Technology stocks have had a spectacular run, and you might be tempted to sell them to avoid the inevitable dips.

If you’re a long-term equity investor, hang on to them. Some of the biggest names out there ranging from

Microsoft

(ticker: MSFT) to

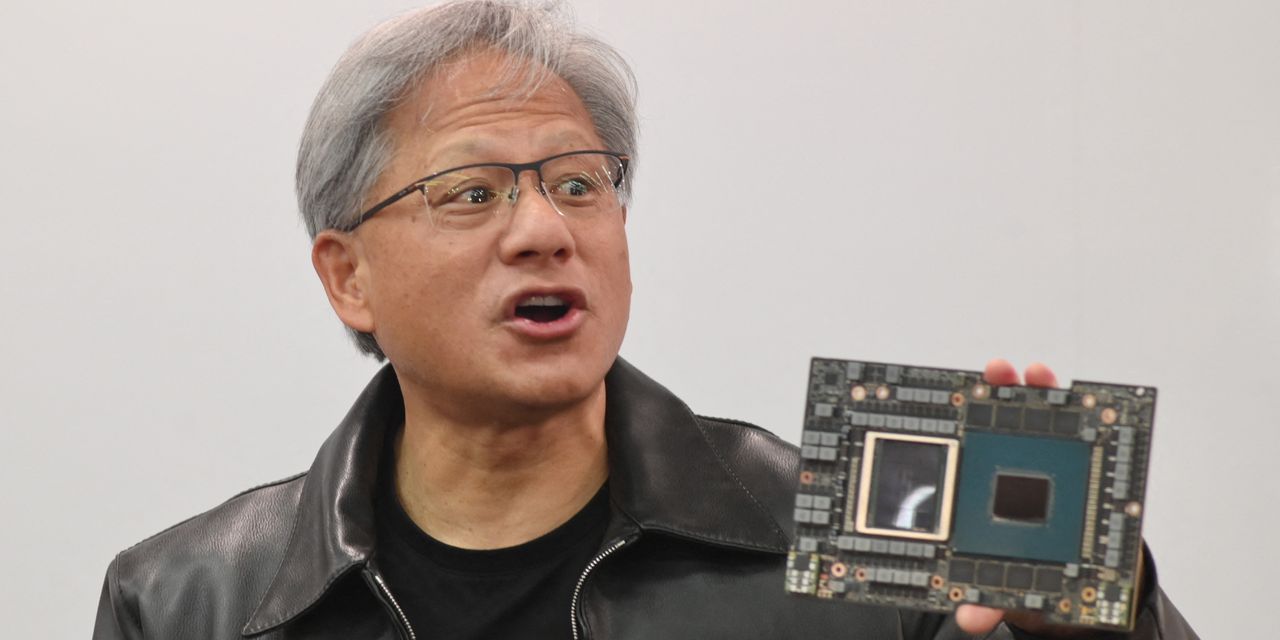

Nvidia

(NVDA) are still reasonably valued once you factor in how quickly they are growing earnings.

“I do think there’s some potential for a mean reversion,” said Keith Lerner, co-chief investment strategist at Truist. “But we’re still favoring Big Tech.”

The Nasdaq 100 index, comprised of just over 100 of the largest non-financial companies on the Nasdaq Composite, is up about 34% from its bear market low hit in late December. By comparison, the

S&P 500

stock index has risen 9% year to date while the

Vanguard S&P 500 Value Index Fund ETF

(VOOV) is up a mere 4%

Nvidia and Microsoft are up more than double and about 55%, respectively, from their late 2022 low points.

Meta Platforms

(META) stock has almost doubled from its second half of 2022 low, while and

Alphabet

(GOOGL) is up about 50%. These companies are layering Artificial Intelligence into their products, expanding their markets for their services, while falling bond yields have boosted their valuations.

The Nasdaq 100 is now about eight times the value of the Russell 2000, up from just under six times a few months ago. The last time the Nasdaq 100 outpaced the Russell 2000 to a similar degree was in 2020 when extremely low interest rates juiced growth stock valuations, while Covid-related restrictions kept people inside and on screens, boosting earnings for streaming, social media and work-from-home necessities such as the cloud.

That didn’t end well for tech. Higher inflation sent rates soaring, while people started spending time outside the home as the pandemic eased, causing tech earnings to drop. The Russell 2000 went on to trounce the Nasdaq 100 for most of 2021 and 2022.

This time could be different. Certainly, tech stock performance is likely to moderate and investors could find better opportunities in selected areas of the market, but the long-term trends powering tech are still in place.

Analysts for Nvidia, Microsoft, Meta Platforms and Alphabet expect double-digit earnings-per-share growth for several years, according to FactSet. Meanwhile, valuations, while high, aren’t out of control.

Alphabet and Meta trade at just over 20 times expected EPS for the next year, less than two times their expected annual EPS growth rates for the next few years. While Nvidia and Microsoft trade at 48 times and 30 times their earnings, respectively, that is still less than two times their expected EPS growth as well. These aren’t wild valuations, given that the S&P 500 goes for18 times earnings, and has expected EPS growth of just 8% for the next couple of years.

The ride for tech stocks won’t be smooth—it never is. Technical analysts say there may be a dearth of buyers because portfolio managers have loaded up on tech stocks and don’t want to take any more risk at higher prices. Indeed, tech stocks have finally flatlined in the past several trading days.

But unless you believe that developments like Artificial Intelligence aren’t here to stay, tech stocks will resume their upward march. Stay the course.

Write to Jacob Sonenshine at [email protected]

Read the full article here