© Reuters.

By Manas Mishra

(Reuters) – Danaher Corp (NYSE:) on Monday agreed to buy protein consumables manufacturer Abcam Plc in a $5.7 billion all-cash deal including debt, as the medical tools supplier looks to expand its portfolio of products and services.

The deal will help Danaher cushion the hit from sluggish demand for some of its products from smaller biotech companies that are grappling with a funding crunch.

Danaher, one of the world’s largest suppliers of medical and diagnostic tools, has already cut its annual sales growth forecast multiple times this year.

“This is a nice tuck in deal for Danaher that checks all the boxes. In an ideal scenario, we would have perhaps liked to see something larger,” said Evercore ISI analyst Vijay Kumar.

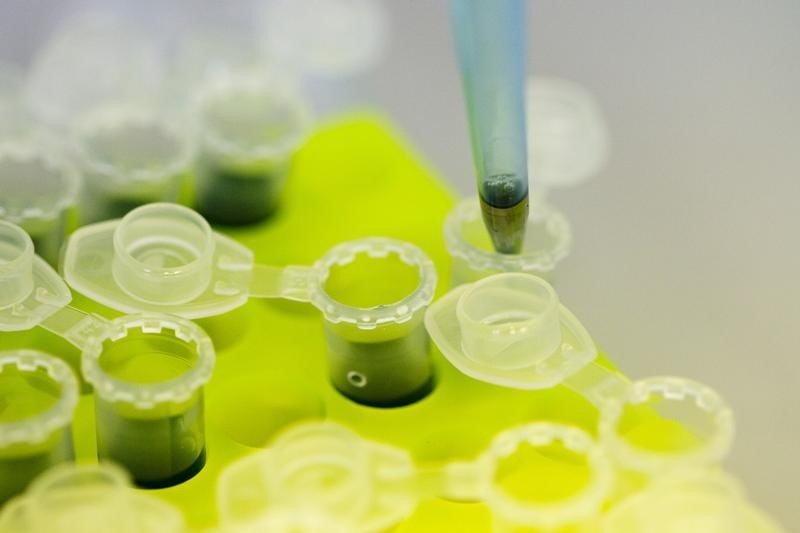

Cambridge, England-based Abcam manufactures and supplies so-called protein consumables such as antibodies, reagents and other products used for medical research, which analysts said represented a higher-margin business for Danaher.

Abcam, which has been under pressure from activist shareholders to sell itself, said in a separate statement that it had engaged with 20 potential buyers before the deal with Danaher was finalized. Reuters reported on Friday that Danaher was in the lead to acquire Abcam.

Danaher expects the deal to close in mid-2024 and add to adjusted earnings per share by 20 cents in the first full year after completion of the transaction.

The company offered $24 per Abcam share in cash, a 2.7% premium to the stock’s last closing price, and a nearly 26% premium since Bloomberg reported in mid-June that the company was fielding takeover interest.

Shares of Abcam fell about 3.1% to $20, while those of Danaher rose 1.8% in noon trading.

Abcam is the latest in a string of deals by Danaher to build heft. Danaher acquired contract development and manufacturing organization Aldevron for $9.6 billion in 2021, and before that General Electric (NYSE:) Co’s biopharma solution business for $21.4 billion in 2019.

Read the full article here