If you ever doubted that the markets and regular folks inhabit two different planets, consider the latest employment report released this past Friday.

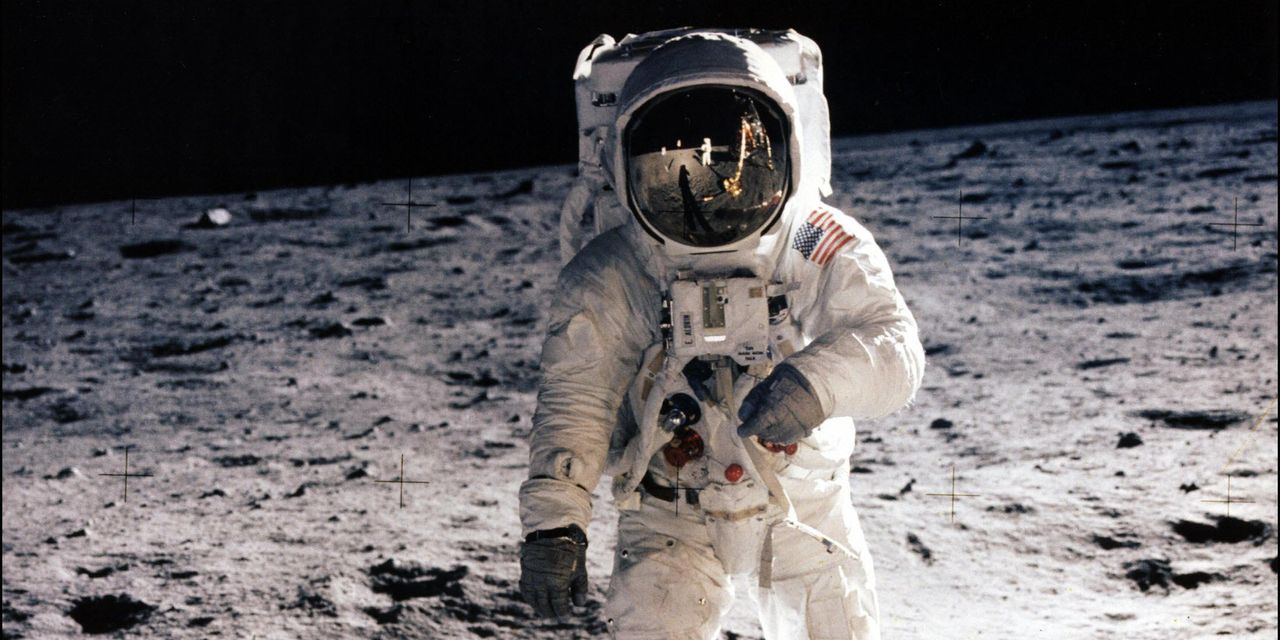

The Bureau of Labor Statistics reported that the jobless rate fell back to 3.5% in July, matching the halcyon days in 1969 when men first walked on the moon. Payrolls expanded by 187,000 while hourly wages were up 4.4%, a Goldilocks combination of a not-too-hot or -cold labor market, as economists see it. At the same time, Bank of America and J.P. Morgan have joined the list of forecasters that have canceled their recession calls for 2023.

But in the latest CNN poll, 51% of respondents said the economy still is in a downturn and getting worse. Even worse for President Joe Biden’s re-election prospects next year, his approval rating for handling the economy was 37%—and that was even lower than his overall approval rating, a dismal 41%. Those numbers were right in line with an array of other polls tracked by RealClearPolitics.

Consumer sentiment as tracked by the University of Michigan has been picking up, hitting 72.6 in the most recent reading, the highest since September 2021. Still, that remains well below the scores that bounced near 100 in the years before the Covid-19 pandemic hit in early 2020.

You’d also think that working Americans would be pleased to have their wages finally rising faster than prices. Average hourly earnings were up 4.4% in the latest 12 months and rose at a 4.9% annual rate in the past three months. Consumer prices were up 3% in the most recent 12 months ended in June, down by more than two-thirds from the four-decade inflation peak hit in 2022.

What has economists and market watchers more encouraged is that the economy and employment continue to expand even after the Federal Reserve has raised interest rates by a huge 5.25 percentage points while also shrinking its balance sheet. All of which has futures markets betting that the Fed is done hiking and will leave its federal-funds target at 5.25%-5.50%—and possibly begin cutting rates as early as next spring, according to the CME FedWatch tool.

As Fed Chairman Jerome Powell indicated following the latest hike on July 26, what happens at the next policy meeting on Sept. 19-20 will depend on data released by then. After Friday’s solid job report, attention turns to July’s consumer price index, due this Thursday. Economists’ guesses center around a 0.2% increase for the month in both the headline and core (ex-food and energy) measures. But the improvement in the headline year-over-year change could reverse, to 3.3% from 3.0% in June, owing to the comparisons from 2022.

Those base effects suggest that the inflation picture in the June CPI is as good as it gets. Meanwhile, the economy continues to chug along. After gross domestic product expanded at a 2.4% annual rate in the second quarter, up from 2% in the prior quarter, the Atlanta Fed’s GDPNow tracker for the third quarter is running at a 3.9% pace.

The just-right jobs report gave some respite to the bond market after its recent swoon, which lifted longer yields back to near 2022 highs. But the statistical reality of a solid economy and inflation stuck well above the Fed’s 2% target should keep monetary policy on hold longer than the futures market expects. That, in turn, could bring longer-term Treasury yields closer to the fed-funds rate. The resulting hit to stocks could then make Wall Street as blue as Main Street.

Write to Randall W. Forsyth at [email protected]

Read the full article here