Between Nvidia’s blowout earnings and an unsurprising Jackson Hole, the stock market should have gotten everything it needed to end talk of a correction. That fact that it didn’t suggests that there is probably more downside ahead.

Entering the week, only two events mattered—and both should have been good news for the market. First,

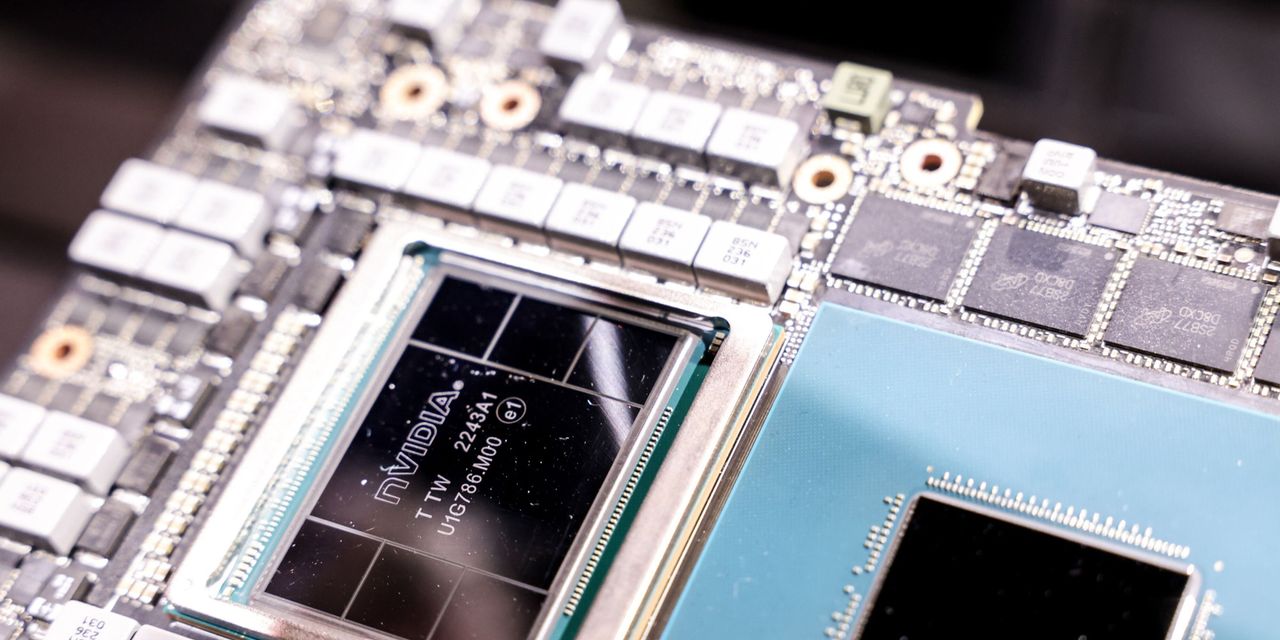

Nvidia

(ticker: NVDA) had earnings to report, and the bar was set high, given the smashing success of its artificial-intelligence-driven results three months earlier. No problem. Nvidia blew past sales and earnings-per-share forecasts and issued a strong current quarter outlook, as it sells even more chips to power the AI boom.

Then, Federal Reserve Chair Jerome Powell had to give his speech at Jackson Hole, Wyo., without spooking the market. Consider it done. Powell, though hawkish, didn’t say anything that resembled a surprise: The Fed will remain data-dependent as it waits for inflation to subside to 2%.

“Fed Chair Powell delivered what we thought was a balanced assessment of the economic and monetary policy outlook at Jackson Hole,” writes Aditya Bhave, U.S. economist at BofA Securities. “As expected, he gave little forward guidance on policy, instead emphasizing data dependence.”

On the surface, the stock market seemed to be comfortable with the direction things were heading. The

S&P 500

index rose 0.8% to end a three-week losing streak, while the

Nasdaq Composite

gained 2.3%, reversing some recent losses. The

Dow Jones Industrial Average

rallied strongly on Friday, finishing the week down 0.5%.

But we know better. The biggest concern is that investors have been selling the rips, not buying the dips. Take the reaction to Nvidia’s earnings. The S&P 500 traded as high as 4458 this past Thursday, up 0.4%, but finished the day down 1.4% at 4376. And the peak was right where technically inclined traders would have expected it to be—near the index’s 50-day moving average of 4459. What’s more, the stock market has been acting this way all month, with brief rallies being used as opportunities to sell.

Now, it’s all about where the S&P 500 can find support, a level where buyers step in to prop up the market. Right now, it looks to be at 4300, says Frank Cappelleri, founder of CappThesis. If that level breaks, the next stop could be near the index’s 200-day moving average around 4135, down 11% from the 2023 peak, and a fall large enough to meet the definition of a market correction.

“If you go below 4300, there’s no support to key off of,” says Cappelleri. “People will talk about the 200-day moving average.”

The recent weakness is a reminder that the stock market is always looking ahead. Yes, earnings estimates may be on the rise, especially among tech stocks, and interest rates may not be going much higher, but the S&P 500 has already gained 15% to reflect those pieces of good news. What have you done for me lately?

“While the market waits for the next catalyst, we think it’s going to be bumpy,” says Jeffrey Buchbinder, chief equity strategist at LPL Financial.

Perhaps very bumpy. Remember, the economy reacts to rate hikes with a lag, and even Powell acknowledged that figuring out if they’ve gone high enough is an inexact science. Much will depend on how the economic data look, whether it’s August payrolls, due on Sept. 1, or the consumer price index, to be released on Sept. 13. After months of surprisingly strong data, the risk might be that it’s too weak, not too strong, says the Sevens Report’s Tom Essaye.

Add it all up and it’s probably best to wait to buy stocks. The market needs to have the first correction of the new bull market first.

Write to Jacob Sonenshine at [email protected]

Read the full article here