Today we’ll conclude our three-part series on the $20 billion club strategy. For those who missed the first two articles in the series, the $20 billion club is a group of pension plans each with more than $20 billion of global pension liability.

We have been reporting on this cohort for the last 13 years following how and why their funded status has changed over time and reporting on how these sponsors’ strategies for managing risk have evolved over time.

We highly encourage you to read the first two articles in the series, if you’ve missed them, for insight into what these mega-plans sponsors are working on with their investment and benefits policies.

However, there are some key points worth reiterating for the sake of this article. This series addresses the major levers that plan sponsors can pull to impact the trajectory of their large defined benefit (DB) plans. These three broad levers are often closely intertwined and pulling one can lead to adjusting another. The three key levers are:

- Investment policy – This lays out how those contributions go to work for the sponsor

- Benefits policy – This directly impacts plan participants’ benefit accruals

- Funding policy – This determines the contributions made by the sponsor to pay for those benefits

In the first article in the series, we looked at the investment policy of these mega plans, and we reviewed the benefits policy in the second. For the final piece, we’ll be reviewing the funding policy of the $20 billion club and what we might gather from the recent history of these mega plans.

Many plan sponsors have official policies to “contribute at least the amount required under the law” but under the hood, there is often much more going on than meets the eye with respect to this policy.

Similar to the other policies we’ve discussed over the course of this series, the funded policy is intertwined with the other policies but, perhaps even more so than the others, the funding policy is a function of the funded status of the plan.

Of course, there are regulatory contribution requirements under the Pension Protection Act (PPA) based primarily on funded status, but it goes further than that.

Depending on the goals of the plan sponsor, funding can continue up to and beyond the plan being fully funded. Before we dive into some more contribution specifics, let’s take a step back and review the funding status of the plans in the $20 billion club.

In what has felt like a string of extraordinary years, 2022 was exceptional within the pension space. Broadly speaking, interest rates have been on the decline for the past 40 years and this creates an additional headwind for pension plans as falling discount rates mean rising liabilities.

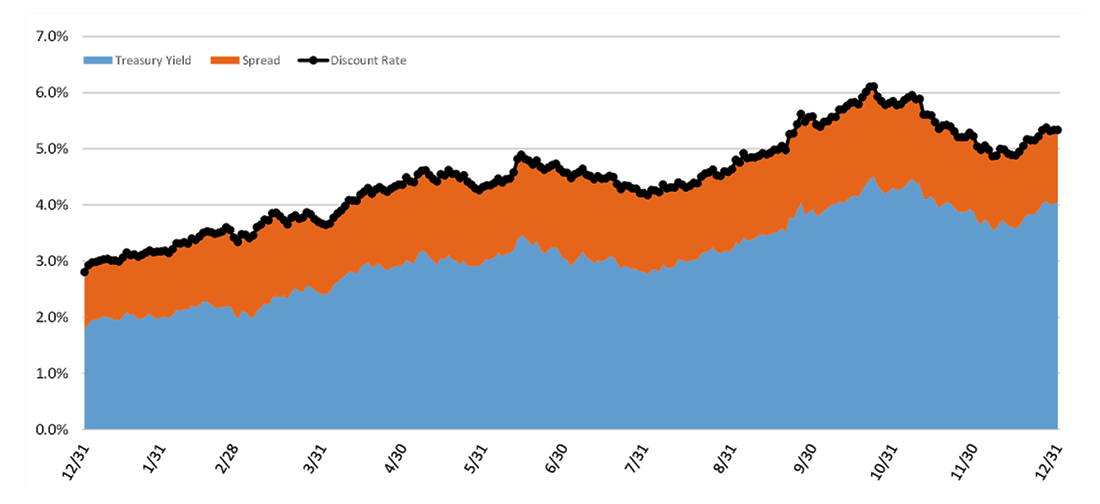

Over the course of 2022, we saw discount rates rise 250 basis point (bps) for plans with a duration of 12 years (with a peak of +330 bps in the middle of October), as illustrated in Exhibit 1.

As detailed in our $20 billion club 2023 update, this created an actuarial gain larger than any we’ve seen in the history of the $20 billion club. However, this was largely offset by the largest investment loss we’ve seen – even larger than the investment losses seen in 2008 as part of the Global Financial Crisis.

Exhibit 1: Discount rates during 2022 for a 12-year duration liability; discount rate based on Merrill Lynch A-AAA yield curve.

Source: Russell Investments

Discount rate based on Merrill Lynch A-AAA yield curve.

However, pension plans don’t live in absolute returns space like much of the investment industry, and the interest rate rise had a larger impact on the liabilities than losses seen on the asset side.

This led to an increase in funded status for the $20 billion club members in aggregate. This puts the $20 billion club at its highest aggregate funded level since 2007, a threshold that could mean interesting things for the future and something we’ll be keeping a keen eye on.

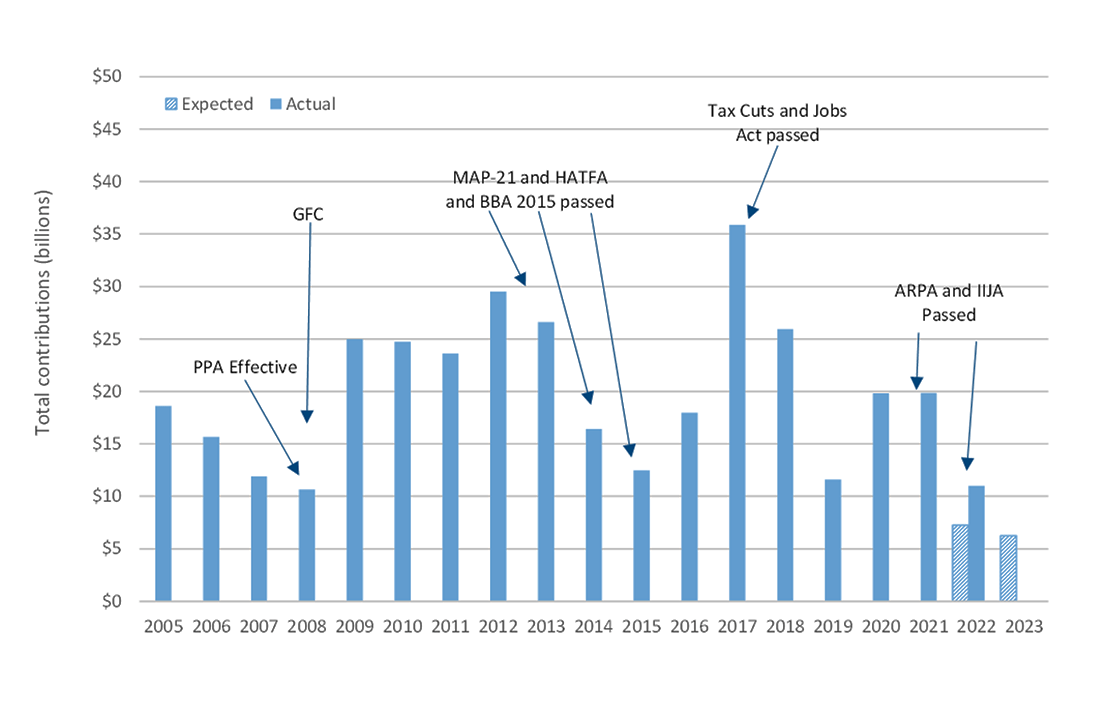

As mentioned, for better or worse, many plan sponsors’ funding policies are linked to minimum required contributions under PPA. While PPA does provide a path to full funding in large part due to the shortfall amortization, regulations over the past decade have enabled plan sponsors to reduce or fully put off contributing to their plans, as seen in Exhibit 2.

With the exception of the Tax Cuts and Jobs Act (TCJA), each noted piece of legislation with pension funding relief-related measures has led to a reduction in contributions in the following years.

The Tax Cuts and Jobs Act led to a large increase in contributions in 2017 and 2018 due to the tax benefits of contributing to pension plans. While funding relief sometimes provides much-needed cash flow flexibility for plan sponsors, plan funded status has not always benefited from it.

Exhibit 2: $20 billion club members contribution history in the context of legislation

We also see in Exhibit 2 that contributions for the $20 billion club members were at their lowest point since PPA became effective and would have been the lowest if not for ExxonMobil (XOM) contributions of $4.2 billion ($3.2 billion more than the expected 2022 contributions). If the expected contributions in 2023 hold, they will be the lowest we’ve seen while monitoring the $20 billion club.

What does this all mean for your DB plan?

As mentioned in our investment policy and benefits policy blogs, one of the main goals of the $20 billion club has always been to help plan sponsors understand how industry trends have been developing.

Not all plans are created equal, and we focus on these largest plans because they have access to the most sophisticated service providers and the latest innovative strategies. They also tend to have experienced experts on staff who can focus a large portion of their time on their DB plans.

By gathering and examining what these jumbo-sized plans have been implementing and adjusting, both reactively and proactively, we not only observe the current trends, but also gain unique insight into where the industry may be heading.

As previously mentioned, while the different levers available to plan sponsors are often intertwined, the industry trend on funding policy has geared itself to taking advantage of the funding relief and opportunities offered up by regulatory changes over the past decade as well as their increased funded status.

Since the introduction of MAP-21 (Moving Ahead for Progress in the 21st Century Act) legislation and subsequent pension funding relief legislation, discount rates for contributions have been disconnected from discount rates for accounting disclosures.

For the first time since MAP-21 was passed, because of the large increase in rates in 2022 that were mentioned, the market interest rates are near or above the interest rates used to determine regulatory contributions.

This can lead to interesting decisions, which we discussed earlier this year, that have direct impact on the regulatory contributions and therefore many plan sponsors’ funding policy.

Leading up to the plan being fully funded, we would generally advocate for greater funding for the plan if the sponsor has the capacity to do so. In our 2022 prudent pension funding report, we discussed what it might look like to fund a plan in the context of cash flow from operations.

Once the plan is fully funded, managing the plan can then be simplified through hibernation, and costs of the plan decrease in a meaningful way. In most cases, this will lead to no longer needing to make annual contributions and largely reduce the risk of large downside contribution events.

A note on $20 billion club membership

Over the past several years, inclusion in this group of mega-plans could have increased a few times due to falling interest rates, which caused liabilities to soar. However, we have kept this group stable in the past to maintain a certain level of consistency. This past year was an exceptional year in many ways, but that has shone through in the DB plan space perhaps more keenly than many other areas. We have used this as an opportunity to refresh the membership of our $20 billion club. The most recent list of 20 companies—many of which have long been members of the club – can be found in our 2023 update.

Disclosures

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page. The information, analysis, and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity.

This material is not an offer, solicitation or recommendation to purchase any security.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand.

The Russell logo is a trademark and service mark of Russell Investments.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an “as is” basis without warranty.

UNI-12261

Original Post

Read the full article here