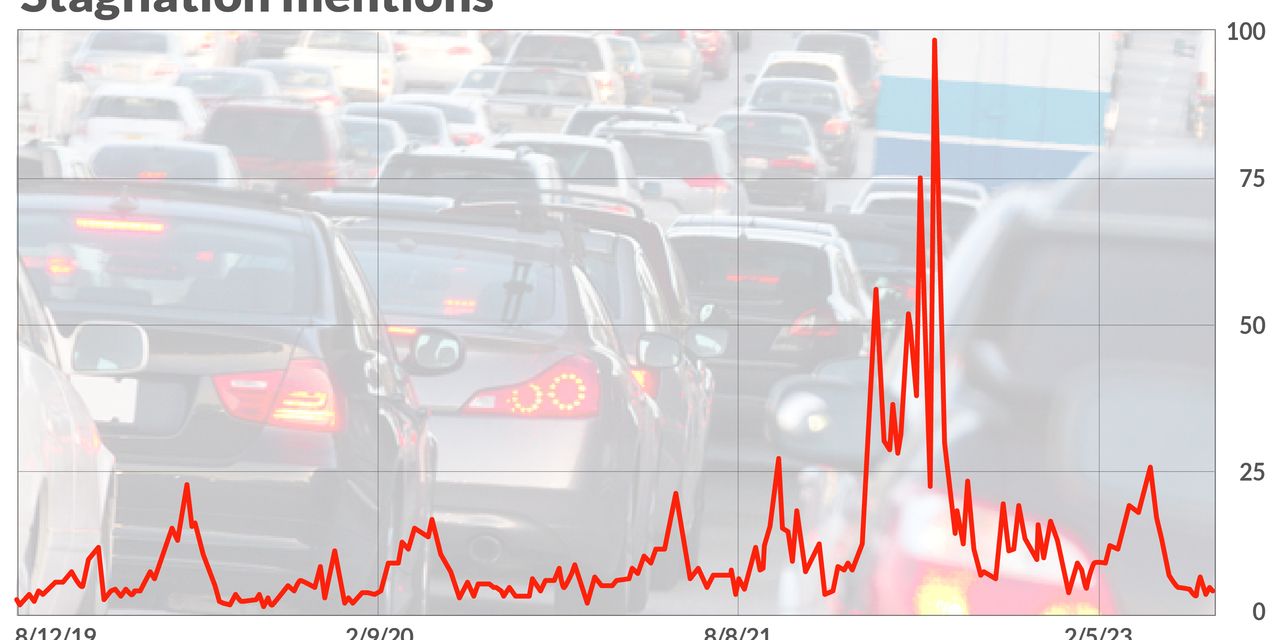

Stagflation has almost disappeared as a talking point, and logically so — the economy keeps growing, and adding jobs, while inflation has decelerated from boiling hot levels. The key inflation report is due from the Labor Department on Thursday.

So it’s notable then that are a few new stagflation calls out there. The first is from Steen Jakobsen, chief investment officer at Saxo Bank, who in 2021 was among the early crowd forecasting a jump in inflation. What he calls “stagflation light” will begin in the fourth quarter, and really make a major impact in the first and second quarter next year, he says.

Last week, the market reached “debt indigestion” as the U.S. Treasury stepped up its issuance of T-bills and announced an aggressive funding plan, he says.

“Simultaneously, the high deficit financing and cascading of issuance is coinciding with U.S. real rates rising to cycle high,” he says. “The premise of [modern monetary theory] is endless financing but under negative real rates. Now we have positive real rates. Eureka!” With the U.S. adding over $5 billion of debt every single day, it is extremely sensitive to funding from overseas.

At the same time, the Fed is effectively trapped — it doesn’t want a 10-year Treasury yield

BX:TMUBMUSD10Y

of over 5%, but at the same time, it doesn’t want to lower rates because it’s dealing with a tight labor market. “We have reached the point where the ‘cost of carry’ is growing exponentially because there is no outlook for either significant debt reduction or lower interest rates/inflation,” says Jakobsen.

One thing Jakobsen stresses is the time spent in any scenario. “The longer we are in a ‘valuation or phase’ the more it will change behavior and impact and in extended time-phases it will evolve into exponential impact. We think we are moving into this phase as seen by the dramatic increases in consumer cost of capital to spend,” he says, pointing to 7% mortgage rates, and rising rates on new car loans and credit cards.

The upshot is that he expects the latter half of the year to be hard for companies as top-line growth comes down, but input costs like wages and energy continue to be elevated. The full impact from this shift should come when third-quarter results are released in the fourth quarter of this year, he says. Saxo’s S&P 500

SPX

target is 4,455 in the short term, but if the scenario plays out, it could drop further to the 4,045 to 4,050 range, he says.

Next up is Bank of America’s research investment committee, who also use the S word, if not outright commit to it. “BofA Research forecasts no recession, but slow growth, sticky inflation, and higher interest rates and bond yields; the overripe whiff of stagflation. Today food, energy, and shelter prices are surging from ’22/’23 lows: iron ore +41%, sugar +47%, gasoline +39%, beef +38%, cotton +21%, US houses+14%, orange juice at record highs, Shanghai to LA shipping costs +47%…only the basic stuff of life.”

The bank says most portfolios still own too many assets priced for a world of 2% inflation, growth and interest rates. They give several reasons for what they call a 5% world.

- Aging demographics, shrinking the pool of labor;

- Record public debt burdens;

- Sticky wages and fewer workers;

- Scarcity and underinvestment in resources;

- Deglobalization.

The investment conclusions? It will be painful for the $70 trillion of tech, growth and debt assets priced for the stable macro regime, they say. They recommend small-cap value

VBR

and equal-weight S&P 500

RSP.

They also say national defense armaments and natural resources are scarce and undervalued, recommending undercapitalized industries, such as aerospace and defense

PPA,

metals and mining

XLE

and energy

XLE.

Read the full article here