Topline

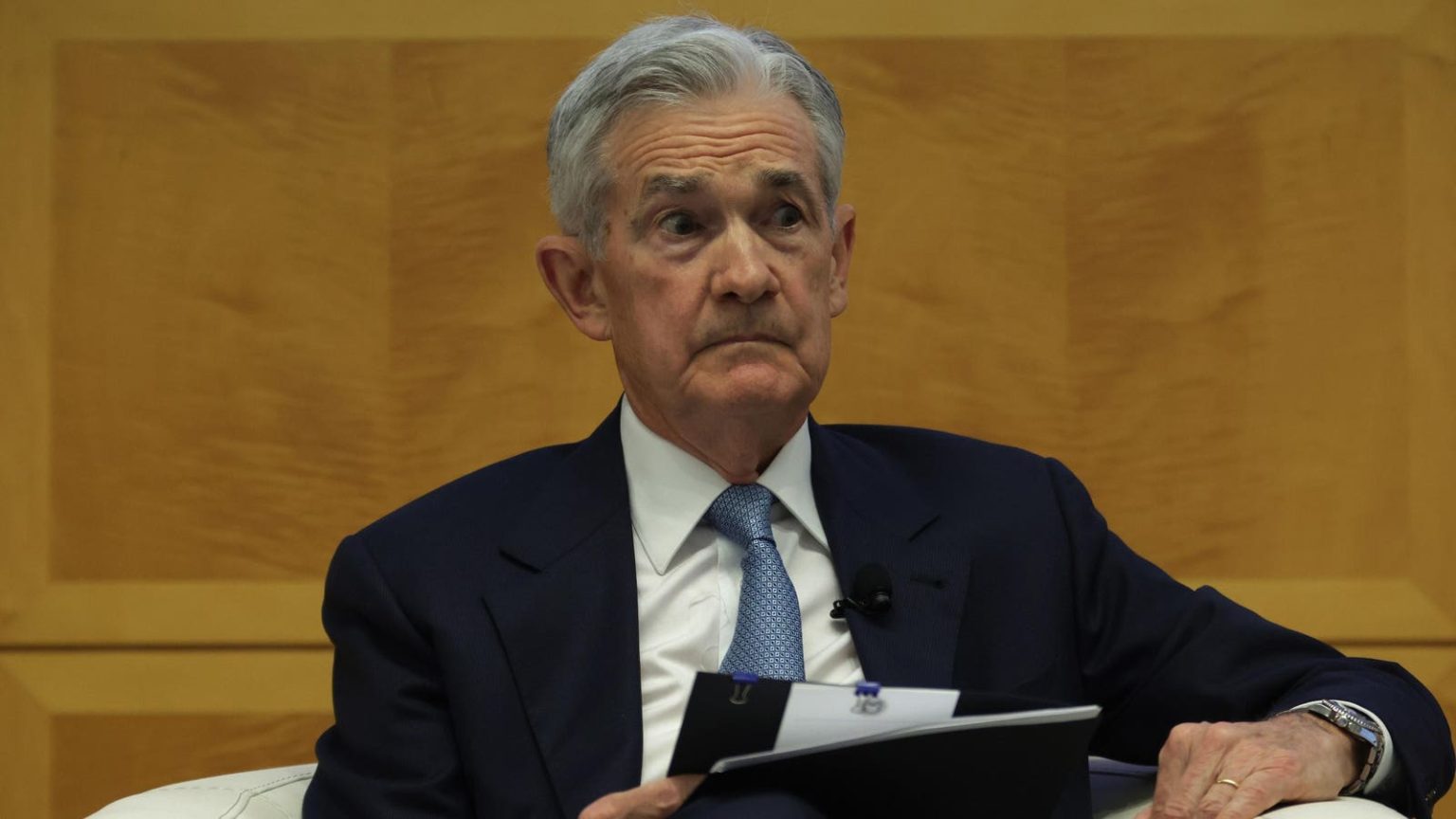

Federal Reserve Chairman Jerome Powell said Friday it’s too early for the Fed to declare victory in its war on inflation or roll back its related increases in interest rates, though markets continue to increasingly price in a friendlier Fed, driving stocks’ historic rally.

Key Facts

It’s “premature” to “speculate” on when the central bank may cut rates from its two-decade high of over 5%, Powell said during prepared remarks at Atlanta’s Spelman College, adding Fed staff are “prepared” to raise rates again if needed.

The Fed’s policy-setting Open Markets Committee is still “making decisions meeting by meeting” and “moving forward carefully,” Powell added.

The language, which matches Powell’s typically cautious tone, did little to dissuade bullish investors who are convinced the latest batch of soft inflation data support a Fed pivot.

Yields for 10-year U.S. Treasury yields fell nine basis points to a three-month low below 4.3% on Friday, and the Dow Jones Industrial Average gained 0.6%, building on its 2023-best 8% rally in November.

Key Background

The Fed, whose primary objectives are to maximize employment and ensure price stability for Americans, began its current rate hiking campaign last March to combat inflation. After peaking at above 9% last summer, inflation has since cooled to about 3% year-over-year, closing in on the Fed’s 2% goal. Higher rates, which make borrowing costs more expensive for corporations, small businesses and individuals alike, have had a noticeable impact, such as partially causing a string of bank failures this spring and the stock market’s worst year since the Great Recession in 2008. However, the economy has largely remained strong, growing 5% during the third quarter. The Federal Open Markets Committee has declined to raise rates for two consecutive meetings, and many experts expect the central bank to begin lowering rates in 2024, despite Powell’s skepticism stated Friday.

What To Watch For

The Federal Open Markets Committee will hold its last meeting of the year Dec.14-15. The futures market prices in a roughly 98% chance that the federal funds rate will hold at 5.25% to 5.5%, according to the CME Group’s FedWatch Tool, and prices in a roughly 90% chance that the Fed will lower rates by at least 100 basis points in 2024.

Read the full article here