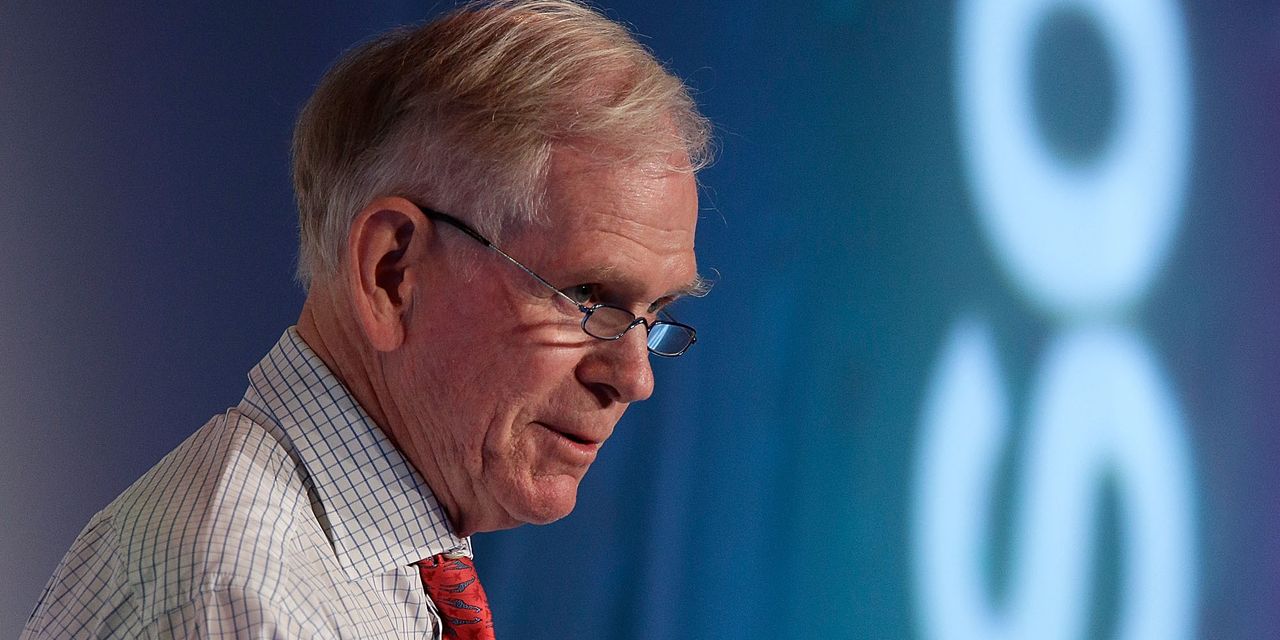

Legendary investor Jeremy Grantham’s GMO is planning to offer an exchange-traded fund that will invest in U.S. quality stocks, the firm’s first ETF as it responds to demand in the wealth management industry.

GMO, an investment firm co-founded by Grantham, is preparing to launch the GMO U.S. Quality ETF under the ticker QLTY, according to a prospectus filed Monday with the Securities and Exchange Commission. The actively managed fund will primarily invest in shares of U.S. companies, with the selection of stocks based in part on profitability, leverage and growth opportunities, the filing shows.

GMO, which is known for value investing, was founded in 1977.

“GMO has always been committed to offering innovative investment solutions in the structures that best suit our clients,” a spokesperson for the firm said in an emailed statement. “Our extension into exchange-traded funds is a natural evolution of that commitment, driven by demand from the intermediary and wealth management space.”

Grantham has built a reputation for calling major stock-market bubbles, including in 2000 and 2007. In January 2022, he warned of a “superbubble” spanning across stocks, bonds, real estate and commodities while pointing to stimulus from the Federal Reserve.

The S&P 500 index closed at a record high in early January 2022 and finished that year down 19.4% — its worst drop since 2008 — as the Fed embarked on an aggressive campaign of raising interest rates to fight high inflation. The central bank began lifting rates from near zero in March 2022, after years of easy monetary policy.

The S&P 500

SPX

is slumping this month but remains up 13.6% so far this year, according to FactSet data reflecting trading levels around midday Monday. The Invesco S&P 500 Quality ETF

SPHQ,

which tracks an index of stocks in the S&P 500 with the highest quality score, has climbed around 15% over the same period, FactSet data show, at last check.

Read: Rising yields put S&P 500 on pace for biggest monthly loss of 2023 as investors brace for Fed Chair Powell’s Jackson Hole speech

Read the full article here