJP-10Y,

is back below 0.5%. But that’s not it, said David Rosenberg, president of Rosenberg Research, in a Wednesday note.

Instead, the rally “is about higher governance standards and a push by the corporate sector to return cash to shareholders,” he wrote. Years of corporate governance reforms originally championed by late former Prime Minister Shinzo Abe are beginning to have an effect.

Rosenberg noted that dividends have expanded sharply, while corporate buybacks in the year-to-March hit a record $71.4 billion.

Also, nearly 50% of Japanese companies have net cash on their balance sheets, Rosenberg observed, versus just over 20% in the U.S., while roughly 54% of the TOPIX members are trading below book value versus 7% in the S&P 500.

And the price-to-book ratio in Japan stands at just 1.3 times, compared with 1.8x in Europe and 4.0x in the U.S., which provides firmer floor and higher ceiling for Japanese stocks based on valuation metrics alone, Rosenberg argued.

Debt-ceiling fears may have also inspired some “doomsday preppers” to pile into Japanese stocks as a safe-haven play, Kleintop said.

And then there’s billionaire investor Warren Buffett, whose Berkshire Hathaway Inc.

BRK.A,

BRKB,

has boosted its stake in five Japanese trading conglomerates and now has more equity exposure in Japan than any other country outside the U.S.

Buffett’s moves may be sparking some of the recent momentum, Kleintop said, but noted that the investments are specific rather than industry- or countrywide.

Deep Dive: Buffett is buying in Japan. This overseas value-stock fund is also making bets there. Is it a good way to diversify?

Meanwhile, data shows Japanese stocks enjoying solid inflows after a long stretch of money going the other way. Despite Japan’s outperformance, Bank of America’s May global fund-manager survey showed portfolio managers remained a net 11% underweight in Japanese stocks, Rosenberg said.

Kleintop said that while being underweight isn’t a reason in itself for investors to increase their exposure, improved performance, lower valuations, and the low price-to-cash flow companies that make up Japanese indexes offer the quality characteristics that remain enticing.

Read the full article here