Shares of

RTX

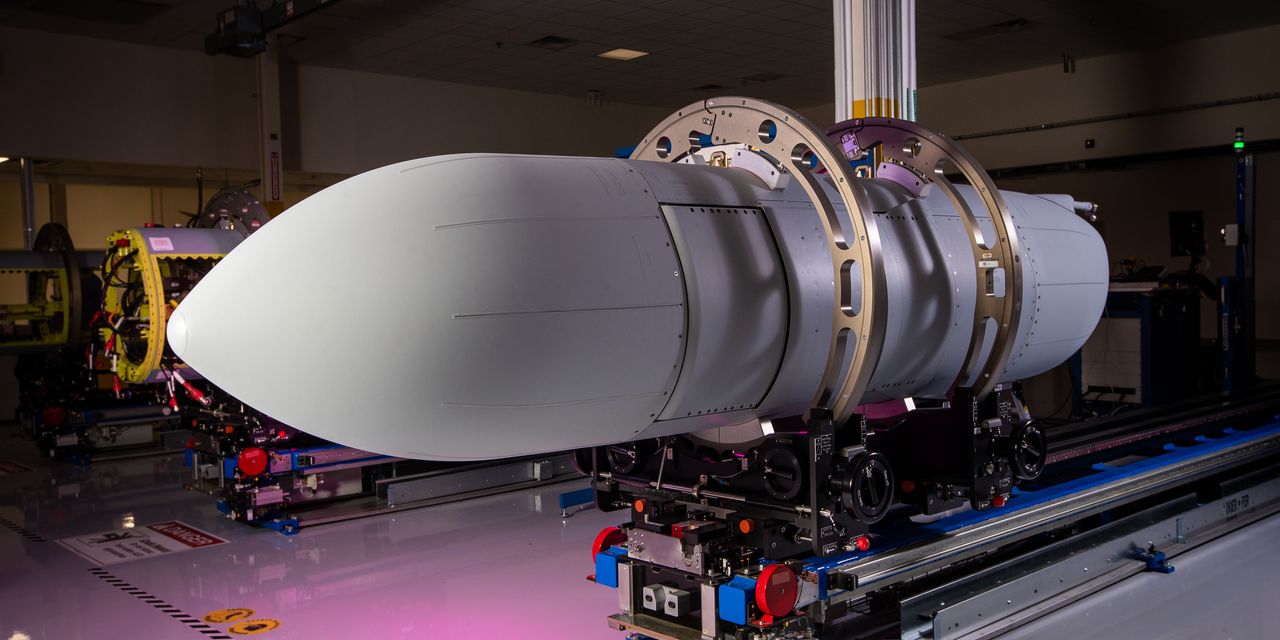

were falling Tuesday after the aerospace and defense company lowered its expectations for full-year free cash flow following issues with some Pratt & Whitney engines.

RTX

(ticker: RTX) said in its second-quarter earnings report Tuesday that it now expects full-year free cash flow of $4.3 billion, down from previous guidance of $4.8 billion. This was due to what the company called a “rare condition” in powder metal that is used to manufacture certain engine parts.

“We are lowering our free cash flow outlook to reflect the impact of an issue that has recently come to light, which will require Pratt & Whitney to remove certain engines from service for inspection earlier than expected,” Chief Executive Greg Hayes said in a press release.

Shares of RTX were falling 3.4% in premarket trading Tuesday to $93.92. Coming into the session, the stock has dropped 3.9% this year.

The defense company reported second-quarter adjusted earnings of $1.29 on revenue of $18.3 billion, beating Wall Street expectations of $1.18 a share on revenue of $17.7 billion.

RTX also raised the low end of earnings estimates for the full year to between $4.95 and $5.05 a share from previous guidance of $4.90 to $5.05. The company also said it now expects sales of $73 billion to $74 billion for the year, higher than the previous outlook of $72 billion to $73 billion.

Write to Angela Palumbo at [email protected]

Read the full article here