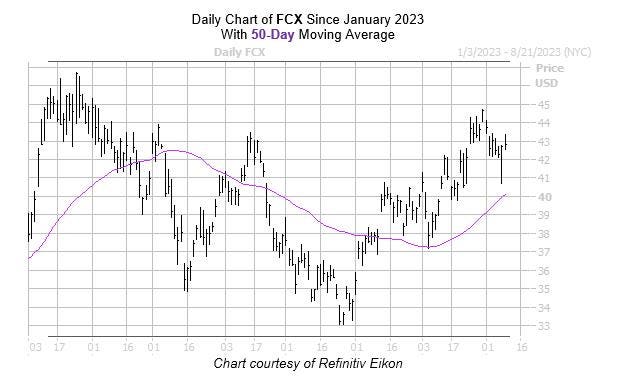

Shares of copper miner Freeport-McMoRan (FCX) are struggling this month, as the red metal’s prices suffer amid weakening trade data from China. Though last seen up 0.4% at $42.85, FCX has shed more than 4% already in August. If past is precedent, this pullback could offer an intriguing buying opportunity, thanks to a historically bullish trendline.

According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, FreePort-McMoRan stock just came within one standard deviation of its 50-day moving average. Per White, seven other similar pullbacks have occurred over the past three years. One month after 71% of these signals, FCX notched positive returns, averaging a 10% pop. A similar move would put the shares at a level not seen since April 2022.

A shift in analyst sentiment could also provide tailwinds. Of the 13 in coverage, eight covering brokerage firms call the mining stock a “hold” or worse.

For those looking to bet on FCX’s move lower, options seem to be affordably priced. The equity’s Schaeffer’s Volatility Index (SVI) of 36% ranks in the low 9th percentile of its 12-month range, meaning options traders are pricing in low volatility expectations right now.

Read the full article here