What happens when an unstoppable object meets the debt ceiling’s immovable force? The stock market may be about to find out.

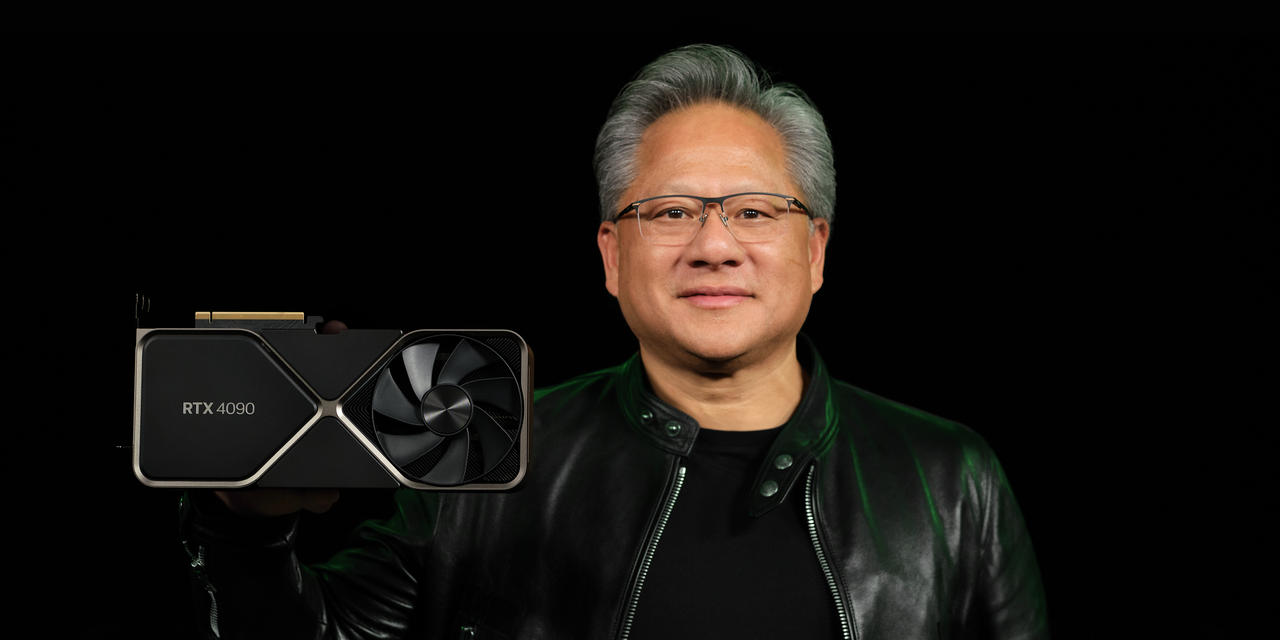

Artificial intelligence is that unstoppable object, as

Nvidia’s

(ticker: NVDA) first-quarter results and blowout guidance demonstrated this past week. The results sent the stock up 24% Thursday, adding nearly $200 billion to its market capitalization and extending its year-to-date gain to around 160%.

Nvidia’s very bullish forecast for demand for chips used in AI applications also sent shares of AI-related companies like

Adobe

(ADBE) and

Advanced Micro Devices

(AMD) soaring. The

Nasdaq Composite,

home to many of these highfliers, finished the week up 2.5%.

The moves also helped the

S&P 500,

which gained 0.3% this past week, but the index now feels top-heavy. It has added 9.5% this year, while the

Invesco S&P 500 Equal Weight

exchange-traded fund (RSP)—which holds all 500 companies in the index at the same 0.2% weight—is down slightly. It’s the biggest lead for the capitalization-weighted index over the equal-weighted version since the 1999 tech bubble sent stocks such as

Qualcomm

(QCOM),

VeriSign

(VRSN), and

Oracle

(ORCL) soaring.

And then there’s the poor

Dow Jones Industrial Average,

down 0.2% in 2023 after falling 1% this past week, resulting in its worst underperformance versus the Nasdaq on record. In fact, the Dow had only five positive days in May—its fewest in any month in more than a decade, per Dow Jones Market Data.

And while the Dow was suffering through one of its toughest stretches ever, the Nasdaq has been experiencing one of its strongest—its best first 100 days of the year since 1991.

History suggests that more gains could be on the way. The Nasdaq has traded higher over the remainder of the year 69% of the time when it has climbed at least 15% through the first 100 days. The looming X-date for when the U.S. Treasury will run out of cash—though it’s been pushed back a few days—complicates matters.

A resolution that avoids default remains most investors’ base case, and stocks should enjoy a relief rally once a deal is struck. The near-term implications of a debt-ceiling resolution won’t be all positive for the growth stocks that have led the market, however.

The Treasury will need to rebuild its cash balance in its general account—down by $500 billion since January—immediately after an agreement is reached. That will mean a flood of Treasury bill issuance in early June, potentially boosting yields and pulling cash out of the system. It will come atop the Federal Reserve’s ongoing quantitative-tightening program, which includes the runoff of $60 billion of Treasuries a month.

The drain on liquidity in the U.S. economy will be a greater headwind for risky assets like growth stocks, and could help narrow the gap between the Nasdaq’s and the Dow’s performances.

If only artificial intelligence could help our elected officials avoid a debt-ceiling disaster.

Write to Nicholas Jasinski at [email protected]

Read the full article here