If you want your portfolio to rise in value, buy stock in companies reporting better results than investors expect. If you have an appetite for risk, buy into companies with heavy short bets based on operational problems and high cash burn.

If such companies beat expectations, they will enjoy a surge in their share prices. That’s what happened to Irvine, Calif-based electric van maker, Rivian.

This week, Rivian made and shipped more EVs than investors expected and its shares soared, noted Investopedia.

Should you invest in Rivian stock? I think the answer is no. In addition to Rivian’s high cash burn rate, D.A. Davidson analyst Michael Shlisky sees operational risks ahead that could disappoint investors, MarketWatch reported.

Rivian investors — who have watched the company’s shares lose 86% of their value since peaking in November 2022 — might be better off if the automaker were to endure these growing pains as a private company.

Rivian’s Month Of Good News

Rivian stock has popped 22% since the start of July. Higher-than-expected electric van deliveries in second quarter caused the rise. According to CNBC, here are the key numbers:

- Second quarter EV deliveries were up 59%. from the previous quarter to 12,640 — 15% higher than investors expected.

- 2023 EV production to increase 100% to 50,000 vehicles by the end of 2023. In the first half of the year, Rivian produced roughly 23,400 EVs. Analysts polled by FactSet expect Rivian to fall 3,000 units short of its 2023 production target, the Wall Street Journal reported.

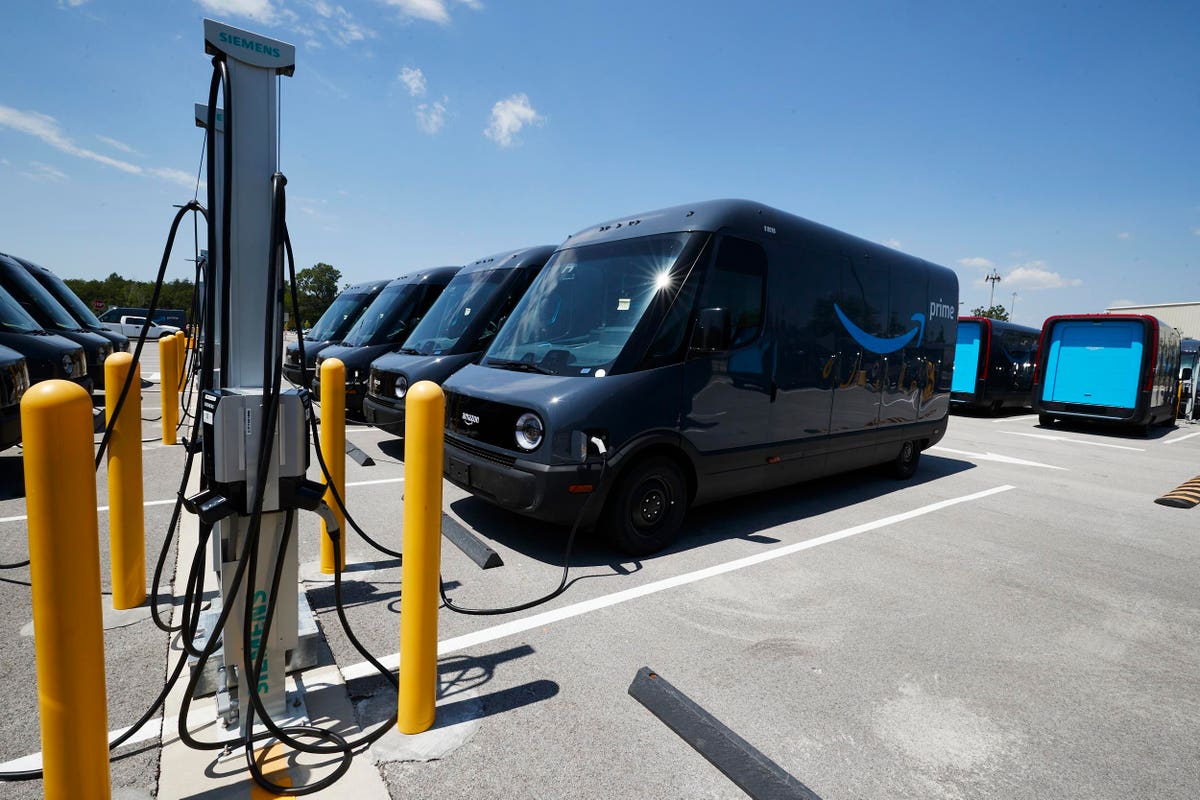

- Amazon to take delivery of more than 300 Rivian EVs in Germany. In July 2022, Amazon began using Rivian EVs to deliver its packages after the e-commerce giant’s $700 million equity investment in the automaker in 2019, noted Investopedia.

Rivian — which may be benefiting from Tesla’s 83% rise in second quarter deliveries — cut an agreement in June that will enable Rivian owners to use Tesla’s fast-charger network beginning in 2025, noted the Journal.

Rivian’s Mixed First Quarter Earnings

All is not well with Rivian — which provides electric R1T pickups for business and R1S SUVs for consumers.

On May 9, Rivian delivered investors a mixed financial report for the first quarter of 2023. The good news was the company had losses that were narrower than investors expected, it decided to conserve cash through spending cuts, and it held pat on its 50,000-unit production target, the Journal reported.

While Rivian shares increased after the announcement, the automaker’s CEO RJ Scaringe expressed concern about making a profit before it runs out of money. He told investors, “We have a lot of work to do in terms of continuing to drive our production ramp and drive costs down.”

Rivian has experienced numerous growing pains, noted the Journal. These include the following:

- Dropping production. In the first quarter, the company fell 625 vehicles short of the 10,020 it produced in the final quarter of 2022.

- Under-pricing its EVs. “A large portion of Rivian’s existing orders for the were placed before the company raised prices to help offset rising raw-material costs,” noted the Journal.

Investors are somewhat skeptical of the company. In June, short interest in Rivian stock topped 13%, according to the Journal.

Rivian ended March with cash of $11.1 billion. However, it is unclear how long that sum will last. In 2022, the company burned through $6.4 billion in free cash flow. In Q1 of 2023, Rivian consumed $1.8 billion in free cash flow.

Rivian loses money on every vehicle it ships. For example, its gross profit — revenue minus cost of goods sold minus depreciation — was negative $593 million in the first quarter. Rivian never has made a penny of profit on its vehicles.

Where Rivian Stock Goes From Here

Last July, I wrote skeptically about Rivian’s prospects. What strikes me is how analysts were able to look past the company’s struggles to meet production goals and to lower its cash burn rate.

One analyst, Vijay Rakesh, cut his price target on Rivian by $10 to $70 a share — which then was 141% more than its July 2022 stock price. Things have grown worse for the company worse. On July 6, that $70 price target was 250% more than its stock price.

The basis for Rakesh’s optimism was a bright future for the EV industry and a belief in Rivian’s ability to solve its production problems. According to CNBC, he expected improvement in the second half of 2022, “Despite elevated macro risks, BEV could see strong ramps as China re-opens and demand improves, with BEVs potentially up >55%.”

Rivian is optimistic its supply chain difficulties are easing and it is negotiating with Amazon to sell its EVs to other customers. According to Bloomberg, Scaringe said, “What we saw in Q2 is really the beginnings of the supply chain now running in a healthy way. We are in the final stages of negotiating, allowing us to sell the vehicle outside of the Amazon relationship to others.”

News of Amazon taking delivery of more than 300 EVs in Germany prompted one analyst to upgrade Rivian. According to MarketWatch, Shlisky adjusted the automaker’s rating from under-perform to neutral — raising his price target from $11 to $18.

His less negative outlook is due to two news items: First, Rivian delivered EVs to Germany far sooner than he had expected. He also applauded Rivian’s acquisition of Sweden-based Internio, a developer of a mapping app he thinks “should improve the in-cabin experience for users of Rivian vehicles” and provide data that can help the company be more effective at planning and marketing products.

Nevertheless, Shlisky hesitates to recommend Rivian stock. noting the EV maker could suffer from “supplier change-overs and ramp-up challenges, and could face increased cancellations and production-backlog mismatches,” MarketWatch wrote.

CNN notes 20 analysts who set 12-month price targets are more optimistic. Their average price target of $24.45 gives the stock nearly 20% upside.

Read the full article here