Introduction

Shares of 1stDibs (NASDAQ:DIBS) have fallen 18% YTD. Despite the fact that the company continues to show operating losses, I believe that the purchase of the company’s shares provides investors with a good opportunity to bet on the recovery of trade trends in the premium furniture segment.

1stDibs manages an online marketplace selling vintage furniture, home decor, jewelry etc. The company operates in the US, France, and Germany markets.

Investment thesis

The company’s revenue continues to be under pressure, but in the next quarter we may see an improvement in profitability trends due to the optimization of operating expenses (20% reduction in staff). Although the company’s operating income continues to be in the negative zone, the amount of cash on the balance sheet allows the company to continue to finance business activities. In addition, a recovery in consumer spending could result in a significant improvement in operating margins due to economies of scale over several years. Also, I believe that the company can be an attractive takeover target due to its narrow specialization and its own loyal customer base.

2Q 2023 Earnings Review

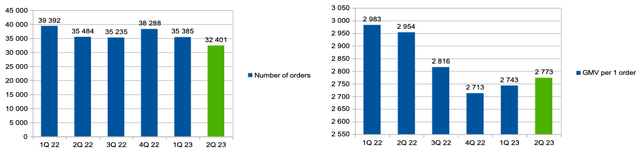

The company reported better than investors expected. The company’s revenue decreased by 14.9% YoY due to a decrease in the number of orders by 8.7% YoY and a decrease in GMV (gross merchandise value) per 1 order by 6.1% YoY.

Number of orders and GMV per 1 order (Company’s information)

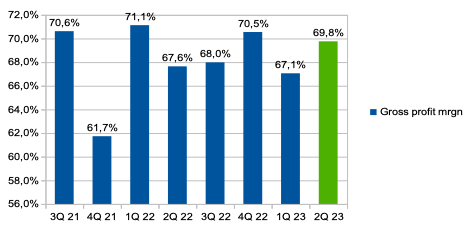

Gross profit margin increased from 67.6% in Q2 2022 to 69.8% in Q2 2023, driven by reduced logistics and personnel costs.

Gross profit margin (Company’s information)

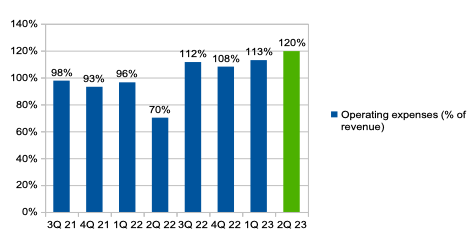

Operating expenses (% of revenue) increased from 70.2% in Q2 2022 to 119.6% in Q2 2023. It’s worth noting that the company generated one-time income of about $9.7 million last year, which slightly skews operating expenses. So, if we subtract revenue from the sale of Design Manager, then operating expenses (% of revenue) increased from 109.6% in Q2 2022 to 119.6% in Q2 2023 due to a decrease in business economies of scale.

Op. expenses (% of revenue) (Company’s information)

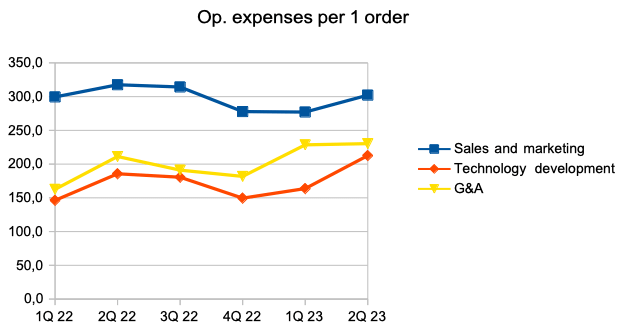

I would like to elaborate on operating expenses. The growth of business volumes and the achievement of economies of scale is one of the key drivers of the company’s investment case, so I decided to analyze the dynamics of operating costs per order. Thus, in view of the reduction in the number of orders, technology development and G&A costs increased by 14.5% YoY and 9% YoY, respectively, but marketing costs decreased by 4.8% YoY.

Op. expenses per 1 order (Company’s information)

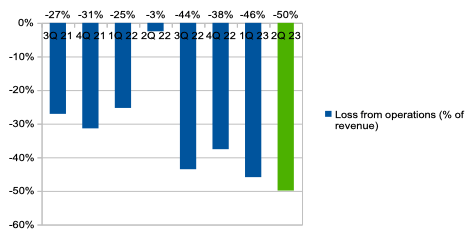

Thus, operating loss (% of revenue) increased from 2.5% in Q2 2022 to 49.9% in Q2 2023.

Loss from operations (% of revenue) (Company’s information)

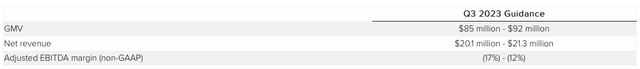

In addition, the company provided guidance for the next quarter. Thus, the company expects GMV in the next quarter to be $85-$92 million, which implies a decrease of 7%-14%, but the company forecasts a reduction in losses at the level of EBITDA margin to 17%-12% due to the optimization of personnel costs.

3Q 23 guidance (Company’s information)

My expectations

On the one hand, I do not expect that we can see a solid recovery in consumer spending in the premium furniture segment in the next 2-3 quarters, as potential buyers continue to face rising prices for materials and labor, however, on the other hand, the company’s shares have fallen strongly from peaks during the COVID period, so I believe that the downside potential of the quotes is limited, especially in the context of the company’s effective control of operating costs.

However, on the other hand, I think that the growth in business volumes can lead to a significant increase in economies of scale and break even in the coming years. Most technology development and G&A costs are fixed (employee salaries), so an increase in revenue can lead to a significant improvement in the unit economy. In addition, the amount of cash on the company’s balance sheet is about $150 million, which allows the company not to increase its debt burden in the medium term.

I would like to point out that the company, in my personal opinion, can be an attractive takeover target due to its own loyal buyer/seller base and a narrow focus. Also, in line with management’s comments during the Earnings Call, management could potentially consider doing so.

Additionally, as opportunities arise, we will continue to evaluate both buy and sell-side M&A opportunities.

Valuation

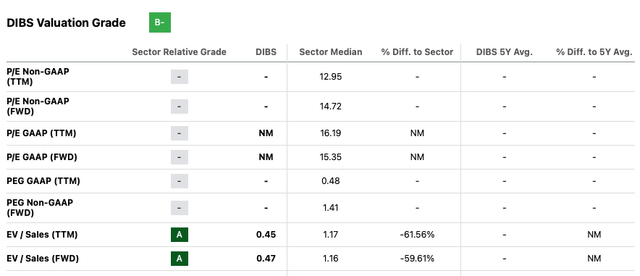

Valuation Grade is B-. The company trades at 0.5x on an EV/Sales (FWD) multiple, implying a discount to the sector median of around 60%. In addition, I suggest paying attention to the EV/GMV multiplier, which, in my opinion, is more relevant for online marketplaces. So, based on the company’s current guidance, the EV/GMV multiple for 2023 is around 0.1x, which is fairly low. I think that the downside potential of the stock is limited, while the improvement in financials in the future may lead to a significant revaluation of shares.

Valuation (SA)

Drivers

Macro (general risk): Lower consumer spending in the premium furniture segment could have a negative impact on business revenue growth. In addition, low revenue growth may prevent the company from fully realizing its business model due to insufficient sales, thus the company may continue to generate an operating loss in the future.

Cash burn: Despite the fact that cash and short-term investments on the company’s balance sheet are about $146 million, a long period of cash burns may lead to the need to increase the leverage in the future.

Risks

Revenue: Growth in the number of buyers due to the recovery of consumer income, an increase in the average check, entering new geography and new categories can help accelerate the company’s revenue growth.

Margin: Reducing operating costs (% of revenue) due to increased economies of scale can provide significant support to business operating margins and speed up the process of reaching the break-even point.

M&A: The company continues to consider M&A both from the buyer’s side and from the seller’s side. Thus, a high amount of cash on the balance sheet allows the company to consider potential targets for purchase at an acceptable price, which can support both revenue growth rates and the unit economy due to increased economies of scale. In addition, as a seller, the company may also receive an offer to buy, which implies a premium to the current price.

Conclusion

On the one hand, I do not expect a quick recovery in financial results, since this requires double-digit growth in the company’s revenue. However, I think that in the next quarter the company’s financial results may show improvement, which may be a catalyst for growth. In addition, the company’s shares are valued cheaply, and a recovery in consumer spending on furniture, an increase in business volumes and the realization of economies of scale may lead to a revaluation of the shares in the future.

Read the full article here