The continued strength of macroeconomic conditions is extraordinary. Real Gross Domestic Product (GDP) grew during 2022Q2 at a 2.4% annualized rate, according to the advance estimate from the Bureau of Economic Analysis, and the early prediction from the Atlanta Fed’s GDPNow tool is for even stronger growth during 2022Q3 at 3.9%.

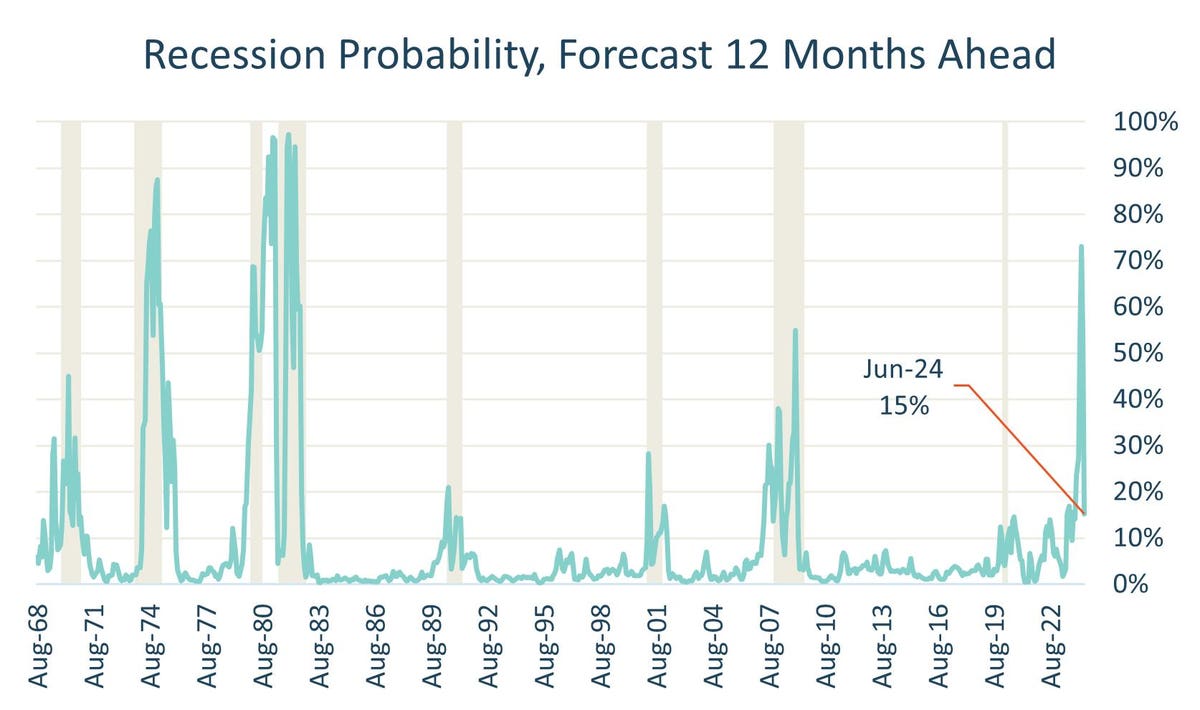

As a result, the likelihood of a recession has plummeted. Using data through April, my forecast model put the probability of a recession starting next spring at 73%. However, updating the model using data through June (that is, the latest data available by the end of July) brings the probability down to just 15%.

As I’ve described before, my recession forecasting model is based on five key macroeconomic indicators:

- The Near-Term Forward Spread (NTFS), which has proven far superior to yield spreads (that is, the slope of the yield curve) for recession forecasting purposes;

- The strength of the labor market as measured by nonfarm payroll employment, labor force participation, and average working hours for manufacturing employees;

- The strength of housing construction as measured by single-family housing starts and new permits for single- or multifamily construction;

- The pace of overall inflation; and

- Total capacity utilization.

Each of these depicts a macroeconomy holding steady despite the aggressive hikes in interest rates since early 2022 by the Federal Open Market Committee (FOMC).

For example, total capacity utilization—which had declined during the last quarter of 2022—has held quite steady during 2023 at about 79.6%, which is pretty much its average value over the past 50 years. The resilience of the labor market has been widely noted, and of course inflation has remained stubbornly high although it has moderated over the past several months.

Probably the most important factor causing recession threats to back off, however, has been the recovery in single-family housing construction. Both the number of starts and the number of permits declined very sharply during 2022, with the three-month moving average sinking by more than -15% during July, August, and September. Both measures of residential construction activity have come back strongly in 2023, however, contributing to the overall economy.

The NTFS remains negative, meaning that investors collectively believe that short-term interest rates will be lower 18 months from now than they are now. It is important to notice, however, that the NTFS has become far less negative over the past two months, improving from an average of -1.45% in April and -1.70% in May to -1.16% in June and -1.04% in July.

Typically investors have believed that short-term rates would be declining because the FOMC was trying to help the economy recover from a recession, so a negative NTFS has been a very good signal of a coming recession. In the current market environment, however, investors believe that the FOMC will bring down rates over the next 18 months even if there is no recession—that is, as part of a “soft landing.”

The continued strength in macro conditions, and the plummeting likelihood of a recession, explain not only why the FOMC raised rates again on July 26 but also why it is quite likely that the members will raise them again at least one more time this year. The CME FedWatch tool, for example, currently shows a 29.9% chance of one more rate hike and a 3.3% chance of two more.

Mortgage interest rates have remained quite high for almost a year, with the average rate on a 30-year fixed-rate mortgage hovering above 6.5% since mid-May 2023, and it seems very unlikely that they will decline soon. As I’ve explained before, mortgage interest rates tend to be high when other interest rates are high, and for many of the same reasons including overall macro strength and inflation pressures. And there is no question that inflationary pressures remain, even as inflation itself has declined sharply. For example, the Job Openings and Labor Turnover Survey (JOLTS) published on August 1 showed that the number of job openings still far exceed the number of unemployed people, as has been true for more than two years, even though the gap has moderated from about 100% in March 2022 to just about 60% in June 2023.

In short, the U.S. economy has coped remarkably well with the most aggressive program of rate hikes since the early 2000s—and it seems very likely to cope equally well with one or even more boost in interest rates.

Read the full article here