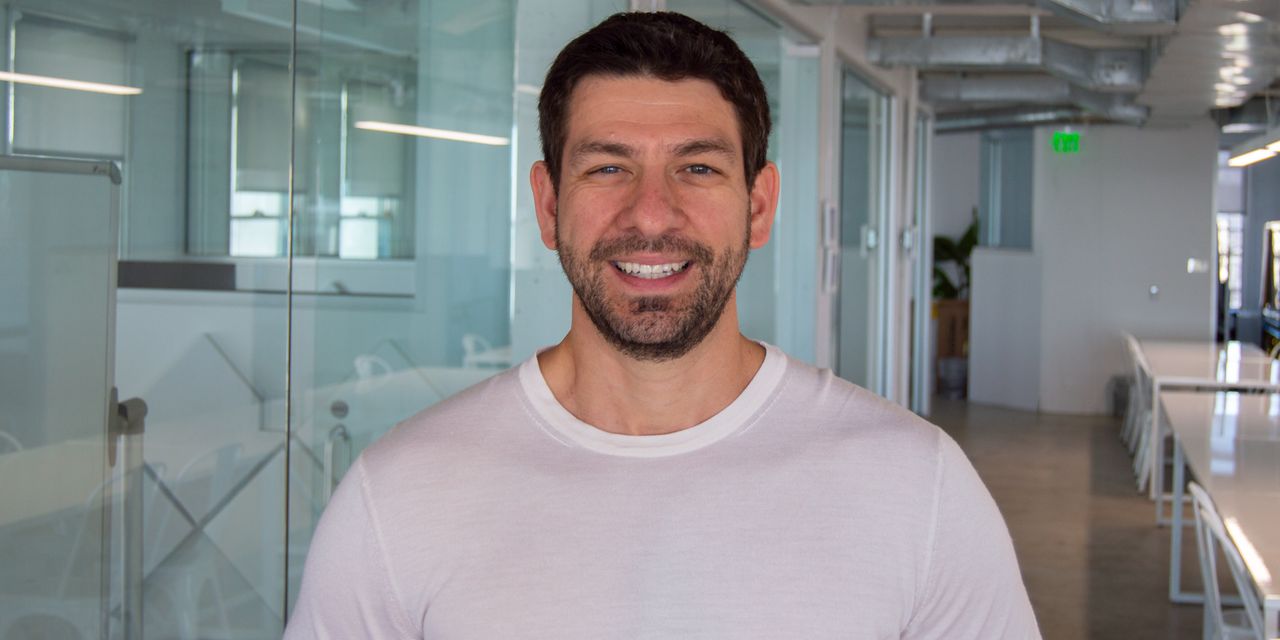

For Marko Papic, a partner and chief strategist at Clocktower Group, the notion that a Russian oligarch would rise up to challenge President Vladimir Putin’s government and military apparatus was practically foreordained.

Clocktower manages a portfolio of about $1.5 billion in long-term investments. But Papic, who previously founded BCA Research’s geopolitical strategy practice, also advises corporate clients, institutional investors, hedge funds and other asset managers on how geopolitics and markets intersect. The firm also doles out money to macro hedge funds to manage independently.

The war in Ukraine has been a particular focus for him, and his analysis has led to several prescient market calls that would have proved profitable for the firm’s clients, including a recommendation issued in February 2022 that investors should short long-dated Treasury bonds, and another call, in June 2022, to short oil, according to research notes shared with MarketWatch.

He recommended that investors should go long European stocks in September 2022. European stocks as measured by the Euro Stoxx 50 index

FSTX00,

have risen 29% since the start of October, FactSet data show. Meanwhile, West Texas Intermediate crude

CL00,

the U.S.-traded oil benchmark, has fallen more than 30% since July.

Many people in the U.S. first learned on Saturday that Yevgeny Prigozhin, the oligarch, owner and leader of Russian mercenaries the Wagner Group, was seizing control of the Russian military’s center of operations overseeing the war in Ukraine. Reports of a potential coup landed with a shock wave.

Some observers flocked to social-media — Twitter in particular — to try to make sense of the situation amid a fog of unconfirmed rumors and reports, some of which ended up being incorrect.

To Papic, who has been analyzing financial markets through the lens of geopolitics for years, the rush to propose and debate theories, some with little basis in reality, seemed almost comedic.

Papic has spent years developing a framework for conducting careful analysis at the intersection of geopolitics and markets. He even wrote a book about it called “Geopolitical Alpha” that was published in 2020.

“Early in this conflict, I told our clients that the invasion, itself, would fail and that this would throw Russia into a quagmire. Historically in Russia, this usually leads to some form of mutiny, rebellion or coup,” Papic told MarketWatch.

He characterized the incident as the result of misjudgment at the top echelons of power.

“My framework for analyzing geopolitics is all about constraints,” Papic said. “And that basically leads to the view that Vladimir Putin misjudged his constraints. And when policy makers misjudge their constraints, they’re going to be punished for it.”

Although some of his predictions about the war haven’t panned out, Papic’s framework for geopolitical analysis has helped him make a few prescient market calls since the beginning of Russia’s invasion of Ukraine, including recommendations to bet against oil prices

CL00,

and long-dated Treasury bonds

TMUBMUSD10Y,

according to research notes that Clocktower has shared with MarketWatch.

While analysts jumped to the conclusion that a leadership crisis in a country with the world’s largest nuclear arsenal could provoke a selloff in global stocks over the weekend, Papic surmised that any market reaction likely wouldn’t be instantaneous, and that fears of immediate chaos were probably overblown.

“Having seen this before, I think you can fade some of these risks,” Papic said, meaning that investors should interpret any initial Russia-driven selloff as a buying opportunity.

But that doesn’t mean it won’t happen in the future, Papic said.

Speaking from his home in California, Papic joined MarketWatch in two conversions since Sunday, to share his thoughts about the situation in Russia, and what it might mean for global markets. A transcript of the interview edited and condensed for brevity and clarity can be found below.

MarketWatch: What do the armchair analysts on Twitter get wrong about Russia and Prigozhin?

Papic: They see Russia as a monolith, they see Russia as pursuing some grand geopolitical goals in Ukraine and they believe that Putin is unassailable. The reality is that countries that pursue wars despite domestic constraints risk a revolt because this strategy isn’t in the country’s interests.

Prigozhin revolted probably for personal ambition, sure, but he also articulated a set of realities that I agree with.

If you read his full speech, Prigozhin is arguing that this war was unnecessary, bungled, pursued for domestic political reasons. And he also cites the number of Russian service members lost. They have already lost somewhere between two and four times as many troops as the Soviet Union and the Russian Federation lost during the combined wars in Afghanistan and Chechnya. [In those conflicts, the combined losses were between 25,000 and 75,000, depending on the sources.]

Papic: [Prigozhin] was in a Russian prison for over a decade. He doesn’t run an NGO. He is a brutal, swashbuckling mercenary. So, when somebody like that articulates those criticisms, he opens a whole new narrative inside Russia. He allows others to then use those same words and same ideas as a criticism for “hold on a second, this isn’t in Russian interests.”

MarketWatch: More recently you talked about how regime change in Russia could create chaos in the energy market since Russia is such a large commodity exporter. Do you think that’s a risk now? How are markets going to react?

Papic: Yes, let’s talk about the second and third derivative of the Prigozhin coup. It’s all about seeing beyond the curve. My guess is Monday that markets are going to be ambivalent about this. Beyond that, people should be watching what happens to the U.S. 10-year [Treasury note], what happens to gold

GC00,

what happens to the U.S. dollar

DXY,

Those are the assets that tend to move with geopolitical risk. I don’t think you’re going to see much going on with those four. I think there’s a case to go long oil markets, but not necessarily because of Russia. You can make an argument for being long oil without this concern about where Russia goes from here.

MarketWatch: What do you think might happen next as this situation evolves?

Papic: The fact that the Wagner Group is being deployed in Ukraine is a sign of real domestic rot in Russia. It is not normal to have independent military and law enforcement organizations that make their own strategic and tactical calls.

Max Weber, the famous sociologist, argued that one of the ways we define sovereignty is the monopoly over the use of force.

I would argue that Russia doesn’t have that anymore. This is a very important event and it’s telling us that the future of Russia is —- well, there’s a huge spectrum of outcomes.

Everything from a palace coup, a Khrushchev moment for Putin where he is politely pushed aside, all the way to a ’Mad Max’-style future where Mel Gibson is roaming the highways of Russia and the country descends into chaos.

The macro context in Russia is going to continue to be destabilized. What does this mean for the war in Ukraine is also a derivative of this. Is this good for Ukraine? Is it bad? Is their offensive going to be more successful?

I would just say that it is unclear at this moment, and it is a nonlinear outcome. If the mutiny affected Russian esprit de corps, then the benefits for Ukrainians could be extraordinary. But if the morale holds up, we may simply be in the current stalemate for a very long time.

MarketWatch: You once noted that Putin was playing checkers, not chess, in Ukraine, and I think that was an interesting point. Is this all some kind of an elaborate maneuver by Putin? Is he playing 3-D chess with the West, like some have speculated?

Papic: I think it’s highly unlikely. I think anybody who understands Russian history and domestic politics, including Russia apologists, would scoff at the idea that this is a maskirovka — which is like a false flag operation. The conspiracy theorists believe that because it doesn’t make sense, this must be an elaborate plot. But Russian history is replete with weak czars.

MarketWatch: Are there any ways in which Putin benefits from this rift?

Papic: People who understand Russian history will know what just happened is like one of the czar’s regional warlords rising up against him. The fact that Prigozhin got to live signals to every other person that’s close to the regime that they have an opportunity, an opening at some point. I don’t think this is in any way a positive for Putin, because there are other members of his elite who are scarier than Prigozhin.

Related: After a coup attempt in Russia, how should you invest $100,000 right now?

Read the full article here