Deal Overview

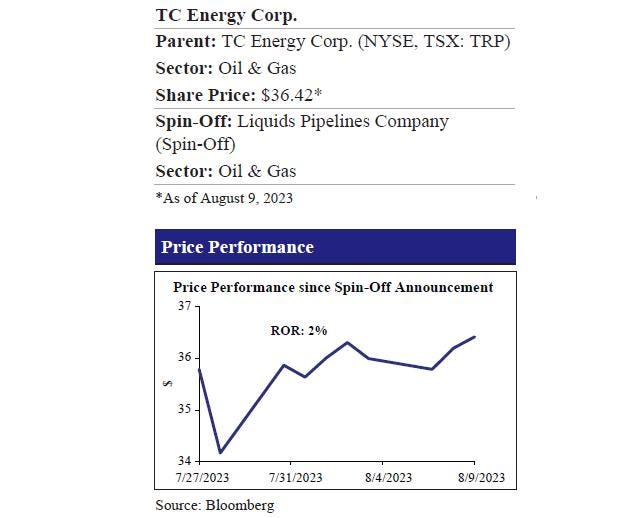

On July 27, 2023, TC Energy

TRP

The spin-off is expected to be tax-advantageous to TC Energy and its shareholders for US and Canadian federal income tax purpose. The separation is anticipated to be completed by second half of 2024; however the transaction is subject to customary conditions, including final approval by the TC Energy Corps’ shareholders, receipt of a tax opinion, and effectiveness of a Form 10 registration statement with the US Securities and Exchange Commission.

After the spin-off, TC Energy will transition to operate like a utility company, with a focus on natural gas infrastructure, nuclear energy, pumped hydro storage, and new low-carbon energy opportunities. Additionally, the Liquid Pipelines Company will work on enhancing the value of its existing 4,900-kilometer crude oil pipelines, notably the critical Keystone pipeline system that transports oil from Alberta to refining hubs in the U.S. Midwest and Gulf Coast.

Shareholders of TC Energy will uphold their existing ownership in the company’s common shares and will also be granted a proportionate distribution of common shares in the new liquid pipelines entity. The exact count of common shares to be allocated to TC Energy shareholders within the new company will be ascertained before the spin’s completion.

Following the separation, both entities are expected to uphold the parent company’s current dividend policy. Over time, the total dividends from these entities are projected to align with the parent company’s consolidated dividend growth outlook.

François Poirier continues to be President and CEO of TC Energy, supported by Siim A. Vanaselja, Chair of the Board. Meanwhile, Stanley (Stan) G. Chapman, III assumes the role of Executive Vice-President and COO for Natural Gas Pipelines. On the other hand, Bevin Wirzba will head the newly formed Liquids Pipelines Company as its President and CEO.

The new Liquid Pipeline business will be headquarters in Calgary, Alberta, while also having an office in Houston, Texas.RBC Capital Markets and JP Morgan Securities Canada have been appointed as financial advisors, while Blake, Cassels & Graydon LLP and White & Case LLP has been engaged as the legal advisor. Bain & Company would be advising on the separation process.

Recent Developments:

Before announcing the spin-off of the Liquid Pipeline business, on August 7, 2023, TC Energy announced the sale of a 40.0% stake in its Columbia Gas Transmission and Columbia Gulf Transmission system to New-York based Global Infrastructure partner for $5.2 billion. The management plans to utilize this proceeds to pay back the parent company’s debt.

Deal Rationale

TC Energy is a leading Canadian Energy infrastructure company with a presence in three core businesses: Natural Gas Pipelines, Liquids Pipelines and Power and Energy Solutions. Regionwide, its operations are divided into Canadian Natural Gas Pipeline, U.S. Natural Gas Pipeline, Mexico Natural Gas Pipeline, Liquids Pipeline and Power and Energy Solution. It mainly generates, stores, and delivers energy to people across North America. For the past two years, the management has been conducting a strategic review of their business and focusing on allocating capital to their business according to their growth prospects. Following the strategic review, the management decided to retain its Natural Gas Pipeline, Storage and Power business while it will be spinning off its Liquid Pipelines and Storage business.

TC Energy (consolidated) is a highly levered company with a debt-to- EBITDA ratio of 5.4x as of December 2022. The management has targeted reducing its debt-to-EBITDA ratio to 4.75x by 2024E. It has been taking various measures to deleverage itself, and recently the company has agreed to sell 40.0% of its holdings in British Columbia Gas and Columbia Gulf system, which could fetch cash proceeds of $5.2 billion. These proceeds are being used to decrease the debt and lower the company’s leverage by 0.4x. Furthermore, the anticipated proceeds from the spin-off of the Liquid Pipeline business (~C$ 8.0 billion) are also being employed to repay the parent company’s debt.

After the spin-off, the company will retain control of a Natural Gas Pipeline network spanning ~93,700 kilometers from western Canada to the U.S. north-east and Gulf coast, addressing more than 25.0% of North America’s energy demands. Furthermore, the pipelines managed by TC Energy are responsible for delivering ~30.0% of the gas destined for export from US LNG liquefied natural gas (LNG) terminals. Additionally, TC Energy will be the provider for Canada’s inaugural LNG terminal, scheduled for completion in 2025E. Conversely, boasting a three-decade track record, the Power section commands a generating capacity of approximately 4,600 MW. Notably, 70.0% of this capacity relies on nuclear energy, categorized as a carbon-free source, contributing significantly to environmental well-being.

Moreover, the business has solid growth prospects as 96.0% of its adjusted EBITDA is linked with regulated and securely contracted assets. For the next five years, the Natural Gas and Power Business is anticipated to grow at a CAGR of 7.0%, with an EBITDA reaching $11.2 billion by 2026E. Post spin-off, the remaining business has strong growth potential and an environmentally sustainable business model compelling investors who want to invest in low-carbon companies.

On the other hand, the liquid pipeline business is a relatively low-growth business. It is anticipated to grow at merely 2.0-3.0% CAGR for the next five years, with comparable EBITDA reaching $1.5 billion by 2026E. Currently, the segment has 4,900 kilometers of liquid pipeline network supplying low-cost crude to key demand markets. The management is committed to setting an impactful ESG target, but the liquid pipelines are prone to leakages and spillages, causing environmental hazards. In December 2022, the Keystone pipeline, owned by TC Energy, encountered a substantial oil spill, discharging more than 14,000 barrels of crude oil into a creek in Kansas in the U.S. This occurrence has sparked apprehensions regarding the security of the pipeline infrastructure and forced the company to reduce rates on the system.

Additionally, the Keystone XL project, which could have carried bitumen from the Northern Alberta oil sands to refineries on the US gulf coast, witnessed political attention in pursuing climate change issues. In our view, the cancellation of the proposed Keystone XL project in 2021 due to U.S. President Joe Biden revoking an essential permit could be one of the reasons behind the Liquid Pipeline business separation. Furthermore, in recent years, pipeline construction in the U.S. has encountered significant environmental resistance, driven by activists aiming to hinder the expansion of infrastructure that perpetuates dependence on fossil fuels. Therefore, the decision to separate the liquid pipeline business to concentrate on environmentally sustainable and low-carbon ventures appears favorable to the management. This move caters to investors who prefer not to invest in both businesses collectively.

Company Description

TC Energy Corporation (Parent)

TC Energy Corporation is involved in the transportation, production, and storage of energy throughout North America. The company is focused on enhancing and modernizing its activities to decrease emissions and promote a sustainable business model. Moreover, TC Energy offers a range of energy options, varying from natural gas to renewable sources, incorporating innovations like carbon capture and hydrogen utilization. TC Energy operates through three main divisions: natural gas operations, liquid pipelines, and power and energy solutions.

Liquids Pipelines Company (Spin-Off)

The new company will manage the pipeline network transporting Alberta crude oil to U.S. refining markets. This extensive network spans 4,900 kilometers and possesses a substantial capacity exceeding 14 mbbl/d. Additionally, the company will operate storage facilities in Hardisty, Cushing, and Houston. The company is dedicated to addressing energy requirements by utilizing its current resources and exploring fresh possibilities. Its ongoing objective is to ensure customers have access to the required destinations.

Read the full article here